PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892666

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892666

Solid State Battery Electrolyte Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

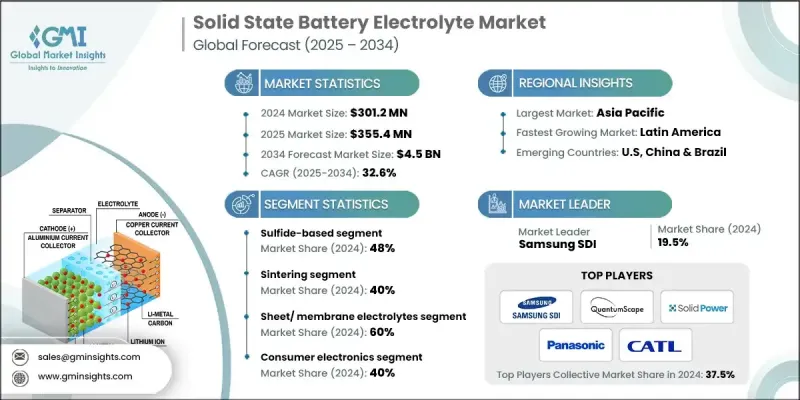

The Global Solid State Battery Electrolyte Market was valued at USD 301.2 million in 2024 and is estimated to grow at a CAGR of 32.6% to reach USD 4.5 billion by 2034.

The Asia-Pacific region is expected to see the fastest growth, with China leading investments in sulfide and polymer electrolytes, followed by notable activity in North America and Europe. Latin America and the Middle East & Africa also show strong potential due to abundant lithium resources, rising electric vehicle adoption, and domestic renewable energy initiatives, which will drive new production capacity. Technological advancements, large-scale battery manufacturing, and regulatory support are accelerating the adoption of solid-state electrolytes worldwide. Computational screening and machine learning are being leveraged to discover materials with high ionic conductivity and enhanced electrochemical stability. Innovations such as interface engineering, grain boundary optimization, and protective coatings for lithium metal anodes are improving safety, cycle life, and energy density, enabling broader applications in electric vehicles, consumer electronics, and energy storage systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $301.2 Million |

| Forecast Value | $4.5 Billion |

| CAGR | 32.6% |

In 2024, the oxide electrolytes segment accounted for USD 84.3 million. These materials offer exceptional mechanical strength, electrochemical stability, and compatibility with lithium metal anodes, making them ideal for automotive and consumer electronics applications. However, high sintering temperatures and inherent brittleness make their manufacturing complex.

The thin-film electrolytes segment was valued at USD 60.2 million in 2024 owing to their lightweight structure, high volumetric energy density, and uniform ion transport. These films are produced through physical vapor deposition (PVD) or atomic layer deposition (ALD) to achieve defect-free, homogeneous layers, though scaling production is costly and challenging.

North America Solid State Battery Electrolyte Market accounted for a 30% share in 2024. Growth in the region is supported by rising electric vehicle adoption, energy storage demand, and consumer electronics applications. The U.S. market benefits from government-backed programs and funding initiatives, alongside investments from companies such as QuantumScape, Solid Power, and Factorial Energy. Canada contributes through collaborative prototype-scale production facilities involving public research institutions and universities.

Key players in the Global Solid State Battery Electrolyte Market include CATL (Contemporary Amperex Technology Co., Limited), Panasonic Holdings Corporation, QuantumScape Corporation, Solid Power Inc., SAMSUNG SDI, Ampcera Inc., Blue Solutions SAS, Idemitsu Kosan Co., Ltd., Ionic Materials Inc., and Murata Manufacturing Co., Ltd. Companies in the Solid State Battery Electrolyte Market strengthen their presence through strategic R&D investments to enhance ionic conductivity, electrochemical stability, and compatibility with lithium metal anodes. They are forming partnerships with automakers, consumer electronics manufacturers, and energy storage providers to accelerate adoption. Additionally, firms focus on scaling production capabilities, pilot programs, and supply chain optimization while leveraging government incentives and funding initiatives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Manufacturing Process

- 2.2.4 Form Factor

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automotive OEMs accelerating adoption of solid-state batteries globally

- 3.2.1.2 Non-flammable solid electrolytes enhance safety and reduce thermal risks

- 3.2.1.3 Lithium metal anodes enable higher energy density and extended EV range

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Solid-solid interface resistance limits power density and cycling performance

- 3.2.2.2 Manufacturing scale-up from lab to GWh production remains complex

- 3.2.3 Market opportunities

- 3.2.3.1 Energy storage systems demand growth drives stationary solid-state applications

- 3.2.3.2 Consumer electronics miniaturization creates high-value, compact battery applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oxide-Based Solid Electrolytes

- 5.2.1 Garnet-type (LLZO)

- 5.2.2 NASICON-type (LATP, LAGP)

- 5.2.3 Perovskite-type (LLTO)

- 5.2.4 LiPON (Lithium Phosphorus Oxynitride)

- 5.3 Sulfide-Based Solid Electrolytes

- 5.3.1 Argyrodite Family (Li6PS5X)

- 5.3.2 LGPS Family (Li10GeP2S12 & Derivatives)

- 5.3.3 Thio-LISICON (Li3PS4, Li4-xGe1-xPxS4)

- 5.4 Polymer-Based Solid Electrolytes

- 5.4.1 PEO (Polyethylene Oxide)

- 5.4.2 PC (Polycarbonate) & PAN (Polyacrylonitrile)

- 5.4.3 Composite Polymer Electrolytes (CPEs)

- 5.4.4 Hybrid Electrolytes (Polymer + Inorganic)

- 5.5 Halide-Based Solid Electrolytes

- 5.5.1 Chloride-based (Li3YCl6, Li3InCl6, Li2ZrCl6)

- 5.5.2 Bromide-based (Li3YBr6)

- 5.5.3 Mixed Halide Systems (Li3Y(Br3Cl3))

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Physical Vapor Deposition (PVD) & Atomic Layer Deposition (ALD)

- 6.3 Tape casting & screen printing

- 6.4 Sintering & hot pressing

- 6.4.1 Conventional sintering

- 6.4.2 Hot pressing

- 6.4.3 Spark Plasma Sintering (SPS)

- 6.4.4 Cold sintering

- 6.5 Solution casting & polymer processing

Chapter 7 Market Estimates and Forecast, By Form Factor, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Thin-film electrolytes (<10 μm)

- 7.3 Sheet/membrane electrolytes (10-100 μm)

- 7.4 Bulk/pellet electrolytes (>100 μm)

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric vehicles

- 8.3 Consumer electronics

- 8.4 Energy storage systems

- 8.5 Medical devices

- 8.6 Aerospace & defense

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Ampcera Inc.

- 10.2 Blue Solutions SAS

- 10.3 Contemporary Amperex Technology Co., Limited (CATL)

- 10.4 Idemitsu Kosan Co., Ltd.

- 10.5 Ionic Materials Inc.

- 10.6 Murata Manufacturing Co., Ltd.

- 10.7 Panasonic Holdings Corporation

- 10.8 QuantumScape Corporation

- 10.9 SAMSUNG SDI

- 10.10 Solid Power Inc.