PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892897

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892897

Endodontics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

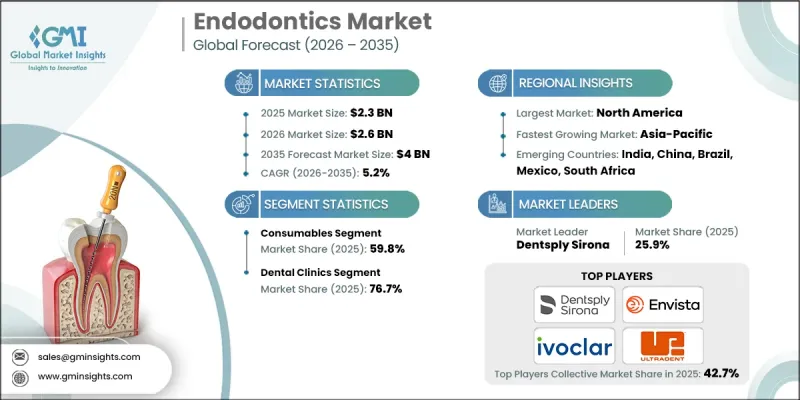

The Global Endodontics Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 4 billion by 2035.

Market expansion is fueled by rapid technological advancements in endodontic instruments, growing public awareness of dental health, and the increasing prevalence of dental diseases. The rising number of dental professionals and clinics worldwide further supports demand. Endodontics focuses on diagnosing and treating diseases of the dental pulp and surrounding tissues, primarily through root canal therapy aimed at removing infections, alleviating pain, and preserving natural teeth. Leading players such as Envista, Dentsply Sirona, Ivoclar, and Ultradent Products maintain their market positions through innovation, global distribution, and substantial investments in research and development. Breakthroughs, including rotary endodontic instruments, apex locators, laser-assisted therapies, and 3D imaging systems, have improved procedural precision, safety, and patient comfort, encouraged wider adoption of modern techniques, and accelerated market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.2% |

In 2025, the consumables segment captured a 59.8% share. High-frequency use, recurring replacement requirements, and the essential role of files, sealers, obturation materials, and irrigants in every root canal procedure sustain steady demand. As the volume of root canal treatments rises globally due to increasing dental caries and pulp infections, consumables continue to be the most purchased category.

The dental clinics segment held a 76.7% share in 2025, projected to reach USD 3.2 billion. Clinics serve as the primary point of care for root canal procedures and increasing patient visits driven by caries and pulp infection prevalence are boosting demand for endodontic services.

North America Endodontics Market held a share of 37.7% in 2025, driven by a high prevalence of dental issues linked to lifestyle factors, sugar consumption, and aging populations. Root canal procedures remain in significant demand, supporting sustained use of endodontic instruments and consumables across clinics.

Key players in the Global Endodontics Market include Kerr, BRASSELER, COLTENE, Dentsply Sirona, EdgeEndo, DiaDent, Envista, FKG, Ivoclar, MANI, Pac-Dent, Septodent, Shenzhen Perfect, ULTRADENT, and Essential Dental Systems. Companies in the Endodontics Market are strengthening their positions by continuously innovating products, launching technologically advanced instruments, and expanding distribution networks globally. Strategic R&D investments allow them to improve procedural efficiency, patient safety, and treatment precision. Firms are also investing in training programs for dental professionals, enhancing brand recognition, and fostering loyalty. Collaborations with dental associations, clinics, and research institutes help in promoting new technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dental disorders

- 3.2.1.2 Increasing awareness and importance of oral health

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited access to advanced endodontic care in developing or rural regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging and underserved markets

- 3.2.3.2 Growing demand for painless, minimally invasive and patient-centric treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer insights

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Supply chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.2.1 Files and shaper

- 5.2.2 Obturation materials

- 5.2.3 Solutions and lubricants

- 5.2.4 Other consumables

- 5.3 Instruments

- 5.3.1 Motors

- 5.3.2 Apex locator

- 5.3.3 Endodontic scalers

- 5.3.4 Machine assisted obturation system

- 5.3.5 Other instruments

Chapter 6 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BRASSELER

- 8.2 COLTENE

- 8.3 Dentsply Sirona

- 8.4 DiaDent

- 8.5 EdgeEndo

- 8.6 Envista

- 8.7 Essential Dental Systems

- 8.8 FKG

- 8.9 Ivoclar

- 8.10 Kerr

- 8.11 MANI

- 8.12 Pac-Dent

- 8.13 Septodent

- 8.14 Shenzhen Perfect

- 8.15 ULTRADENT