PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892662

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892662

Europe Medical Device Distribution Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

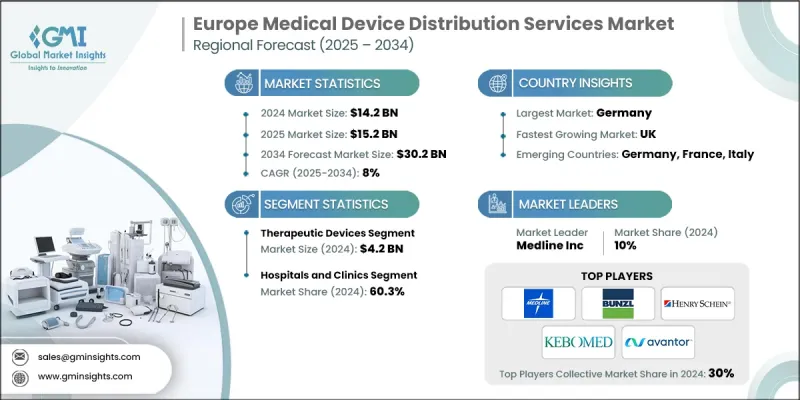

Europe Medical Device Distribution Services Market was valued at USD 14.2 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 30.2 billion by 2034.

Steady expansion across this sector is being shaped by the growing incidence of chronic illnesses, increasing approval of new technologies, and the heightened need for home-based healthcare and remote monitoring solutions. The market is advancing rapidly as both public and private stakeholders elevate investments in device innovation to improve safety, efficiency, and accessibility across multiple care environments. This momentum aligns with Europe's broader shift toward precision-driven medicine, minimally invasive procedures, and digitally enabled care pathways. Strong R&D commitments across major European countries continue to create a robust influx of next-generation devices, further supported by regulatory acceptance of smart diagnostic platforms and advanced surgical systems. As the region continues integrating digital health tools and personalized treatment models, dependable distribution channels will remain essential for connecting medical device manufacturers with care providers, enabling quick deployment of cutting-edge medical technologies throughout Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $30.2 Billion |

| CAGR | 8% |

The therapeutic devices segment generated USD 4.2 billion in 2024. This segment benefits from consistent demand for technologies that support chronic disease treatment and surgical care across hospitals and home environments. It includes systems for respiratory support, infusion and drug delivery, cardiovascular interventions, prosthetic solutions, and dialysis, all of which require detailed handling, specialized servicing, and technical expertise. These needs further strengthen the importance of distribution partners across Europe's healthcare network.

The hospitals and clinics segment accounted for a 60.3% share in 2024. Their extensive service portfolios, which range from emergency management to complex therapeutic procedures, create high and continuous demand for reliable medical devices. Their capacity to treat large patient populations drives the need for a wide array of equipment supplied through stable and efficient distribution systems.

UK Medical Device Distribution Services Market is expected to grow at a CAGR of 8.8% through 2034. Demand is rising as healthcare delivery continues shifting toward home settings and remote patient monitoring, supporting more personalized, flexible, and cost-effective care options. With age-related conditions and chronic illnesses on the rise, the requirement for devices that can support continuous monitoring outside hospitals is increasing across the country.

Prominent companies participating in the Europe Medical Device Distribution Services Market include Avantor, Inc., Bunzl plc, B. Braun Melsungen, Cardinal Health, Inc., Henry Schein, Inc., KEBOMED Europe AG, McKesson Corporation, Medline Inc., Owens & Minor, Inc., and Patterson Companies, Inc. Companies competing in the Europe Medical Device Distribution Services Market employ several strategies to strengthen their market foothold. Many organizations are expanding their logistics networks to enable faster delivery times, temperature-controlled storage, and improved inventory accuracy. Firms are also investing in digital solutions such as automated tracking systems and data-driven supply chain tools to enhance transparency and operational efficiency. Partnerships with manufacturers and healthcare facilities are being deepened to secure long-term contracts and ensure consistent product availability. Companies are broadening their product portfolios to cover high-demand categories, while also improving technical support and training services for healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic diseases

- 3.2.1.2 Increasing investments and device approvals

- 3.2.1.3 Rising demand for home healthcare and remote monitoring

- 3.2.1.4 Advancements in medical device technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory compliance

- 3.2.2.2 High initial capital expenditure

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for integrated solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Europe

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.3 Therapeutic devices

- 5.4 Patient monitoring devices

- 5.5 Home healthcare devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers (ASCs)

- 6.5 Long-term care facilities

- 6.6 Homecare settings

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Germany

- 7.3 UK

- 7.4 France

- 7.5 Spain

- 7.6 Italy

- 7.7 Netherlands

Chapter 8 Company Profiles

- 8.1 Avantor, Inc.

- 8.2 Bunzl plc

- 8.3 B. Braun Melsungen

- 8.4 Cardinal Health, Inc.

- 8.5 Henry Schein, Inc.

- 8.6 KEBOMED Europe AG

- 8.7 McKesson Corporation

- 8.8 Medline Inc.

- 8.9 Owens & Minor, Inc.

- 8.10 Patterson Companies, Inc.