PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892665

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892665

North America Remote Patient Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

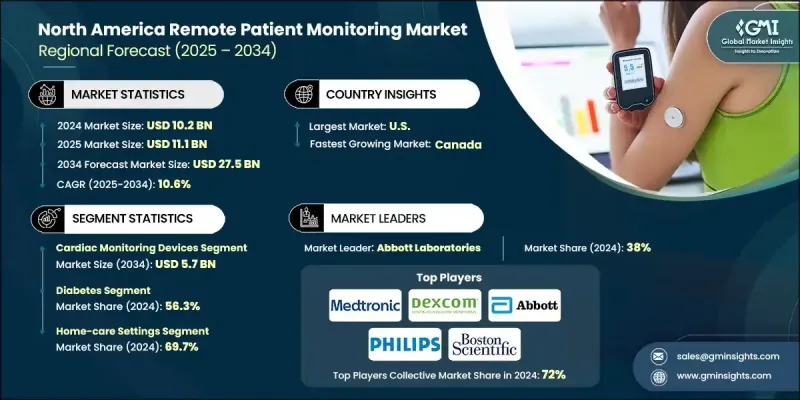

North America Remote Patient Monitoring Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 27.5 billion by 2034.

Demand for remote patient monitoring (RPM) solutions continues to rise due to the growing burden of chronic illnesses, rapid advancements in digital health technologies, and the ongoing shift toward value-based healthcare. Patients and clinicians are increasingly adopting connected, intuitive, and accurate RPM tools, including wearable sensors, digital health apps, and cloud-based platforms to support continuous monitoring outside traditional clinical environments. Adoption is further boosted by strong reimbursement policies, well-established healthcare systems, and the expanding elderly population across the region. Federal initiatives and government-led digital health programs play a pivotal role in accelerating RPM deployment. Expanded reimbursement from the Centers for Medicare & Medicaid Services (CMS) has encouraged healthcare providers to integrate remote monitoring into chronic care workflows. Combined with rising awareness and widespread access to connected technologies, these factors continue to drive significant growth in wearable sensors, mobile platforms, and cloud-integrated monitoring systems throughout North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $27.5 Billion |

| CAGR | 10.6% |

In 2024, the cardiac monitoring devices segment accounted for a 19.6% share and is expected to reach USD 5.7 billion by 2034, growing at a CAGR of 11.2%. This category remains essential within the RPM landscape as cardiovascular conditions require ongoing, precise monitoring. These systems track critical cardiac indicators, including rhythm irregularities, heart rate behavior, and related markers that support earlier detection and faster clinical responses. They have become an integral solution for patients managing long-term heart conditions or those undergoing post-procedural recovery.

The diabetes segment captured a 56.3% share in 2024, supported by the increasing number of individuals diagnosed with diabetes and the continued shift toward real-time disease management. Continuous glucose monitoring devices are widely preferred since they help patients check glucose fluctuations, manage insulin needs, and monitor metabolic patterns without repeated clinic visits. With seamless integration into digital care platforms, such systems enable patients and providers to share real-time updates, improving adherence and facilitating timely clinical adjustments.

U.S. Remote Patient Monitoring Market held a significant share in 2024, owing to its large chronic disease population, advanced digital health infrastructure, and strong regulatory backing. The country's diverse patient base sustains steady usage of RPM technologies across multiple demographics. As home-based care becomes more prominent, individuals increasingly favor smart monitoring tools such as connected blood pressure systems, wearable ECG devices, and digital pulse oximeters rather than frequent office appointments. These technologies support continuous data transmission, enabling clinicians to make quick, informed decisions while helping reduce emergency visits and hospital readmissions.

Key companies active in the North America Remote Patient Monitoring Market include Medtronic, Abbott Laboratories, Dexcom, Johnson & Johnson, GE Healthcare, OMRON Healthcare, Baxter International, BIOTRONIK SE & Co. KG, Koninklijke Philips N.V., Boston Scientific, F. Hoffmann-La Roche Ltd, Sotera Wireless, and VitalConnect. Companies in the North America Remote Patient Monitoring Market strengthen their positions by expanding AI-enabled monitoring platforms, enhancing device connectivity, and integrating cloud-based analytics to deliver real-time insights. Many firms collaborate with healthcare providers, insurers, and digital health networks to improve care coordination and expand reimbursement coverage. Investments in data security, interoperability, and multi-parameter monitoring capabilities also play a major role in building trust and improving adoption. Partnerships with telehealth companies, acquisitions of digital health startups, and continuous product innovation, such as advanced wearables and long-term biosensors, help organizations scale their presence, meet regulatory standards, and address the rising demand for home-based healthcare solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High prevalence of chronic diseases

- 3.2.1.2 Strong healthcare infrastructure and reimbursement policies

- 3.2.1.3 Technological leadership and innovation in the market

- 3.2.2 Growing adoption of remote patient monitoring devices

- 3.2.3 Industry pitfalls and challenges

- 3.2.3.1 High cost of devices

- 3.2.3.2 Stringent regulatory framework

- 3.2.4 Market opportunities

- 3.2.5 Increasing adoption of AI-powered predictive monitoring tools

- 3.2.6 Emergence of wearable biosensors for continuous, real-time health tracking

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac monitoring devices

- 5.3 Blood pressure monitoring devices

- 5.4 Neurological monitoring devices

- 5.5 Respiratory monitoring devices

- 5.6 Multiparameter monitoring devices

- 5.7 Blood glucose monitoring devices

- 5.8 Fetal and neonatal monitoring devices

- 5.9 Sleep monitoring devices

- 5.10 Other monitoring devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular diseases

- 6.3 Cancer

- 6.4 Diabetes

- 6.5 Neurological disorders

- 6.6 Infectious diseases

- 6.7 Respiratory diseases

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Home-care settings

- 7.3 Long-term care

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Baxter International

- 9.3 BIOTRONIK SE & Co. KG

- 9.4 Boston Scientific

- 9.5 Dexcom

- 9.6 F. Hoffmann-La Roche Ltd

- 9.7 GE Healthcare

- 9.8 Johnson & Johnson

- 9.9 Koninklijke Philips N.V.

- 9.10 Medtronic

- 9.11 OMRON Healthcare

- 9.12 Sotera Wireless

- 9.13 VitalConnect