PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892795

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892795

Medical Device Distribution Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

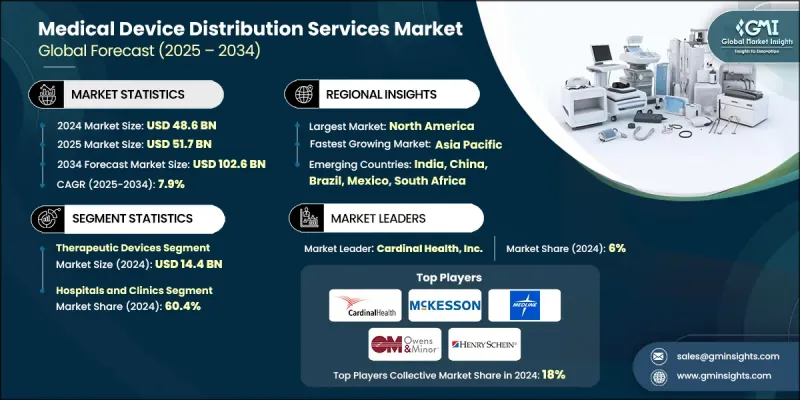

The Global Medical Device Distribution Services Market was valued at USD 48.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 102.6 billion by 2034.

The expansion is driven by rising chronic disease prevalence, rapid adoption of home-healthcare and remote monitoring solutions, and significant investments in digital supply-chain capabilities. Distributors are increasingly positioned as strategic partners to healthcare systems, providing not just logistics but value-added services such as installation, calibration, training, cold-chain management, and UDI traceability, which is accelerating the shift from commodity shipping to integrated clinical supply solutions. Simultaneously, hospitals' large procurement volumes and Group Purchasing Organization (GPO) dynamics are increasing demand for sophisticated distribution services that reduce stockouts, shorten lead times, and ensure regulatory compliance across multiple jurisdictions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.6 Billion |

| Forecast Value | $102.6 Billion |

| CAGR | 7.9% |

By product type, the therapeutic devices segment led the market in 2024 with USD 14.4 billion, reflecting strong demand for infusion pumps, respiratory devices, cardiovascular stents, prosthetic implants, dialysis systems, and other treatment-critical technologies. Therapeutic devices typically require specialized handling, cold-chain or condition-sensitive logistics, and after-sales support (installation, servicing, staff training), which amplifies distributor margins and cements long-term partnerships with hospitals and clinics.

On an end-use basis, the hospitals and clinics segment held 60.4% share in 2024, owing to their broad device requirements, centralized procurement processes, and need to maintain high in-house inventories for emergency and surgical care. Hospitals' preference for bundled service offerings combining logistics, installation, and post-sale support heightens the strategic importance of distribution partners who can guarantee traceability, rapid response repair, and compliance reporting.

North America Medical Device Distribution Services Market held 39.2% share in 2024, reflecting the region's mature healthcare infrastructure, high procedural volumes, and early adoption of digital logistics technologies (IoT, AI, blockchain for traceability). The U.S. market dynamics, including large hospital networks, centralized GPO contracting, and strong home-healthcare reimbursement systems, support higher distributor margins and investment in advanced cold-chain and automated replenishment systems. North America's leadership is further reinforced by substantial private and public funding for supply-chain resilience, technology modernization in distribution centers, and regulatory frameworks such as UDI that incentivize traceable, quality-assured distribution models.

Key players shaping the Global Medical Device Distribution Services Market include Cardinal Health, Inc.; McKesson Corporation; Medline Inc.; Owens & Minor, Inc.; Henry Schein, Inc.; Patterson Companies, Inc.; Bunzl plc; Avantor, Inc.; Alfresa Holdings Corporation; CAN-med Healthcare; KEBOMED Europe AG; Meditek Systems Pvt. Ltd.; Soquelec Ltd.; Southmedic Inc.; and The Stevens Company Limited. These companies are competing on breadth of coverage, cold-chain and compliance capabilities, digital ordering platforms, and value-added clinical services. Market leaders are investing in smart warehouses, temperature-validated storage, last-mile home care delivery capabilities, and partnerships with OEMs and telehealth providers to capture higher margin service revenues and lock in long-term procurement agreements. Companies in the medical device distribution services market are strengthening footprints through vertical integration, digital platform investments, and strategic partnerships with hospitals, GPOs, and device OEMs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic diseases

- 3.2.1.2 Surge in investments for research purpose and growth in medical device approvals

- 3.2.1.3 Rising demand for home healthcare and remote monitoring

- 3.2.1.4 Advancements in medical device technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement for high initial capital expenditure

- 3.2.2.2 Presence of stringent regulatory compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in online distribution services and digital ordering system

- 3.2.3.2 Increasing public private partnership to strengthen supply chain

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.3 Therapeutic devices

- 5.4 Patient monitoring devices

- 5.5 Home healthcare devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers (ASCs)

- 6.5 Long-term care facilities

- 6.6 Homecare settings

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alfresa Holdings Corporation

- 8.2 Avantor, Inc.

- 8.3 Bunzl plc

- 8.4 CAN-med Healthcare

- 8.5 Cardinal Health, Inc.

- 8.6 Henry Schein, Inc.

- 8.7 KEBOMED Europe AG

- 8.8 McKesson Corporation

- 8.9 Meditek Systems Pvt. Ltd.

- 8.10 Medline Industries, LP.

- 8.11 Owens & Minor, Inc.

- 8.12 Patterson Companies, Inc.

- 8.13 Soquelec Ltd.

- 8.14 Southmedic Inc.

- 8.15 The Stevens Company Limited