PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892683

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892683

U.S. and Europe Endodontics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

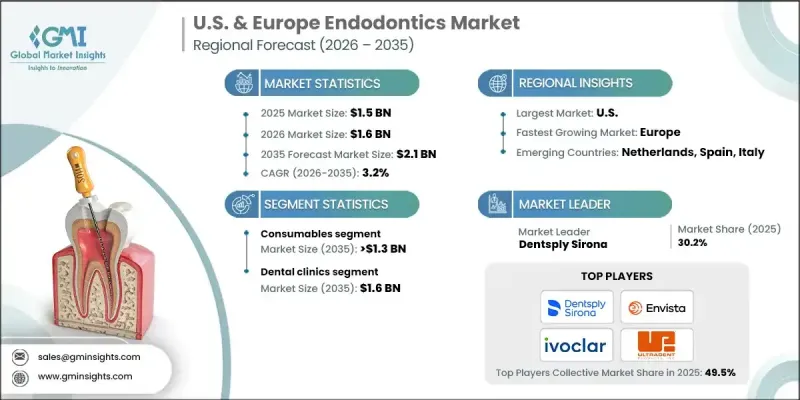

U.S. and Europe Endodontics Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 2.1 billion by 2035.

Market growth continues to be influenced by the widespread incidence of dental caries, the steady volume of root canal procedures, and ongoing innovation across endodontic technologies. The expansion of dental service organizations (DSOs), along with the rising need for restorative care among aging populations, further supports long-term demand. Endodontics focuses on diagnosing and treating issues affecting the dental pulp and surrounding tissues, with root canal therapies serving as the primary intervention to preserve natural teeth. The specialty aims to remove infection, relieve discomfort, and restore tooth function for extended periods. Leading market participants such as Ultradent Products, Dentsply Sirona, Envista, and Ivoclar maintain strong competitive positions through product development, global sales reach, and continued investment in R&D. Increasing awareness of tooth preservation and the preference for conservative care remain key factors stimulating market activity across both regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 3.2% |

The instruments category is anticipated to grow at a CAGR of 3.6% through 2034, as clinicians continue to incorporate advanced rotary systems, upgraded imaging capabilities, and precision-driven tools that improve procedural accuracy. The rising demand for minimally invasive approaches is motivating practitioners to choose instruments that enhance control and shorten chair time. Added investment from DSOs and dental clinics in modernizing equipment to improve clinical outcomes and streamline workflow is further accelerating the uptake of these tools.

The dental clinics segment accounted for a 75.3% share in 2025 and is expected to reach USD 1.6 billion through 2034. Increasing patient preference for retaining natural teeth is contributing to higher procedure volumes within clinics. This trend is encouraging providers to expand their endodontic services and adopt technologies that elevate diagnostic and treatment precision. To support the growing caseload, clinics are acquiring CBCT imaging systems, digital microscopes, apex locators, and rotary NiTi files to achieve more predictable results and enhance patient comfort.

U.S. Endodontics Market reached USD 785.9 million in 2024. The rising inclination toward tooth-saving therapies is driving the demand for root canals, microsurgical procedures, and retreatments. As conservative treatment becomes the preferred choice, the need for premium endodontic materials and instruments continues to grow. DSOs play a major role in shaping the market as they consolidate practices, standardize clinical procedures, and increase equipment purchasing efficiency through bulk procurement.

Prominent companies active in the U.S. and Europe Endodontics Market include Brasseler USA, COLTENE, Dental Perfect, Dentsply Sirona, DiaDent, EdgeEndo, Envista, Essential Dental Systems, FKG Dentaire SA, HuFriedyGroup, Ivoclar, MANI, Pac-Dent, Septodont, and Ultradent Products. Companies in the U.S. and Europe Endodontics Market are adopting targeted strategies to reinforce their competitive advantage and strengthen market presence. Many firms are expanding their product portfolios with advanced instruments, biocompatible materials, and enhanced imaging solutions to meet the evolving needs of clinicians. Investments in research and development remain a priority as manufacturers work to introduce devices that improve procedural speed, visibility, and long-term treatment success. Organizations are also broadening partnerships with DSOs and large dental groups to gain access to high-volume purchasing channels and secure consistent sales pipelines. Geographic expansion through distributor networks and digital sales platforms is helping companies reach a wider clinical base.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of dental diseases

- 3.2.1.2 Technological advancements in endodontic instruments

- 3.2.1.3 Rising awareness towards oral hygiene and growing dental tourism

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with root canal treatment

- 3.2.2.2 Cost barriers to dental care

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in endodontic microsurgery and regenerative endodontics

- 3.2.3.2 Expansion of DSO-led investments in specialty services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Consumer insights

- 3.8 Volume analysis, by type, 2022-2035 (Units)

- 3.8.1 U.S.

- 3.8.2 Europe

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 U.S.

- 4.3.2 Europe

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.2.1 Files and shaper

- 5.2.2 Obturation materials

- 5.2.3 Solutions and lubricants

- 5.2.4 Other consumables

- 5.3 Instruments

- 5.3.1 Motors

- 5.3.2 Apex locator

- 5.3.3 Endodontic scalers

- 5.3.4 Machine assisted obturation system

- 5.3.5 Other instruments

Chapter 6 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

Chapter 8 Company Profiles

- 8.1 Brasseler USA

- 8.2 COLTENE

- 8.3 Dental Perfect

- 8.4 Dentsply Sirona

- 8.5 DiaDent

- 8.6 EdgeEndo

- 8.7 Envista

- 8.8 Essential Dental Systems

- 8.9 FKG Dentaire SA

- 8.10 HuFriedyGroup

- 8.11 Ivoclar

- 8.12 MANI

- 8.13 Pac-Dent

- 8.14 Septodent

- 8.15 Ultradent Products