PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836706

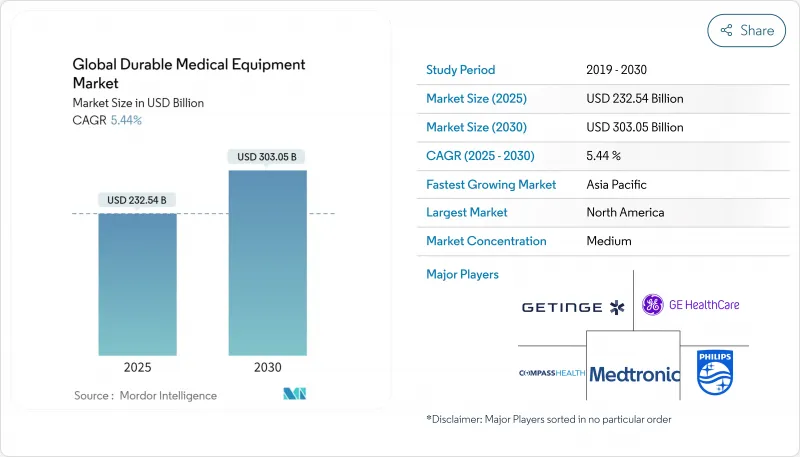

Global Durable Medical Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The market size is valued at USD 232.54 billion in 2025 and is forecast to expand to USD 303.05 billion by 2030, reflecting a 5.44 % CAGR.

The global durable medical equipment (DME) arena is crossing an important inflection point where rising chronic disease prevalence, accelerated home-care adoption, and rapid digital convergence are reinforcing one another to sustain mid-single-digit growth through the end of the decade. Investors and operators are increasingly treating DME as a platform business that blends hardware, software, and recurring service revenues rather than as a series of isolated product lines. That shift is visible in capital-allocation patterns: large incumbents are using balance-sheet strength to bolt on disease-specific specialists, while newer entrants leverage cloud connectivity and data analytics to leapfrog legacy designs. An important implication for executives is that future competitive advantage will hinge less on manufacturing scale alone and more on the capacity to orchestrate cross-functional ecosystems linking payers, caregivers, and patients-a dynamic likely to re-draw traditional value-chain boundaries just as demographic pressures intensify demand for reliable, outcomes-oriented equipment solutions.

Global Durable Medical Equipment Market Trends and Insights

Aging Population Driving Sustained Demand

Across every mature health system, the demographic tilt toward older age brackets is undeniably the most durable growth engine for durable medical equipment (DME). By 2030, a sizable share of United States residents will move past the age-65 threshold, a turning point that immediately widens the addressable market for mobility aids, respiratory equipment, and in-home monitoring systems. Behind the headline demographic data sits a more nuanced reality: older adults frequently navigate multiple chronic conditions simultaneously, and that complexity is straining an already capacity-constrained clinical workforce. Fewer bedside nurses and primary-care physicians relative to the total pool of high-need patients inevitably shift more responsibility onto DME that can extend care into homes and long-term care facilities. Many forward-looking manufacturers are finding that this staffing imbalance unexpectedly strengthens the economic case for user-friendly, self-calibrating devices, because each incremental automation feature frees scarce nurse time for higher-acuity interventions.

Technological Advancements Transforming Equipment Capabilities

Product designs that once competed mainly on durability now increasingly differentiate through embedded software, wireless connectivity, and real-time analytics. Artificial intelligence (AI) algorithms trained on longitudinal equipment data are helping clinicians detect deterioration earlier, while the Internet of Things (IoT) enables remote firmware updates that extend product life cycles without physical recalls. Guidance from the U.S. Food and Drug Administration fda.gov makes clear that connected devices must incorporate cyber-risk management from inception, adding both development complexity and a defensive moat for compliant incumbents . An insight emerging from recent prototype launches is that sensors and software are evolving faster than reimbursement codes, creating short-term pressure on manufacturers to bundle digital services with hardware to accelerate payer acceptance. Early adopters who have paired data analytics with traditional DME report measurable reductions in home-visit frequency-an operational benefit that, over time, may shift negotiating leverage away from volume-based distributors toward technology integrators capable of guaranteeing uptime and data integrity.

High Equipment Costs Limiting Market Penetration

The capital intensity of cutting-edge therapeutic and monitoring devices remains a stubborn access barrier, especially in markets dominated by out-of-pocket spending. Less frequently discussed is the cascading economic effect: when patients can't afford first-generation purchases, maintenance revenue and aftermarket accessory sales decline. This, in turn, restricts the scale economies manufacturers rely on to reduce unit costs. To counter this feedback loop, several OEMs are exploring subscription bundles that include hardware, consumables, and software analytics under a single monthly fee, effectively converting a large upfront purchase into an operating expense. Pilot data suggest that the smoother cash-flow profile of subscriptions improves patient adherence and reduces device abandonment rates-benefits that, over time, may lower the total cost of care despite a higher nominal price tag.

Other drivers and restraints analyzed in the detailed report include:

- Rising Chronic Disease Burden Expanding Application Scope

- E-commerce Revolutionizing DME Distribution Models

- Regulatory Complexity Creating Market Fragmentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring and therapeutic devices currently account for 65% of total DME value, an outperformance attributable to their dual role in both diagnosis and continuous management. Devices that once delivered passive readings are evolving into closed-loop systems capable of automatically titrating oxygen flow or insulin dosage. Industry executives are beginning to view these closed loops as data-acquisition gateways-each real-time sensor reading feeds back into machine-learning models that can later justify premium pricing based on demonstrated clinical savings. Within the personal-mobility niche, lightweight composite materials and smart-drive assistance functions are unlocking a 6.7 % compound annual growth rate between 2025 and 2030, a momentum underpinned by the observation that incremental weight reductions translate directly into longer battery life and less caregiver exertion during transfers. For many hospital purchasing committees, these ergonomic gains carry as much strategic weight as headline pricing.

Hospitals and clinics still absorb the largest volume of DME, yet the fastest growth vector remains the home-healthcare environment where medical tasks migrate toward patients' living spaces. One telling indicator is the surge in user-interface redesign projects that simplify device operation; engineers now test prototypes with lay caregivers rather than only with clinical experts. By 2030, healthcare settings is emerging as the fastest-growing segment with a projected 6.4% CAGR from 2025-2030, a shift that has knock-on effects for maintenance networks. Service depots are relocating closer to residential areas to support faster turnaround on repairs, a decentralization trend that simultaneously reduces carbon footprint and enhances brand loyalty among end users who value same-day support.

The Durable Medical Equipment Market Report Segments the Industry Into by Device Type (Personal Mobility Devices, and More), by End-User (Hospitals & Clinics, Home Healthcare Setting, and More), Distribution Channel (Hospital & Clinic Pharmacies / DME Suppliers, Retail Pharmacies & DME Stores, and More), Mode of Acquisition (Rental, Purchase), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains the largest regional share, hovering close to one-third of global DME value in 2024. Mature reimbursement frameworks and widespread insurance coverage accelerate adoption of advanced monitoring devices, yet the region also faces tightening scrutiny around device cybersecurity. Increasing state-level privacy regulations compel manufacturers to invest in secure firmware architectures, an overhead that disproportionately burdens smaller entrants and may catalyze new waves of consolidation. Executives increasingly cite data-protection certification as a gating factor during hospital tender processes, effectively making cyber-resilience a sales prerequisite rather than an optional differentiator.

Asia-Pacific, forecast to expand at a 6.8 % CAGR through 2030, benefits from a demographic sweet spot where rising middle-class consumers meet rapidly aging populations. Unlike legacy markets, many Asia-Pacific health systems leapfrog into cloud-native infrastructure, which enables them to integrate connected devices at the health-system layer without expensive retrofits. An underappreciated consequence is that local manufacturers, particularly in China and India, gain early access to large anonymized data sets that feed AI-driven product iterations. This indigenous data advantage shortens product-development cycles and may allow regional brands to out-innovate Western incumbents on localized disease patterns.

Europe commands a substantial installed base of durable medical equipment thanks to universal healthcare models and stringent quality regulations. The continental focus on sustainability is now permeating DME procurement tenders, with carbon-footprint scoring appearing alongside traditional price-performance metrics. Several European suppliers are trialing take-back programs where end-of-life equipment is refurbished or responsibly recycled, a move that reduces environmental impact and opens secondary revenue streams. Early pilot feedback indicates that sustainability certifications can sway procurement committees even when competing bids are marginally cheaper, suggesting that ecological stewardship is evolving into a competitive differentiator rather than a compliance exercise.

- Compass Health

- GE Healthcare

- Medtronic

- Invacare

- Masimo

- Koninklijke Philips

- Nihon Kohden

- Mindray

- Beckton Dickinson

- Baxter International Inc. (Hillrom & Welch Allyn)

- Pride Mobility Products

- Patricia Industries

- OMRON

- Getinge

- Stryker

- Cardinal Health

- Resmed

- Sunrise Medical

- Drive DeVilbiss Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly ageing global population creating sustained demand for mobility, respiratory and chronic-care equipment

- 4.2.2 Ongoing Technological Advancements

- 4.2.3 Rising Incidences of Chronic Diseases

- 4.2.4 Rapid IoT integration in oxygen & ventilator devices

- 4.2.5 Growth of e-commerce and direct-to-patient fulfilment models

- 4.2.6 Increasing Demand and Funding For Monitoring and Therapeutic Devices

- 4.3 Market Restraints

- 4.3.1 High Upfront Medical Costs

- 4.3.2 Uptake of GLP-1 obesity drugs dampening demand for select mobility devices

- 4.3.3 Stringent Regulatory Guidelines and Reimbursement Scenarios

- 4.3.4 Shortage of certified service technicians

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Personal Mobility Devices

- 5.1.1.1 Wheelchair

- 5.1.1.2 Crutch and Cane

- 5.1.1.3 Walkwalker

- 5.1.1.4 Other Personal Mobility Devices

- 5.1.2 Bathroom Safety Devices & Medical Furniture

- 5.1.2.1 Medical Bed and Mattress

- 5.1.2.2 Commode and Toilet

- 5.1.2.3 Other Bathroom Safety & Medical Furniture

- 5.1.3 Monitoring & Therapeutic Devices

- 5.1.3.1 Blood Glucose Monitor

- 5.1.3.2 Oxygen Equipment

- 5.1.3.3 Vital Sign Monitor

- 5.1.3.4 Other Monitoring & Therapeutic Devices

- 5.1.1 Personal Mobility Devices

- 5.2 By End-User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Home Healthcare Settings

- 5.2.3 Ambulatory Surgical Centers

- 5.2.4 Other End-Users

- 5.3 By Distribution Channel

- 5.3.1 Hospital & Clinic Pharmacies / DME Suppliers

- 5.3.2 Retail Pharmacies & DME Stores

- 5.3.3 Online & Direct-to-Patient Channels

- 5.4 By Mode of Acquisition

- 5.4.1 Rental

- 5.4.2 Purchase

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles ((includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Compass Health Brands

- 6.4.2 GE Healthcare

- 6.4.3 Medtronic PLC

- 6.4.4 Invacare Corporation

- 6.4.5 Masimo Corporation

- 6.4.6 Koninklijke Philips NV

- 6.4.7 Nihon Kohden Corporation

- 6.4.8 Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- 6.4.9 Becton, Dickinson and Company

- 6.4.10 Baxter International Inc. (Hillrom & Welch Allyn)

- 6.4.11 Pride Mobility Products Corp.

- 6.4.12 Patricia Industries (Permobil)

- 6.4.13 OMRON Corporation

- 6.4.14 Getinge AB

- 6.4.15 Stryker Corporation

- 6.4.16 Cardinal Health Inc.

- 6.4.17 ResMed Inc.

- 6.4.18 Sunrise Medical LLC

- 6.4.19 Drive DeVilbiss Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment