PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885856

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885856

Industrial Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

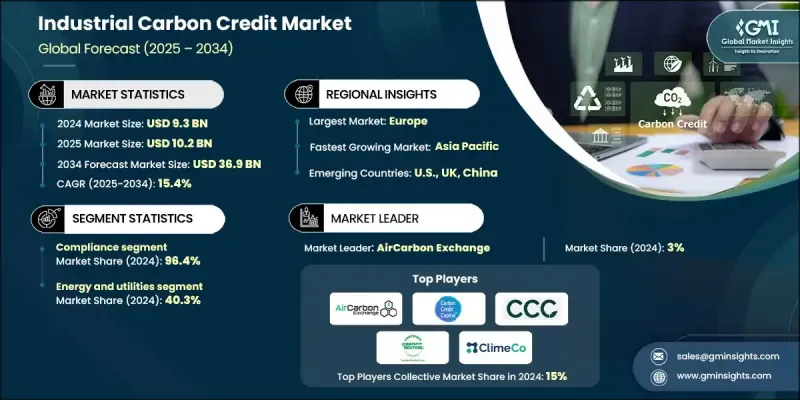

The Global Industrial Carbon Credit Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 36.9 billion by 2034.

Growth is shaped by the tightening of global climate policies and the expanding implementation of mechanisms under major international climate agreements. These policy developments are strengthening compliance requirements, clarifying verification procedures, and encouraging large industrial emitters to participate more actively in cross-border credit trading. Carbon credits are becoming a central component of corporate climate strategies as companies work toward national and internal net-zero commitments. Hard-to-decarbonize industries including chemicals, cement, and steel are increasingly dependent on credits to address emissions that cannot yet be eliminated through existing technologies. Rising ESG expectations from investors, customers, and regulatory bodies further reinforce the need for credible, high-integrity credits. Market confidence continues to improve as new standards emphasize measurable, additional, and verifiable reductions that support environmental integrity and reduce adoption risk across both compliance and voluntary markets. As industries align long-term transition plans with these requirements, the market benefits from a more stable foundation and expanding global participation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $36.9 Billion |

| CAGR | 15.4% |

The voluntary industrial carbon credit segment is expected to grow at a CAGR of 17.6% through 2034, driven by organizations aiming to exceed standard emissions mandates. Corporate climate programs are using voluntary credits to address broader sustainability commitments, especially in areas where direct mitigation remains limited.

The manufacturing sector held a 25.4% share in 2024 and is projected to grow at a 16.3% CAGR through 2034. Its broad emissions footprint spanning automotive, electronics, textiles, and various production industries makes carbon credits an important tool for meeting regulatory and corporate decarbonization requirements.

U.S. Industrial Carbon Credit Market generated USD 1.2 billion in 2024. Market activity is influenced by federal incentives, diverse state-level carbon initiatives, and strong voluntary participation encouraged by corporate sustainability programs. The region benefits from established CO2 transport networks, significant geological storage potential, and considerable public investment in carbon management technologies.

Major participants in the Global Industrial Carbon Credit Market include Verra, Gold Standard Foundation, Climate Impact Partners, CarbonNeutral, AirCarbon Exchange, Carbon Credit Capital, Sylvera, ClimateTrade CarbonCredits, ClimateCare, Natural Capital Partners, South Pole, EcoAct, CarbonBlue, ClimeCo, Pachama, Earthshot Labs, Terrapass, Carbon Credits Consulting, Mission Zero Technologies, and Core CarbonX Solutions Pvt Ltd. Companies in the Industrial Carbon Credit Market are strengthening their competitive positions by investing in verification technologies, expanding digital monitoring platforms, and developing high-integrity credit portfolios that meet emerging global standards. Many firms are forming partnerships with project developers to secure long-term supply while diversifying credit categories across forestry, renewable power, carbon removal, and industrial abatement. Leading organizations are also adopting AI-driven validation tools to improve transparency and accelerate certification timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Type trends

- 2.1.3 End use trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Manufacturing

- 6.3 Energy & utilities

- 6.4 Cement & steel

- 6.5 Chemical & petrochemical

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Denmark

- 7.3.2 Norway

- 7.3.3 France

- 7.3.4 Sweden

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 New Zealand

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Argentina

- 7.6.2 Chile

Chapter 8 Company Profiles

- 8.1 AirCarbon Exchange

- 8.2 Carbon Credit Capital

- 8.3 Carbon Credits Consulting

- 8.4 CarbonBlue

- 8.5 CarbonNeutral

- 8.6 Climate Impact Partners

- 8.7 ClimateCare

- 8.8 ClimateTrade CarbonCredits

- 8.9 ClimeCo

- 8.10 Core CarbonX Solutions Pvt Ltd

- 8.11 Earthshot Labs

- 8.12 EcoAct

- 8.13 Gold Standard Foundation

- 8.14 Mission Zero Technologies

- 8.15 Natural Capital Partners

- 8.16 Pachama

- 8.17 South Pole

- 8.18 Sylvera

- 8.19 Terrapass

- 8.20 Verra