PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892684

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892684

PFAS Alternative Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

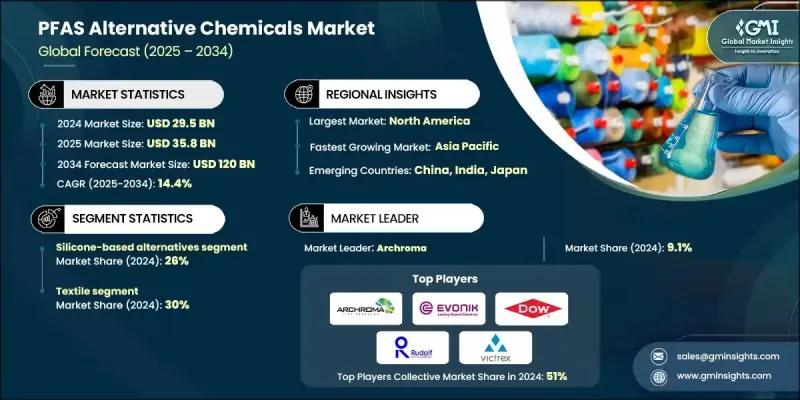

The Global PFAS Alternative Chemicals Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 14.4% to reach USD 120 billion by 2034.

Market momentum is increasing as manufacturers gradually shift toward more sustainable and bio-derived formulations, reflecting a growing preference for safer and environmentally responsible materials. Research organizations are advancing fluorine-free coating technologies and bio-based solutions that provide reliable water repellency and durability comparable to PFAS-based products. This transition is largely driven by expanding regulatory action worldwide, with several regions adopting stricter rules to reduce PFAS exposure. Public concern over water contamination has heightened awareness, strengthening the push for safer alternatives. Regulatory frameworks are becoming more comprehensive, with agencies introducing standards for drinking water, identifying hazardous substances, and imposing reporting and discharge requirements. In parallel, additional restrictions and product-phase-out timelines are being implemented across multiple jurisdictions, reinforcing the need for reliable PFAS replacements and accelerating industry-wide innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $120 Billion |

| CAGR | 14.4% |

The polyurethane alternatives segment held a 17% share in 2024. Waterborne polyurethane dispersions enable coatings, adhesive systems, and textile treatments to function without fluorinated inputs. Performance is largely influenced by the selection of isocyanates, with aliphatic variants offering stronger UV and discoloration resistance than aromatic types. These waterborne formulations reduce exposure to solvents and isocyanate monomers and support applications such as weather-resistant textile finishes, waterproof membranes, and protective layers across automotive and industrial environments.

The paint and coating manufacturers segment held 18% share in 2024. PFAS were historically used to enhance coating properties such as defoaming, leveling, and wetting, and several suppliers now offer substitutes that match or exceed the capabilities of conventional fluorinated additives.

Europe PFAS Alternative Chemicals Market accounted for a 29% share in 2024, supported by strict regulatory frameworks and proactive adoption of alternatives. The updated PFAS restriction proposal outlines several pathways toward significant reductions in PFAS use, including options for full bans and risk-based conditional allowances. Final regulatory decisions are expected within the coming years, positioning Europe as one of the most tightly regulated markets for PFAS alternatives.

Key players in the PFAS Alternative Chemicals Market include NICCA Chemical, Archroma, James Walker Group, CHT Group, Victrex, Evonik Industries, Daikin Industries, Dow, Rudolf, Cerakote, and HeiQ Materials. Companies in the PFAS Alternative Chemicals Market are strengthening their competitive stance through a blend of innovation, regulatory alignment, and long-term collaboration. Many firms are increasing investments in bio-based chemistries, naturally derived additives, and fluorine-free coating technologies to deliver performance levels comparable to PFAS. Strategic partnerships with manufacturers and research institutions help accelerate product validation and broaden application testing. Companies are also focusing on expanding production capacity for next-generation materials to meet rising demand as phase-out deadlines approach. Continuous engagement with regulatory bodies ensures timely compliance and supports the development of solutions tailored to evolving legislation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Alternative chemical type

- 2.2.2 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Alternative Chemical Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Silicone-based alternatives

- 5.3 Polyurethane-based alternatives

- 5.4 Acrylate & acrylic polymer alternatives

- 5.5 Hydrocarbon-based alternatives

- 5.6 Polysaccharide & cellulose-based alternatives

- 5.7 Inorganic & ceramic alternatives

- 5.8 Organophosphorus alternatives

- 5.9 Dendritic & specialty polymers

- 5.10 Others

Chapter 6 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Textile & apparel manufacturing

- 6.3 Paint & coating manufacturers

- 6.4 Firefighting & emergency services

- 6.5 Food & beverage packaging industry

- 6.6 Semiconductor & electronics manufacturing

- 6.7 Automotive manufacturing

- 6.8 Aerospace & defense

- 6.9 Medical device manufacturing

- 6.10 Construction & building materials

- 6.11 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Archroma

- 8.2 Evonik Industries

- 8.3 Dow

- 8.4 Daikin Industries

- 8.5 Rudolf

- 8.6 HeiQ Materials

- 8.7 NICCA Chemical

- 8.8 CHT Group

- 8.9 Cerakote

- 8.10 James Walker Group

- 8.11 Victrex