PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885917

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885917

Durable Medical Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

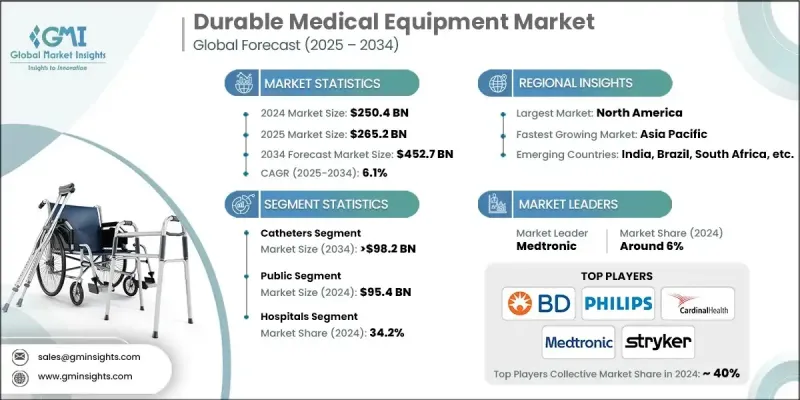

The Global Durable Medical Equipment Market was valued at USD 250.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 452.7 billion by 2034.

Market growth is driven by the rising prevalence of chronic illnesses worldwide, advancements in medical technology, the growing preference for home healthcare, and supportive reimbursement policies. Increasing emphasis on rehabilitation, patient-centered care, and ergonomic, user-friendly equipment is further fueling demand. The aging population also contributes to the need for specialized devices. Companies are actively innovating products, integrating novel materials, and forming regional partnerships to expand geographically. Technological integration is becoming a core market driver, with devices now offering wireless monitoring, AI-powered diagnostics, and mobile app connectivity to enable real-time data sharing and personalized care. As healthcare shifts toward digital and value-based models, technology-enhanced DME is increasingly critical for efficient, patient-focused treatment, opening new opportunities for differentiation and market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $250.4 Billion |

| Forecast Value | $452.7 Billion |

| CAGR | 6.1% |

The catheters segment held a 22.3% share in 2024, driven by the growing number of surgical procedures and urology-related treatments. Catheters serve essential roles in draining fluids, administering medication, and providing circulatory system access. They are widely used across hospitals, long-term care facilities, and home care settings, particularly among patients with urinary retention, cardiovascular conditions, or those undergoing dialysis.

The public payer segment was valued at USD 95.4 billion in 2024. Public payers include government-backed health programs and insurance plans that provide coverage for insured individuals. They often negotiate bulk pricing and emphasize cost-effective essential DME. Public payers are crucial in expanding access, especially in low-income and rural areas, with reimbursement policies directly influencing product availability and market demand.

North America Durable Medical Equipment Market held a substantial share in 2024, owing to advanced healthcare infrastructure, high medical expenditure, and a significant elderly population. The prevalence of chronic illnesses such as diabetes, cardiovascular disorders, and respiratory diseases drives long-term equipment use. The growing adoption of home healthcare and digital health technologies has accelerated demand for portable, connected devices. Government initiatives, including Medicare and Medicaid, further support access to essential DME products, particularly for geriatric and disabled populations.

Prominent players in the Global Durable Medical Equipment Market include B Braun, Baxter, BD, Cardinal Health, CAREX, Coloplast, COMPASS HEALTH, ConvaTec, Drive DeVilbiss Healthcare, Getinge, Graham-Field, INTCO MEDICAL, INVACARE, Koninklijke Philips, MEDLINE, Medtronic, ResMed, Stryker, and SUNRISE MEDICAL. Market leaders focus on product innovation, developing ergonomic, patient-specific, and connected devices to enhance usability and improve clinical outcomes. Companies invest heavily in R&D to integrate AI, wireless monitoring, and mobile connectivity into their equipment, differentiating themselves in the market. Strategic partnerships and collaborations with regional distributors, healthcare providers, and technology firms allow broader geographic reach and faster market penetration. Firms also leverage mergers and acquisitions to expand portfolios and strengthen supply chains. Focus on regulatory compliance, quality certifications, and government reimbursement programs to ensure market credibility and access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Payer trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising patient preference for home-based care

- 3.2.1.2 Increasing prevalence of chronic diseases across the globe

- 3.2.1.3 Growing geriatric population

- 3.2.1.4 Technological advancements in products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device costs and affordability challenges

- 3.2.2.2 Growing demand for pediatric-focused products

- 3.2.3 Opportunities

- 3.2.3.1 AI/ML integration and predictive analytics

- 3.2.3.2 Emerging markets expansion and infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Reimbursement scenario

- 3.8 Healthcare delivery model transformation

- 3.9 Personalized medicine and precision healthcare applications

- 3.10 Software as medical device (SaMD) integrated analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Personal mobility devices

- 5.2.1 Wheelchair and scooter

- 5.2.2 Crutches and canes

- 5.2.3 Walkers

- 5.2.4 Other personal mobility devices

- 5.3 Monitoring and therapeutic devices

- 5.3.1 Oxygen equipment

- 5.3.2 Blood glucose analyzers

- 5.3.3 Vital sign monitors

- 5.3.4 Infusion pumps

- 5.3.5 Continuous positive airway pressure (CPAP) devices

- 5.3.6 Nebulizers

- 5.3.7 Other monitoring and therapeutic devices

- 5.4 Bathroom safety devices

- 5.5 Medical furniture

- 5.6 Incontinent pads

- 5.7 Breast pumps

- 5.8 Catheters

- 5.9 Consumables and accessories

- 5.10 Other products

Chapter 6 Market Estimates and Forecast, By Payer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

- 6.4 Out-of-pocket

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Home healthcare

- 7.4 Ambulatory surgical centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Baxter

- 9.3 BD

- 9.4 Cardinal Health

- 9.5 CAREX

- 9.6 Coloplast

- 9.7 COMPASS HEALTH

- 9.8 convaTec

- 9.9 drive DeVilbiss Healthcare

- 9.10 Getinge

- 9.11 graham-field

- 9.12 INTCO MEDICAL

- 9.13 INVACARE

- 9.14 Koninklijke Philips

- 9.15 MEDLINE

- 9.16 Medtronic

- 9.17 ResMed

- 9.18 Stryker

- 9.19 SUNRISE MEDICAL