PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885893

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885893

Telecom API Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

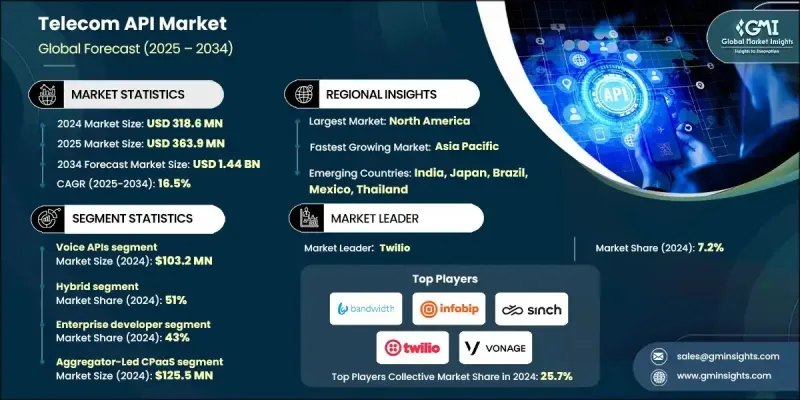

The Global Telecom API Market was valued at USD 318.6 million in 2024 and is estimated to grow at a CAGR of 16.5% to reach USD 1.44 billion by 2034.

The transition toward standalone 5G networks is reshaping the communications environment, enabling operators to move from hardware-heavy systems to cloud-native platforms built around APIs. With 5G delivering higher speeds, providers can introduce capabilities that support new revenue models through services that empower developers and enterprises. Organizations across multiple sectors are modernizing infrastructure and adopting API-driven architectures to support real-time communication, unify digital channels, and automate interactions with AI for greater personalization. Telecom APIs support scalable communication flows and enhance omnichannel customer engagement. The rise of Communications Platform as a Service (CPaaS) allows businesses to integrate programmable communication tools without deploying their own infrastructure. With advanced AI-based functions becoming more accessible, companies can streamline workflows, lower operational costs, and create deeply customized user interactions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $318.6 Million |

| Forecast Value | $1.44 Billion |

| CAGR | 16.5% |

The voice APIs generated USD 103.2 million in 2024, enabling developers to initiate, receive, route, record, and manage calls through RESTful interfaces without maintaining telecom systems. These APIs allow companies to control call-related tasks that support customer interactions, authentication processes, reminders, and alerts. Demand continues to climb as enterprises embed voice into existing systems, transition traditional contact centers to cloud environments, and apply AI-powered enhancements such as intelligent recognition and sentiment evaluation.

The enterprise developers segment held a 43% share in 2024. These teams build both internal and external integrations to connect APIs with systems that manage customer support, workflows, and communications. Segment growth is strongly influenced by ongoing digital transformation and rising adoption of low-code and no-code tools supported by AI.

United States Telecom API Market held an 86% share in 2024 and generated USD 93.7 million. Operators in the country are prioritizing telecom API frameworks built with security at their core. Regulatory expectations, including federal cybersecurity directives, are prompting the adoption of APIs that reinforce identity validation, network monitoring, compliance measures, and zero-trust principles, which is strengthening enterprise demand.

Companies active in the Telecom API Market include Bandwidth, Telesign, Sinch, AT&T, Nokia, Twilio, Infobip, Plivo, Vonage, and MessageBird. Key players in the Telecom API Market are expanding their presence through strategies that emphasize platform scalability, deeper enterprise integration, and advanced security capabilities. Many are strengthening partnerships with cloud providers to broaden deployment options and improve global reach. Firms are also focusing on enhancing developer experience by offering streamlined toolkits, robust documentation, and flexible pricing models. Continuous investment in AI-driven intelligence, such as automated intent handling and predictive analytics, helps companies elevate the value of their APIs. Additionally, providers are pursuing regional expansion, strengthening compliance frameworks, and adopting modular product roadmaps to meet evolving enterprise requirements and maintain a strong competitive position.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Communication service

- 2.2.2 Deployment

- 2.2.3 End use

- 2.2.4 Business model

- 2.2.5 Regional

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global telco collaboration

- 3.2.1.2 Developer ecosystem growth

- 3.2.1.3 5g standalone expansion

- 3.2.1.4 Enhanced security & identity verification

- 3.2.1.5 Accelerated digital transformation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity

- 3.2.2.2 Integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 New enterprise services

- 3.2.3.2 Cross-network innovation

- 3.2.3.3 Ai and analytics integration

- 3.2.3.4 Global developer marketplace

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.9.1 Transactional (per-api-call) pricing

- 3.9.2 Tiered bundle pricing

- 3.9.3 Usage-based pricing models

- 3.9.4 Revenue-sharing arrangements

- 3.9.5 Freemium & developer incentive programs

- 3.9.6 Enterprise contract structures

- 3.9.7 Regional pricing variations

- 3.10 Critical market gaps & product innovation response

- 3.10.1 Fragmented multi-operator API access

- 3.10.2 Lack of standardized network API specifications

- 3.10.3 Poor developer experience and onboarding friction

- 3.10.4 Limited real-time fraud prevention capabilities

3.10.5. Insufficient 5 G monetization models

- 3.10.6 Cross-border API federation and roaming

- 3.10.7 Lack of AI-native telecom APIs

- 3.11 Use case analysis & sector impact

- 3.11.1 Financial services & banking use cases

- 3.11.2 Healthcare & telemedicine use cases

- 3.11.3 Retail & e-commerce use cases

- 3.11.4 Manufacturing & industrial IoT use cases

- 3.11.5 Transportation & automotive use cases

- 3.11.6 Media & entertainment use cases

- 3.11.7 Smart cities & public sector use cases

- 3.11.8 Logistics & supply chain use cases

- 3.12 API transaction volume

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Communication Service, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Voice

- 5.3 Messaging

- 5.4 Video

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Hybrid

- 6.3 Multi-Cloud

- 6.4 On-Premises

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Enterprise Developer

- 7.3 Internal Telecom Developer

- 7.4 Partner Developer

- 7.5 Long-Tail Developer

Chapter 8 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Direct Carrier Exposure

- 8.3 Aggregator-Led CPaaS

- 8.4 Platform-as-a-Service (PaaS)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AT&T

- 10.1.2 Ericsson

- 10.1.3 Infobip

- 10.1.4 MessageBird

- 10.1.5 Microsoft (Azure Communication Services)

- 10.1.6 Nokia

- 10.1.7 Plivo

- 10.1.8 Sinch

- 10.1.9 Telesign

- 10.1.10 Twilio

- 10.1.11 Vonage

- 10.2 Regional Players

- 10.2.1 Bandwidth

- 10.2.2 Deutsche Telekom

- 10.2.3 Orange

- 10.2.4 Reliance Jio Infocomm

- 10.2.5 Singtel

- 10.2.6 Telnyx

- 10.3 Emerging players and disruptors

- 10.3.1 Aduna Global

- 10.3.2 Bridge Alliance

- 10.3.3 Enstream (JT Global)

- 10.3.4 Google Cloud

- 10.3.5 Syniverse Technologies

- 10.3.6 Tech Mahindra

- 10.3.7 Wipro