PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885924

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885924

Data Center Infrastructure Management (DCIM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

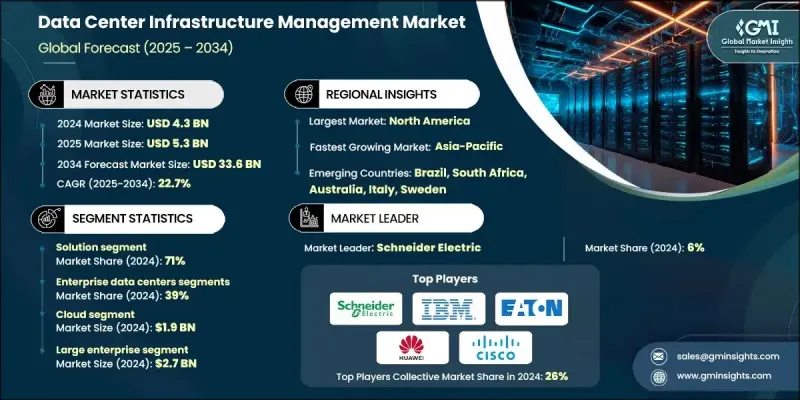

The Global Data Center Infrastructure Management (DCIM) Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 33.6 billion by 2034.

The market expansion is driven by the rapid adoption of AI workloads, hybrid cloud complexities, and increasingly stringent energy efficiency regulations. Traditional capacity planning is giving way to AI-powered predictive operations, digital twin simulations, and fully converged IT and operational technology (OT) environments. DCIM solutions have become indispensable as operators seek real-time visibility into power distribution, thermal conditions, and cooling systems to maintain performance and avoid downtime, particularly in high-density AI training clusters exceeding 40 kW per rack. Accelerating growth in this market is also linked to the rising need for infrastructure optimization, sustainability reporting, and cost-effective operations across enterprise, hyperscale, and colocation data centers globally. The integration of AI, machine learning, and predictive analytics is redefining operational management and ensuring higher efficiency, resilience, and scalability for modern data center environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $33.6 Billion |

| CAGR | 22.7% |

The solutions segment held a 71% share in 2024 and is anticipated to grow at a CAGR of 23.5% from 2025 to 2034. This segment includes DCIM software platforms, monitoring tools, analytics engines, and integrated hardware-software appliances. Modern DCIM solutions extend beyond monitoring to provide comprehensive asset management, capacity planning, predictive maintenance, digital twin simulations, power and cooling optimization, and sustainability reporting, enabling operators to gain actionable insights across the infrastructure.

The enterprise data centers segment held a 39% share in 2024 and is expected to grow at a CAGR of 21.7% through 2034. These centers, owned and operated internally by organizations, dominate due to their global prevalence across sectors such as healthcare, manufacturing, government, and financial services. Increasing efficiency demands, cost reduction targets, and sustainability compliance requirements are driving enterprise adoption of DCIM solutions.

U.S. Data Center Infrastructure Management (DCIM) Market generated USD 1.48 billion in 2024. North America continues to dominate due to its high concentration of hyperscale operators, colocation providers, and enterprise data centers, with the U.S. accounting for 90% of regional revenue. Approximately 60% of global data center capacity and 45% of worldwide data center energy consumption are in the United States. The market in the U.S. is driven by rising electricity usage, which fuels the adoption of intelligent management solutions to optimize efficiency, monitor power consumption, and reduce operational costs.

Prominent players in the Global Data Center Infrastructure Management (DCIM) Market include Eaton, Fujitsu, Cisco, Schneider Electric, ABB, Siemens, Emerson, Hewlett-Packard Enterprise Company, IBM Corporation, and Huawei Technologies. Companies in the Data Center Infrastructure Management (DCIM) Market are strengthening their foothold by investing in AI-powered predictive analytics, digital twin modeling, and advanced monitoring tools to improve operational efficiency. Strategic collaborations with hyperscale operators, enterprise clients, and cloud providers allow customization of solutions for complex IT and OT environments. Firms are also expanding into emerging markets and offering cloud-enabled DCIM platforms to increase accessibility and scalability. Enhancing sustainability features, integrating IoT-based energy management, and providing full-service maintenance contracts are key strategies that help maintain customer loyalty, differentiate from competitors, and reinforce market leadership in a rapidly growing industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data Center

- 2.2.4 Deployment

- 2.2.5 Organization Size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 System integrators & distributors

- 3.1.1.3 Facility operators & service providers

- 3.1.1.4 End use & enterprises

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Explosion of high-density AI & HPC workloads

- 3.2.1.2 Shift toward hybrid & multi-cloud infrastructure

- 3.2.1.3 Rising energy costs & mandatory efficiency regulations

- 3.2.1.4 Edge data center proliferation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront integration & deployment complexity

- 3.2.2.2 Fragmented vendor ecosystem & interoperability issues

- 3.2.3 Market opportunities

- 3.2.3.1 DCIM 2.0 adoption

- 3.2.3.2 Integration of OT + IT for full facility digital twins

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Artificial intelligence & machine learning

- 3.3.1.2 Generative AI & large language models

- 3.3.1.3 Digital twin technology

- 3.3.1.4 Internet of things (IoT) & edge computing

- 3.3.2 Emerging technologies

- 3.3.2.1 Blockchain & distributed ledger technology

- 3.3.2.2 Augmented reality (AR) & virtual reality (VR)

- 3.3.2.3 Quantum computing

- 3.3.2.4 5G & next-generation connectivity

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Data sovereignty & localization requirements

- 3.5.2 Environmental & sustainability regulations

- 3.5.3 Building codes & safety standards

- 3.5.4 Regional regulatory comparison

- 3.5.4.1 North America

- 3.5.4.2 Europe

- 3.5.4.3 Asia-Pacific

- 3.5.4.4 Latin America

- 3.5.4.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Competitive pricing strategies

- 3.10.2 Software licensing price ranges

- 3.10.3 Professional services rates

- 3.10.4 Vendor revenue models & strategies

- 3.11 Product pipeline & R&D roadmap

- 3.11.1 Current product generation analysis

- 3.11.1.1 Feature set & capabilities benchmarking

- 3.11.1.2 Technology stack & architecture

- 3.11.1.3 Performance & scalability metrics

- 3.11.1.4 Strengths & limitations

- 3.11.2 Next-generation product pipeline

- 3.11.2.1 Announced product releases (2024-2026)

- 3.11.2.2 Beta & early access programs

- 3.11.2.3 Technology previews & proof-of-concepts

- 3.11.2.4 Expected feature enhancements

- 3.11.1 Current product generation analysis

- 3.12 Patent analysis

- 3.12.1 USPTO patent classification analysis

- 3.12.2 Key patent holders & innovation leaders

- 3.12.3 Patent pools & standards-essential patents

- 3.12.4 Emerging technology patent hotspots

- 3.13 Sustainability and environmental aspects

- 3.13.1 Data center environmental footprint

- 3.13.2 Carbon pricing & emissions trading schemes

- 3.13.3 DCIM role in sustainability

- 3.13.4 DCIM-enabled sustainability achievements

- 3.14 Market adoption & penetration analysis

- 3.14.1 Technology adoption lifecycle

- 3.14.2 Adoption barriers & enablers

- 3.14.3 Market penetration analysis

- 3.14.4 Customer decision journey

- 3.15 Use case analysis & application scenarios

- 3.15.1 Use case taxonomy & classification

- 3.15.1.1 By data center type

- 3.15.1.2 By functional objective

- 3.15.1.3 By industry vertical

- 3.15.1.4 By deployment scale

- 3.15.2 Detailed use case analysis

- 3.15.2.1 Energy efficiency optimization

- 3.15.2.2 Capacity planning & forecasting

- 3.15.2.3 Predictive maintenance & failure prevention

- 3.15.2.4 Multi-site visibility & management

- 3.15.1 Use case taxonomy & classification

- 3.16 Customer & End use insights

- 3.16.1 Buying behavior & decision-making process

- 3.16.2 Customer journey mapping

- 3.16.3 Customer satisfaction & net promoter score

- 3.16.4 Customer pain points & unmet needs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Asset management

- 5.2.2 Network management

- 5.2.3 Cooling management

- 5.2.4 Power and temperature management

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Installation & integration

- 5.3.2 Managed

- 5.3.3 Consulting

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Enterprise data centers

- 6.3 colocation data centers

- 6.4 hyperscale data centers

- 6.5 edge data centers

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Large enterprise

- 8.3 SME

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Colocation

- 9.4 Energy

- 9.5 Government

- 9.6 Healthcare

- 9.7 Manufacturing

- 9.8 IT & telecom

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 ABB

- 11.1.2 Eaton

- 11.1.3 FNT Software

- 11.1.4 Hewlett-Packard Enterprise

- 11.1.5 IBM

- 11.1.6 Nlyte Software

- 11.1.7 Schneider Electric

- 11.1.8 Siemens

- 11.1.9 Sunbird Software

- 11.2 Regional champions

- 11.2.1 CommScope

- 11.2.2 Cormant

- 11.2.3 Device42

- 11.2.4 EkkoSense

- 11.2.5 Emerson

- 11.2.6 Fujitsu

- 11.2.7 Huawei Technologies

- 11.2.8 Hyperview

- 11.2.9 Packet Power

- 11.2.10 Rittal

- 11.3 Emerging players & innovators

- 11.3.1 Arista

- 11.3.2 Cisco

- 11.3.3 Inspur

- 11.3.4 Lenovo

- 11.3.5 Modius

- 11.3.6 NetApp

- 11.3.7 Supermicro