PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892695

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892695

U.S. Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

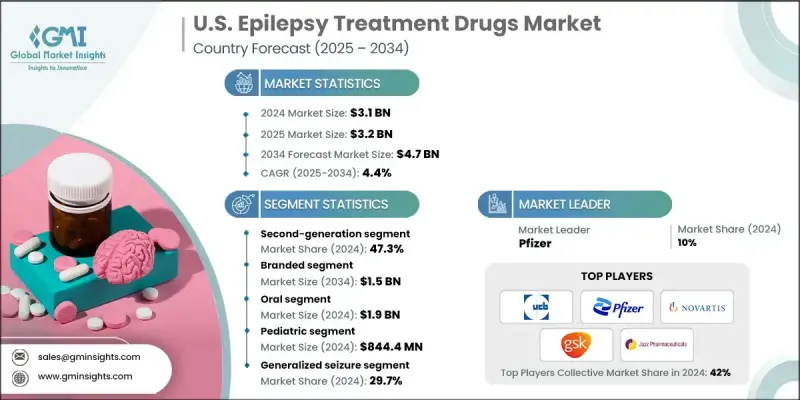

U.S. Epilepsy Treatment Drugs Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 4.7 billion by 2034.

This growth is fueled by multiple factors, including the rising prevalence of epilepsy, expanding research and development investments, increasing demand for innovative therapies, and greater awareness leading to earlier diagnosis. Pharmaceutical companies and research institutions are dedicating substantial resources to understanding neurological disorders, which accelerates the development of advanced anti-epileptic drugs (AEDs) with improved efficacy and safety profiles. These investments drive innovation in drug formulations, minimize side effects, and enhance patient outcomes. Epilepsy drugs, also referred to as anti-seizure or anticonvulsant medications, are essential for controlling and preventing seizures by stabilizing abnormal electrical activity in the brain. As the first-line and most prescribed treatment, they remain the backbone of epilepsy management in the U.S., supported by consistent funding and ongoing scientific advancements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.4% |

The second-generation AED segment held a 47.3% share in 2024 and is expected to grow at a CAGR of 4.4% during 2025-2034. Second-generation therapies are favored for their superior safety, tolerability, and patient-friendly profiles, offering fewer adverse effects, reduced drug-drug interactions, and improved long-term adherence compared to first-generation medications.

The oral administration segment generated USD 1.9 billion in 2024 and is projected to grow at a CAGR of 4.6% through 2034. Oral extended-release formulations are increasingly preferred for their ability to maintain steady drug levels, reduce dosing frequency, and improve patient compliance. These formulations cater to a wide range of age groups and seizure types, providing a convenient alternative to injectable or complex dosing regimens.

The retail pharmacy segment generated USD 840.7 million in 2024 and is expected to grow at a CAGR of 4.7%. Retail pharmacies serve as a key distribution channel, ensuring easy access to both branded and generic AEDs. Generics provide cost-effective alternatives with comparable effectiveness, making long-term treatment more affordable and accessible for patients managing chronic conditions.

Key players operating in the U.S. Epilepsy Treatment Drugs Market include Sumitomo Pharma, Bausch Health Companies, Dr. Reddy's Laboratories, GSK, Jazz Pharmaceuticals, Novartis, AbbVie, Eisai, Lupin Pharmaceuticals, Neurelis, Pfizer, Sanofi, SK Biopharmaceuticals, Sun Pharmaceutical Industries, and UCB. Companies in the U.S. Epilepsy Treatment Drugs Market are adopting strategies to strengthen their presence and expand market share. They are investing heavily in R&D to launch next-generation therapies with improved safety and efficacy. Strategic partnerships with hospitals, healthcare providers, and research organizations accelerate drug adoption. Companies are expanding their geographic reach and distribution networks to access untapped patient populations. Regulatory engagement and participation in clinical trials facilitate faster approvals, while patient support programs and digital adherence tools enhance long-term treatment compliance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Drug class trends

- 2.2.2 Type trends

- 2.2.3 Route of administration trends

- 2.2.4 Age group trends

- 2.2.5 Seizure type trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy in U.S.

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Rising demand for novel treatment for epilepsy

- 3.2.1.4 Growing awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Patent expiration

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in drug development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Bausch Health Companies

- 11.3 Dr. Reddy’s Laboratories

- 11.4 Eisai

- 11.5 GSK

- 11.6 Jazz Pharmaceuticals

- 11.7 Lupin Pharmaceuticals

- 11.8 Neurelis

- 11.9 Novartis

- 11.10 Pfizer

- 11.11 Sanofi

- 11.12 SK Biopharmaceuticals

- 11.13 Sumitomo Pharma

- 11.14 Sun Pharmaceutical Industries

- 11.15 UCB