PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885866

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885866

Ultra-Fast EV Charging (350kW+) Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

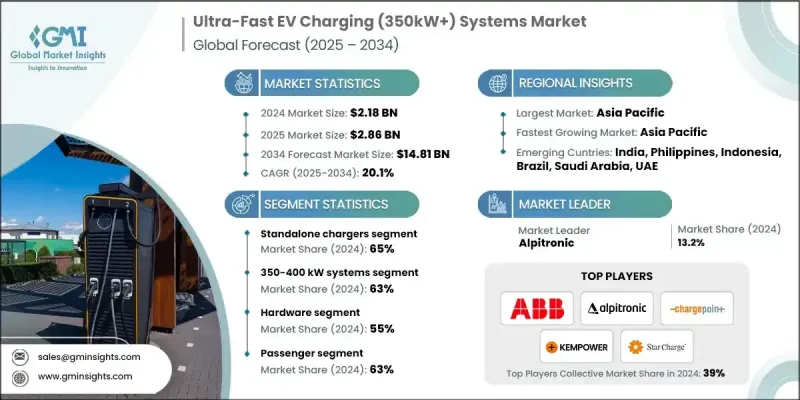

The Global Ultra-Fast EV Charging (350kW+) Systems Market was valued at USD 2.18 billion in 2024 and is estimated to grow at a CAGR of 20.1% to reach USD 14.81 billion by 2034.

The surge in demand for ultra-fast EV chargers (350kW+) is reshaping the electric vehicle infrastructure worldwide. These high-power chargers allow compatible vehicles to reach 80% battery capacity in under 20 minutes, significantly reducing downtime and accelerating EV adoption. They are essential for both passenger and commercial EV segments, offering high-voltage operation, scalable modular designs, and advanced thermal management. Charger manufacturers, power electronics suppliers, and utility partners are investing strategically to simplify technology integration, lower installation costs, and enhance system reliability. The COVID-19 pandemic indirectly boosted infrastructure investments, as governments emphasized low-emission mobility, sustainability, and clean transportation, introducing incentives to expand high-power charging networks. Rising EV adoption has further increased the demand for 350 kW+ charging systems capable of servicing both commercial and passenger vehicles efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.18 Billion |

| Forecast Value | $14.81 Billion |

| CAGR | 20.1% |

The standalone chargers segment held a 65% share in 2024 and is expected to grow at a CAGR of 20.5% through 2034. Standalone chargers dominate the market due to their deployment flexibility, lower installation complexity, and suitability for public and highway networks. Operating independently, they can be installed across service stations, retail hubs, and rest areas while providing ultra-fast 350 kW+ charging, meeting the growing demand for rapid turnaround among EV users.

The 350-400 kW systems segment captured 63% share in 2024 and is anticipated to grow at a CAGR of 20.5% between 2025 and 2034. These systems are favored for their cost-performance balance and compatibility with most 800 V EV architectures. They can recharge 70-80% of battery capacity in under 20 minutes, making them ideal for passenger and light commercial vehicles. Their broad EV compatibility has driven adoption across public and highway charging networks globally.

China Ultra-Fast EV Charging (350kW+) Systems Market held a 40% share, generating USD 366.6 million. The country's dominance is attributed to its large-scale EV production, government-supported infrastructure programs, and cost-effective manufacturing ecosystem. Policy initiatives under the "New Energy Vehicle (NEV)" program, coupled with investments exceeding USD 15 billion in charging infrastructure, have accelerated the deployment of ultra-fast chargers across major cities and highways.

Key players in the Ultra-Fast EV Charging (350kW+) Systems Market include Siemens, ABB, Alpitronic, Delta, Huawei, ChargePoint, Heliox, Kempower, StarCharge, and Tritium. Market players are investing heavily in R&D to improve charger efficiency, modularity, and thermal management while reducing installation and maintenance costs. Companies are forming strategic partnerships with utility providers, EV manufacturers, and infrastructure developers to expand charging networks and ensure compatibility with diverse EV models. Geographic expansion, particularly in regions with high EV adoption, strengthens market presence. Mergers and acquisitions allow firms to consolidate technology and enhance service capabilities. Companies are also integrating digital platforms for real-time monitoring, predictive maintenance, and user-friendly payment solutions to enhance customer experience.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Installation

- 2.2.3 Power rating

- 2.2.4 Component

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 Configuration

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in global EV adoption across passenger and commercial segments

- 3.2.1.2 Increase in government funding and infrastructure incentives for ultra-fast charging deployment

- 3.2.1.3 Rise in OEM and charging network collaborations for large-scale rollouts

- 3.2.1.4 Growth in advancements of power electronics, converters, and thermal management technologies

- 3.2.1.5 Increase in fleet electrification initiatives driving high-throughput charging demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure and installation costs for ultra-fast charging infrastructure

- 3.2.2.2 Limited grid capacity and energy supply challenges in several regions

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in integration of energy storage and renewables with ultra-fast chargers

- 3.2.3.2 Rise in ultra-fast charging deployment across emerging and developing markets

- 3.2.3.3 Growth in demand for dedicated fleet and logistics charging hubs

- 3.2.3.4 Surge in development of modular, multi-port, and scalable charging systems

- 3.2.3.5 Increase in corporate and government sustainability initiatives boosting infrastructure investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Investment and funding analysis

- 3.13.1 Government funding programs

- 3.13.1.1 NEVI formula program ($5 billion)

- 3.13.1.2 EU connecting Europe facility (CEF)

- 3.13.1.3 Alternative fuels infrastructure facility (AFIF)

- 3.13.1.4 China NEV subsidy programs

- 3.13.1.5 State and provincial incentives

- 3.13.2 Private investment trends

- 3.13.3 Public-private partnership models

- 3.13.4 Green bonds and sustainable finance

- 3.13.5 Infrastructure funds and REITs

- 3.13.1 Government funding programs

- 3.14 Business model analysis

- 3.14.1 CPO-owned & operated model

- 3.14.2 OEM-owned charging networks

- 3.14.3 Utility-owned infrastructure

- 3.14.4 Retail & commercial host-owned

- 3.14.5 Charging-as-a-service (CaaS) model

- 3.14.6 Hybrid & emerging models

- 3.15 Installation & commissioning process

- 3.15.1 Pre-installation planning

- 3.15.2 Civil works & site preparation

- 3.15.3 Electrical installation

- 3.15.4 Commissioning & testing

- 3.15.5 Timeline analysis by power level

- 3.15.6 Installation cost breakdown

- 3.16 Future outlook & opportunities

- 3.16.1 Emerging Applications

- 3.16.2 Next-Generation Innovations

- 3.16.3 Investment Opportunities

- 3.16.4 Risk Assessment

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Power modules

- 5.2.2 Cables & connectors

- 5.2.3 Cooling systems

- 5.2.4 Enclosures & mounts

- 5.3 Software

- 5.3.1 Energy management systems

- 5.3.2 Payment & access control

- 5.3.3 Remote monitoring & analytics

- 5.4 Services

- 5.4.1 Installation & commissioning

- 5.4.2 Maintenance & upgrades

- 5.4.3 Network management

Chapter 6 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Standalone chargers

- 6.3 Integrated systems

Chapter 7 Market Estimates & Forecast, By Power rating, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 350-400 kW systems

- 7.3 400-500 kW systems

- 7.4 500+ kW systems

Chapter 8 Market Estimates & Forecast, By Configuration, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Single-port systems

- 8.3 Multi-port systems (2-4 ports)

- 8.4 Modular expandable systems

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Public charging stations

- 9.3 Commercial fleet charging

- 9.4 Residential / private charging

- 9.5 Highway and long-distance charging networks

Chapter 10 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Passenger vehicles

- 10.2.1 Hatchbacks

- 10.2.2 Sedans

- 10.2.3 SUV

- 10.3 Commercial vehicles

- 10.3.1 Light commercial vehicles (LCV)

- 10.3.2 Medium commercial vehicles (MCV)

- 10.3.3 Heavy commercial vehicles (HCV)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 ABB

- 12.1.2 Alpitronic

- 12.1.3 ChargePoint

- 12.1.4 Delta

- 12.1.5 Enel X

- 12.1.6 Exicom Power Solutions

- 12.1.7 Huawei

- 12.1.8 Kempower

- 12.1.9 Phoenix Contact

- 12.1.10 StarCharge

- 12.1.11 Webasto

- 12.2 Regional Players

- 12.2.1 BTC Power

- 12.2.2 Circontrol

- 12.2.3 Compleo Charging Solutions

- 12.2.4 EVTEC

- 12.2.5 Heliox

- 12.2.6 Ingeteam

- 12.2.7 Phihong

- 12.2.8 SK Signet

- 12.2.9 TELD (TGood Electric)

- 12.2.10 Tritium DCFC

- 12.3 Emerging Players

- 12.3.1 Blink Charging

- 12.3.2 Designwerk Technologies

- 12.3.3 Gravity

- 12.3.4 HICI Digital Power Technology

- 12.3.5 Nxu

- 12.3.6 Qingdao Hardhitter Electric

- 12.3.7 Rhombus Energy Solutions (BorgWarner)

- 12.3.8 Shijiazhuang Tonhe Electronics

- 12.3.9 Zerova (Noodoe EV)