PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892718

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892718

U.S. Remote Patient Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

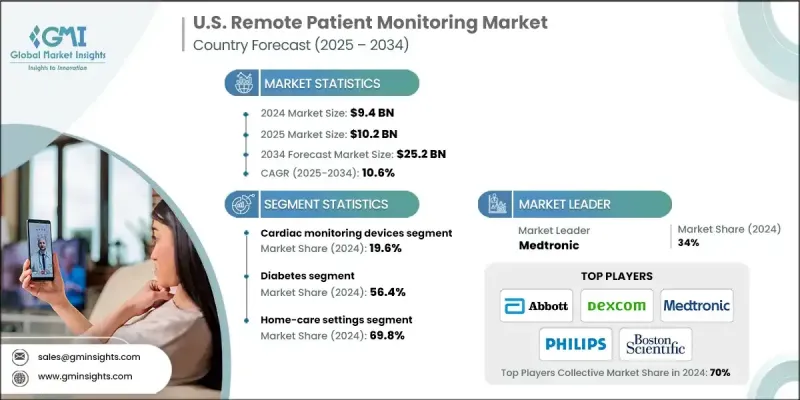

U.S. Remote Patient Monitoring Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 25.2 billion by 2034.

The steady rise is linked to several influential factors, including the growing rate of long-term health conditions across the country and expanding reimbursement frameworks that encourage digital care adoption. RPM technologies allow individuals to measure essential health indicators such as blood glucose levels, heart rate, and blood pressure from their homes, supporting earlier intervention and minimizing unnecessary hospital visits. As chronic disease cases continue to climb, these platforms are becoming an essential component of modern care models, particularly for long-term disease control and preventive healthcare. The RPM landscape covers a wide spectrum of medical tools designed to capture and transfer patient information outside clinical facilities. It incorporates digital systems that evaluate incoming data and support ongoing communication between patients and healthcare professionals. In addition, the market includes specialized devices engineered by manufacturers to integrate efficiently with dedicated RPM platforms, improving data synchronization and overall care delivery.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $25.2 Billion |

| CAGR | 10.6% |

The cardiac monitoring devices segment held a 19.6% share in 2024. Its expansion is attributed to the substantial burden of cardiovascular conditions nationwide and a rising need for continuous, real-time cardiac oversight that enables quicker diagnosis and more effective treatment. Advancements in cardiac-focused RPM technologies have elevated accuracy through refined sensors and intelligent analytics capable of assessing heart rhythm patterns, variability, and additional vital indicators with precision.

The diabetes segment accounted for a 56.4% share in 2024, supported by the increasing number of individuals managing diabetes and the growing demand for consistent, real-time metabolic monitoring. While the condition remains most common among adults above 45, diagnoses among younger groups are becoming more frequent, increasing the need for reliable digital tools that simplify ongoing disease management. RPM solutions play a meaningful role in monitoring blood glucose and other metabolic markers and have significantly improved the way diabetes is managed through enhanced technical capabilities.

The home-care settings segment held 69.8% share in 2024, driven by rising interest in decentralized care models and a preference for managing personal health from familiar surroundings. This shift empowers individuals to handle their own health more actively and reduces the need for frequent clinical visits, supporting the nation's broader movement toward value-driven care and digital transformation.

Major companies participating in the U.S. Remote Patient Monitoring Market include Abbott Laboratories, Baxter International, BIOTRONIK SE & Co. KG, Boston Scientific, Dexcom, F. Hoffmann-La Roche Ltd, GE Healthcare, Johnson & Johnson, Koninklijke Philips N.V., Medtronic, OMRON, Sotera Wireless, and VitalConnect. Key strategies adopted by leading companies in the U.S. Remote Patient Monitoring Market are centered around strengthening product integration, enhancing data accuracy, and expanding their connected-care ecosystems. Many organizations are investing in advanced biosensor innovation, improving device interoperability, and developing software platforms that support real-time clinical decision-making. Firms are also entering collaborations with healthcare providers to boost adoption across chronic-care programs and expanding cloud-based analytics to improve predictive capabilities. Continuous upgrades in user-friendly interfaces, secure data-sharing channels, and scalable monitoring solutions help broaden their reach across home-care settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases

- 3.2.1.2 Growing disposable income and healthcare expenditure

- 3.2.1.3 Growing adoption of remote patient monitoring devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and smart ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac monitoring devices

- 5.3 Blood pressure monitoring devices

- 5.4 Neurological monitoring devices

- 5.5 Respiratory monitoring devices

- 5.6 Multiparameter monitoring devices

- 5.7 Blood glucose monitoring devices

- 5.8 Fetal and neonatal monitoring devices

- 5.9 Sleep monitoring devices

- 5.10 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular diseases

- 6.3 Cancer

- 6.4 Diabetes

- 6.5 Neurological disorders

- 6.6 Infectious diseases

- 6.7 Respiratory diseases

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Home-care settings

- 7.3 Long-term care

- 7.4 Other end use

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Baxter International

- 8.3 BIOTRONIK SE & Co. KG

- 8.4 Boston Scientific

- 8.5 Dexcom

- 8.6 F. Hoffmann-La Roche Ltd

- 8.7 GE Healthcare

- 8.8 Johnson & Johnson

- 8.9 Koninklijke Philips N.V.

- 8.10 Medtronic

- 8.11 OMRON

- 8.12 Sotera Wireless

- 8.13 VitalConnect