PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885876

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885876

Hybrid Plant-Animal Protein System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

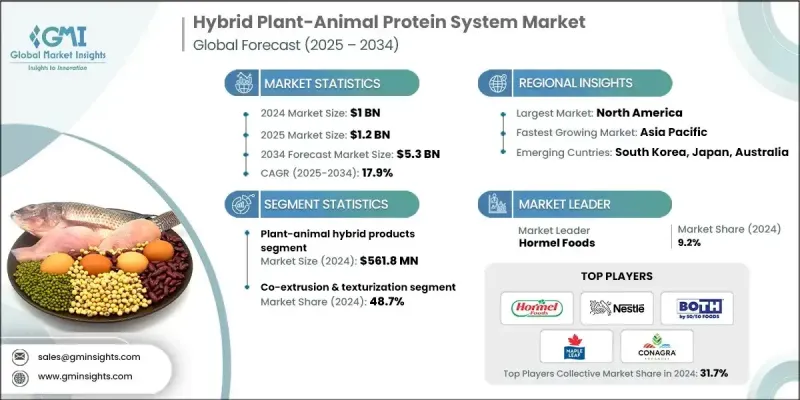

The Global Hybrid Plant-Animal Protein System Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 17.9% to reach USD 5.3 billion by 2034.

This market centers on blended protein systems that integrate plant proteins with animal-derived components to create nutritionally balanced, environmentally conscious, and scalable protein sources for future food supply needs. Growing global population levels and rising pressure on food security continue to push interest in hybrid protein formats. Governments around the world are promoting greener food production practices to advance climate goals, reinforcing demand for innovative protein solutions. Consumers are increasingly adopting flexible eating patterns that reduce meat intake while still incorporating animal-based products, making hybrid proteins an appealing compromise. North America currently leads adoption due to its advanced manufacturing capabilities and regulatory support, while Asia Pacific is witnessing rapid growth driven by higher incomes, urban lifestyle shifts, and rising awareness of sustainability challenges. This growing openness toward foods that balance nutrition, sensory appeal, and environmental benefits is steering manufacturers toward hybrid protein innovations that improve efficiency, reduce resource dependency, and maintain consumer familiarity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 17.9% |

The plant-animal hybrid products segment generated USD 561.8 million in 2024. This segment holds a strong position because hybrid offerings provide adaptable formulations and resonate with consumers who want sustainability without sacrificing recognizable flavors and textures. Substantial advancements in research and processing technologies are enhancing the organoleptic and nutritional attributes of hybrid protein options, allowing them to gain traction across diverse food categories.

The co-extrusion and texturization processes segment accounted for a 48.7% share in 2024. These processing methods lead the market due to their ability to produce fibrous, meat-like textures that closely replicate traditional protein structures. Their capability to integrate plant and animal proteins into cohesive, high-quality hybrid formats supports better sensory performance. The scalability of these processes and suitability for multi-ingredient formulations make them preferred techniques for manufacturers operating at large production volumes.

North America Hybrid Plant-Animal Protein System Market is forecast to grow at a CAGR of 17.9% between 2025 and 2034. Rising consumer interest in sustainable sourcing, transparency, and ethical food production is prompting greater demand for hybrid products that combine the nutritional density of animal proteins with the environmental advantages of plant proteins. Flexitarian dietary habits and increasing preference for natural, clean-label products are encouraging companies to refine hybrid formulations that offer improved flavor, texture, and functional benefits.

Major players in the Hybrid Plant-Animal Protein System Market include Cargill, ITC Limited, Maple Leaf Foods, Conagra Brands, JBS, Tyson Foods, Momentum Foods, Vion Food Group, Rugenwalder Muhle, 50/50 Foods, Inc., Nestle S.A., and Hormel Foods. Companies are strengthening their presence in the Hybrid Plant-Animal Protein System Market by expanding R&D initiatives, advancing processing technologies, and forming strategic alliances with ingredient suppliers and food manufacturers. Many firms are developing next-generation texturization and blending techniques to achieve improved taste, nutritional balance, and consistent product quality. Investments in consumer research help companies tailor hybrid offerings to meet regional dietary preferences and sustainability expectations. Manufacturers are also diversifying their product portfolios to include hybrid options across meat alternatives, ready meals, and snack categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Production process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global protein demand & food security concerns

- 3.2.1.2 Consumer shift toward flexitarian & reducetarian diets

- 3.2.1.3 Sustainability & climate change mitigation goals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & price premium challenges

- 3.2.2.2 Consumer skepticism & acceptance barriers

- 3.2.3 Market opportunities

- 3.2.3.1 B2B ingredient systems for food manufacturers

- 3.2.3.2 Cultivated meat-plant hybrid commercialization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-animal hybrid products

- 5.3 Cultivated meat-plant hybrid products

- 5.4 Mycoprotein-animal hybrid products

- 5.5 Insect-plant hybrid products

- 5.6 Microbial fermentation-animal hybrid products

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Production Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Co-extrusion & texturization

- 6.3 Fermentation

- 6.4 Enzymatic modification

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whole muscle analog hybrids

- 7.2.1 Steak & fillet analogs

- 7.2.2 Cutlet & chop formats

- 7.2.3 Others

- 7.3 Ground / minced hybrid products

- 7.3.1 Burger patties

- 7.3.2 Sausages & links

- 7.3.3 Meatballs & crumbles

- 7.3.4 Others

- 7.4 Processed hybrid products

- 7.4.1 Nuggets & tenders

- 7.4.2 Formed patties & cutlets

- 7.4.3 Strips & bites

- 7.4.4 Others

- 7.5 Ingredient hybrid systems

- 7.5.1 Protein isolates & concentrates

- 7.5.2 Texturized vegetable protein (TVP) blends

- 7.5.3 Functional protein ingredients

- 7.5.4 Others

- 7.6 Ready-to-eat hybrid meals

- 7.6.1 Frozen meal formats

- 7.6.2 Refrigerated prepared meals

- 7.6.3 Shelf-stable options

- 7.6.4 Meal kit

- 7.6.5 Others

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 50/50 Foods, Inc

- 9.2 Cargill

- 9.3 Conagra Brands

- 9.4 Hormel Foods

- 9.5 ITC Limited

- 9.6 JBS

- 9.7 Maple Leaf Foods

- 9.8 Momentum Foods

- 9.9 Nestle S.A.

- 9.10 Rugenwalder Muhle

- 9.11 Tyson Foods

- 9.12 Vion Food Group