PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892668

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892668

North America Industrial Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

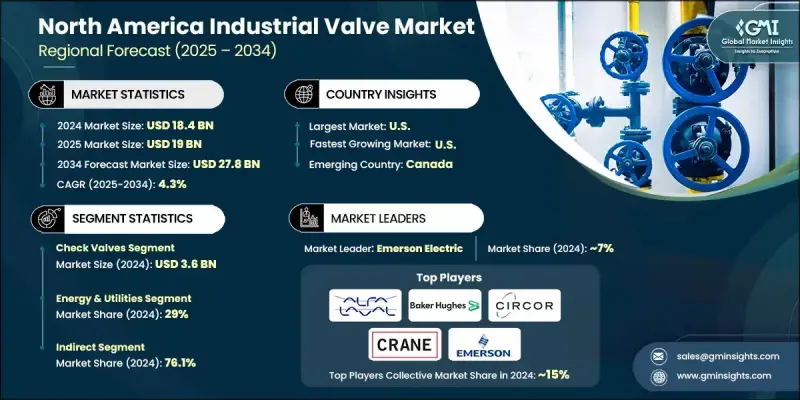

North America Industrial Valve Market was valued at USD 18.4 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 27.8 billion by 2034.

The market is benefiting from significant momentum driven by federal infrastructure programs, energy sector investments, and recent government initiatives aimed at modernizing and expanding the region's industrial and energy systems. Increasing demand for high-performance valves is fueled by the growing need for efficient fluid flow control across pipelines, municipal water systems, and renewable energy facilities. As industries continue to modernize and implement large-scale projects, the requirement for reliable valves that comply with strict safety, efficiency, and environmental standards is rising. Adoption of smart valve technologies and automation is another key growth driver, enabling companies to enhance operational efficiency, minimize downtime, and adhere to environmental regulations. Digital transformation is transforming how valves are used across North America, with advanced monitoring, predictive maintenance, and IoT-enabled systems increasingly becoming integral to industrial operations. Rising infrastructure expenditure, combined with a shift toward cleaner energy and connected networks, is creating substantial opportunities for the industrial valve market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.4 Billion |

| Forecast Value | $27.8 Billion |

| CAGR | 4.3% |

The check valves segment generated USD 3.6 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2034. Their primary function of preventing backflow makes them essential for maintaining process integrity, avoiding contamination, and protecting equipment across energy, water treatment, chemical, and power generation sectors. These valves are particularly critical in high-pressure and demanding industrial environments where reliability and leak prevention are crucial.

The energy and utilities sector held a 29% share in 2024 and is anticipated to grow at a CAGR of 5.2% through 2034. This growth is driven by substantial infrastructure requirements and the transition to cleaner, more efficient energy systems. Valves in this sector are key for flow management, pressure regulation, and safety assurance in operations spanning oil and gas, power generation, and water utilities. Expanding shale production, LNG export facilities, and the modernization of aging pipelines continue to stimulate demand for robust, high-performance valves capable of enduring extreme conditions.

U.S. Industrial Valve Market was valued at USD 15 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. The country's oil and gas sector, supported by shale exploration and LNG projects, drives significant demand for valves designed to withstand high pressures and temperatures. Federal programs such as the Infrastructure Investment and Jobs Act and the Inflation Reduction Act are also propelling the modernization of water, wastewater, and renewable energy systems, further boosting demand. Digitalization is another key trend, with smart valves incorporating IoT, automation, and predictive maintenance technologies helping industries enhance efficiency and meet strict regulatory requirements.

Key players in the North America Industrial Valve Market include Emerson Electric, Danfoss, Alfa Laval, Crane Company, CIRCOR, Baker Hughes, Curtiss-Wright, KSB, Honeywell, Hitachi, AVK Holding, KITZ, SLB, Watts, and The Weir Group. Leading industrial valve manufacturers are focusing on digitalization and smart technology integration to strengthen market presence. Companies are investing in IoT-enabled valves, predictive maintenance platforms, and automation solutions to improve operational efficiency and reduce downtime. Strategic partnerships with energy, water, and industrial operators are helping expand market reach while ensuring compliance with environmental regulations. Continuous research and development allow firms to introduce high-performance, reliable, and specialized valve solutions suitable for extreme conditions. Global and regional supply chain expansions ensure timely delivery and support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Component

- 2.2.5 Size

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure & energy investments

- 3.2.1.2 Automation & smart valve technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Aging infrastructure

- 3.2.2.2 Lack of standardized policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Ball valves

- 5.3 Check valves

- 5.4 Butterfly valves

- 5.5 Gate valves

- 5.6 Globe valves

- 5.7 Plug valves

- 5.8 Diaphragm valves

- 5.9 Others (safety valves etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Plastic

- 6.4 Cast iron

- 6.5 Alloy based

- 6.6 Others (bronze and brass etc.)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Actuators

- 7.3 Valve body

- 7.4 Others (positioners and I/P converters etc.)

Chapter 8 Market Estimates & Forecast, By Size, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 1”

- 8.3 1” to 6”

- 8.4 7” to 25”

- 8.5 26” to 50”

- 8.6 >50”

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Chemical

- 9.3 Energy & utilities

- 9.4 Construction

- 9.5 Metal & Mining

- 9.6 Agriculture

- 9.7 Pharmaceutical

- 9.8 Food & beverages

- 9.9 Pulp & paper

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 U.S.

- 11.3 Canada

Chapter 12 Company Profiles

- 12.1 Alfa Laval

- 12.2 AVK Holding

- 12.3 Baker Hughes

- 12.4 CIRCOR

- 12.5 Crane Company

- 12.6 Curtiss-Wright

- 12.7 Danfoss

- 12.8 Emerson Electric

- 12.9 Hitachi

- 12.10 Honeywell

- 12.11 KITZ

- 12.12 KSB

- 12.13 SLB

- 12.14 The Weir Group

- 12.15 Watts