PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885832

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885832

Heavy Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

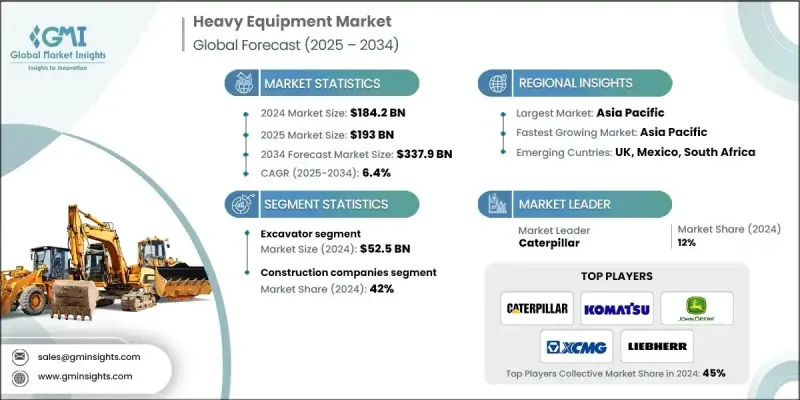

The Global Heavy Equipment Market was valued at USD 184.2 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 337.9 billion by 2034.

The market plays a critical role in supporting global infrastructure and industrial development, acting as a backbone for urbanization, resource movement, and economic expansion. Its primary applications span construction, mining, agriculture, and material handling, sectors that are pivotal for growth worldwide. Demand is being led by emerging economies investing heavily in roads, energy projects, and housing, while established markets are modernizing fleets with fuel-efficient, digitally connected, and technologically advanced machinery. Automation, telematics, and electrification are transforming operations, helping companies achieve sustainability goals while reducing operational costs. The growing emphasis on efficiency and productivity, coupled with technological integration, is reshaping the heavy equipment landscape and enabling smarter, greener operations across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.2 Billion |

| Forecast Value | $337.9 Billion |

| CAGR | 6.4% |

The rental segment is witnessing strong growth as companies seek flexible, cost-effective solutions, avoiding large upfront investments. However, the industry faces challenges, including fluctuating raw material prices, labor shortages, and stricter emission regulations, which are pushing manufacturers to accelerate innovation while maintaining compliance and competitiveness. Despite these challenges, the market outlook remains strong.

The construction companies segment held 42% share in 2024. Machinery such as excavators, loaders, bulldozers, and cranes is heavily utilized in earthmoving, material handling, site preparation, and structural assembly. Rising urbanization and government infrastructure projects are steadily boosting demand for these machines.

The diesel-powered equipment segment generated significant share in 2024, supported by high torque, reliability, and established performance in construction, mining, and agricultural operations. Diesel engines benefit from a well-developed fuel supply infrastructure, extended operational range, and operator familiarity, making them essential in remote or hard-to-access areas where electric charging networks are limited. Diesel remains critical for continuous heavy-duty operations.

U.S. Heavy Equipment Market held 82% share with USD 39.2 billion in 2024. The region emphasizes advanced machinery, automation, and telematics, with large-scale infrastructure and mining projects driving high demand. Strong replacement demand and a mature rental equipment sector ensure steady revenue streams, while ongoing investment in research and development reinforces North America's global market position.

Major players in the Global Heavy Equipment Market include Hitachi Construction Machinery, Tadano Ltd., Volvo Construction Equipment, Liebherr Group, Komatsu Ltd., Sany Heavy Industry, Caterpillar Inc., Zoomlion Heavy Industry, JCB, John Deere, Develon (formerly Doosan Infracore), Terex Corporation, HD Hyundai Construction Equipment, Manitowoc Company, and other leading manufacturers. Companies in the heavy equipment market are focusing on technological innovation, including automation, telematics, and electrification, to differentiate their products and attract environmentally conscious customers. Strategic partnerships and collaborations with contractors, rental service providers, and fleet operators help expand market reach and strengthen distribution networks. Manufacturers are investing in research and development to improve fuel efficiency, durability, and operational performance while complying with stricter emission regulations. Expanding into high-growth emerging markets ensures access to large infrastructure and industrial projects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Mobility

- 2.2.4 Power source

- 2.2.5 Application

- 2.2.6 End Use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and urbanization

- 3.2.1.2 Technological advancements and automation

- 3.2.1.3 Sustainability and emission regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Supply chain disruptions and raw material volatility

- 3.2.3 Opportunities

- 3.2.3.1 Electrification and green equipment solutions

- 3.2.3.2 Digitalization and predictive maintenance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Excavators

- 5.3 Cranes

- 5.4 Backhoe Loaders

- 5.5 Bulldozers/Dozers

- 5.6 Wheel loaders

- 5.7 Motor Graders

- 5.8 Dump Trucks

- 5.9 Compactors/Rollers

- 5.10 Others

Chapter 6 Market Estimates and Forecast, By Mobility, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Mobile equipment

- 6.3 Stationary equipment

- 6.4 Semi-mobile equipment

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Diesel-powered

- 7.3 Electric-powered

- 7.4 Hybrid-powered

Chapter 8 Market Estimates and Forecast, By Application 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Mining

- 8.4 Infrastructure development

- 8.5 Industrial manufacturing

- 8.6 Material handling

- 8.7 Demolition

- 8.8 Others (agriculture, forestry, utilities, etc.)

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction companies

- 9.3 Rental service providers

- 9.4 Mining companies

- 9.5 Infrastructure developers

- 9.6 Manufacturing plants

- 9.7 Others (utilities, government, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Caterpillar Inc.

- 12.2 Doosan Infracore (now Develon)

- 12.3 Hitachi Construction Machinery

- 12.4 Hyundai Construction Equipment (now HD Hyundai Construction Equipment)

- 12.5 JCB

- 12.6 John Deere

- 12.7 Komatsu Ltd.

- 12.8 Liebherr Group

- 12.9 Manitowoc Company

- 12.10 Sany Heavy Industry

- 12.11 Tadano Ltd.

- 12.12 Terex Corporation

- 12.13 Volvo Construction Equipment

- 12.14 XCMG Group

- 12.15 Zoomlion Heavy Industry