PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885878

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885878

Germany Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

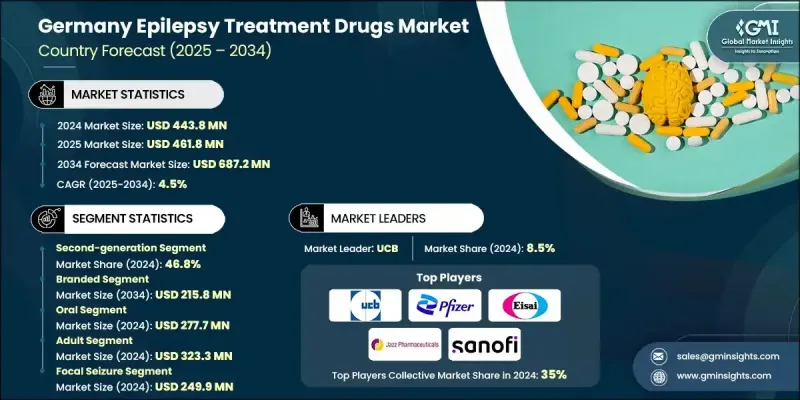

Germany Epilepsy Treatment Drugs Market was valued at USD 443.8 million in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 687.2 million by 2034.

Market growth is heavily influenced by the rising prevalence of neurological disorders linked to aging, as older adults face higher risks of developing epilepsy due to conditions such as strokes, neurodegenerative diseases, and brain tumors. This demographic trend fuels the need for safer, individualized medications designed for long-term management. Epilepsy medicines, also referred to as anticonvulsants or anti-seizure therapies, help regulate electrical activity in the brain to minimize and prevent seizure episodes, making them the primary treatment option for most patients. Growing public awareness and improved diagnostic capabilities are enabling earlier detection, prompting more individuals to seek timely medical support. Advocacy groups, local healthcare systems, and global health initiatives continue working to inform communities, reduce stigma, and encourage appropriate care, especially in regions where underdiagnosis has been prevalent. These combined factors reinforce steady market expansion as demand for reliable treatment options increases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $443.8 Million |

| Forecast Value | $687.2 Million |

| CAGR | 4.5% |

The second-generation segment held 46.8% share in 2024 and is projected to grow at a CAGR of 4.4% through 2034. The movement toward personalized treatment is boosting the adoption of these medications, which are formulated to reduce cognitive and behavioral side effects while offering effective seizure management. Their expanding role in combination regimens also supports broader treatment flexibility, providing clinicians with enhanced therapeutic options.

The branded segment generated USD 135.2 million in 2024 and is forecasted to reach USD 215.8 million by 2034. Branded epilepsy medicines have reshaped clinical practice by delivering innovative mechanisms of action and addressing a wide range of seizure types. These products are recognized for their predictable pharmacokinetics, strong efficacy profiles, and reduced potential for drug interactions, reinforcing their importance for complex or treatment-resistant cases.

The retail pharmacies recorded USD 122.1 million in 2024 and are expected to grow at a CAGR of 4.8% through 2034. Their widespread presence and accessibility make them essential channels for distributing both branded and generic epilepsy medications, particularly for patients who require ongoing therapy for long-term seizure control.

Key companies competing in the Germany Epilepsy Treatment Drugs Market include Bausch Health Companies, Dr. Reddy's Laboratories, Eisai, Jazz Pharmaceuticals, Lupin Pharmaceuticals, Neurelis, Novartis, Pfizer, Sanofi, Sun Pharmaceutical Industries, and UCB. Companies operating in the Germany Epilepsy Treatment Drugs Market deploy several strategies to strengthen their competitive standing. Many focus on expanding research programs to develop next-generation formulations with improved safety and tolerability, addressing unmet needs across diverse patient groups. Firms also invest in lifecycle management tactics, such as extended-release versions and novel delivery systems, to enhance adherence and convenience. Partnerships with healthcare providers and patient organizations help support educational initiatives that promote earlier diagnosis and encourage treatment continuity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Drug class

- 2.2.2 Type

- 2.2.3 Route of administration

- 2.2.4 Age group

- 2.2.5 Seizure type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy in Germany

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Rising demand for novel treatment for epilepsy

- 3.2.1.4 Growing geriatric population in Germany

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with the antiepileptic drugs

- 3.2.2.2 Patent expiration

- 3.2.3 Market opportunities

- 3.2.3.1 Digital health and tell-epilepsy integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Pricing analysis, 2024

- 3.7 Patent analysis

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Company Profiles

- 11.1 Bausch Health Companies

- 11.2 Dr. Reddy’s Laboratories

- 11.3 Eisai

- 11.4 Jazz Pharmaceuticals

- 11.5 Lupin Pharmaceuticals

- 11.6 Neurelis

- 11.7 Novartis

- 11.8 Pfizer

- 11.9 Sanofi

- 11.10 Sun Pharmaceutical Industries

- 11.11 UCB