PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892661

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892661

Coiled Tubing Drilling Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

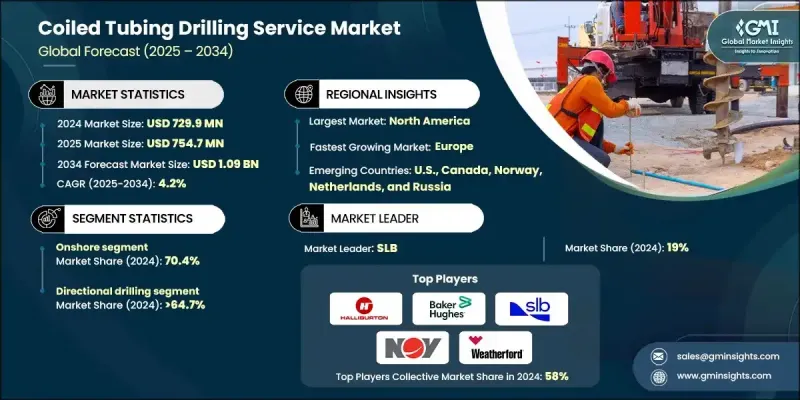

The Global Coiled Tubing Drilling Service Market was valued at USD 729.9 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 1.09 billion by 2034.

Rising global energy requirements and the growing need to maintain aging oil and gas assets are accelerating investment in advanced well intervention and drilling technologies. Modern coiled tubing solutions are becoming essential as operators seek safer and more efficient methods for handling complex well interventions, particularly in reservoirs that require re-entry operations. Expanding development of unconventional resources, supported by horizontal drilling and shale extraction activity, is further elevating demand for coiled tubing systems. Operators working to maximize output in challenging reservoirs are showing greater interest in integrated coiled tubing technologies that support high-performance extraction strategies. Digital transformation is also reshaping the landscape, with automation and real-time monitoring improving operational precision and safety, especially in offshore environments. Service providers offering optimized, high-efficiency drilling solutions are increasingly preferred as companies look to streamline workflows and strengthen field reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $729.9 Million |

| Forecast Value | $1.09 Billion |

| CAGR | 4.2% |

The onshore segment held a 70.4% share in 2024 and is forecasted to grow at a CAGR of 4% through 2034. Expansion in shale development and the presence of extensive mature infrastructure continue to support onshore adoption, where a wide range of drilling approaches, including vertical, horizontal, and directional techniques, are used to access unconventional reserves. Lower operational expenses compared with offshore activity also contribute to segment growth.

The directional drilling segment held a 64.7% share in 2024 and is anticipated to grow at a 3.5% through 2034. The need to reach deeper formations and unconventional hydrocarbon sources is driving demand for precise wellbore control. Advancements in automated steering technologies and data-driven systems are improving well accuracy and reducing operational hazards, supporting further expansion of this segment.

U.S. Coiled Tubing Drilling Service Market held a 62% share in 2024 and generated USD 182.4 million. Strong production from tight oil and shale fields continues to shape market progress. Improvements in real-time data systems, automation tools, and enhanced material technologies are strengthening drilling performance. Regulatory initiatives aimed at lowering emissions and improving well integrity are encouraging broader adoption of coiled tubing as an efficient alternative to conventional drilling practices.

Prominent companies in the industry include Hunting PLC, TAQA KSA, SLB, Tenaris, Nabors Industries Ltd., AnTech Ltd, GOES GmbH, Halliburton, Oilserv, Weatherford, National Petroleum Services Company (NAPESCO), Baker Hughes, Stena Drilling US Inc., Kleen, HI LONG OIL SERVICE & ENGINEERING CO., LTD., AFG Holdings, Inc., EXCEED (XCD) Holdings Ltd., Blade Energy Partners, Pruitt, FracJet-Volga LLC, and Granite Construction Inc. Companies operating in the Global Coiled Tubing Drilling Service Market are adopting targeted strategies to strengthen their competitive position. Many are upgrading their service portfolios with automation-based drilling systems, high-strength tubing materials, and enhanced downhole tools to improve performance in complex reservoir conditions. Partnerships with operators and technology developers are helping service providers expand capabilities and deliver integrated solutions tailored to unconventional and offshore environments. Firms are also investing in digital monitoring platforms, predictive maintenance technologies, and real-time analytics to boost operational safety and increase efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Drilling type trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digital transformation with IoT technologies

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Key innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Drilling Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Managed pressure drilling

- 5.3 Directional drilling

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

- 6.3.1 Shallow

- 6.3.2 Deep

- 6.3.3 Ultra-deep

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Norway

- 7.3.4 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 AFG Holdings, Inc.

- 8.2 AnTech Ltd

- 8.3 Baker Hughes

- 8.4 Blade Energy Partners

- 8.5 EXCEED (XCD) Holdings Ltd.

- 8.6 FracJet-Volga LLC

- 8.7 GOES GmbH

- 8.8 Granite Construction Inc.

- 8.9 Halliburton

- 8.10 HI LONG OIL SERVICE & ENGINEERING CO., LTD.

- 8.11 Hunting PLC

- 8.12 KLX

- 8.13 Nabors Industries Ltd.

- 8.14 National Petroleum Services Company (NAPESCO)

- 8.15 Oilserv

- 8.16 Pruitt

- 8.17 SLB

- 8.18 Stena Drilling US Inc.

- 8.19 TAQA KSA

- 8.20 Tenaris

- 8.21 Weatherford