PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892692

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892692

Electric Bus System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

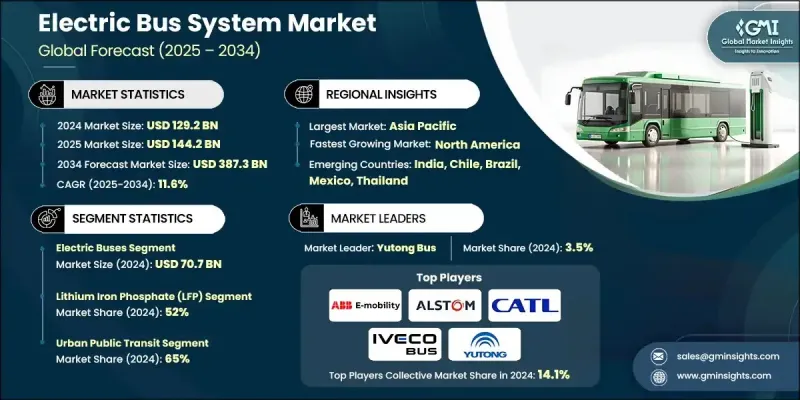

The Global Electric Bus System Market was valued at USD 129.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 387.3 billion by 2034.

The market growth is driven by global government initiatives promoting zero-emission public transit. Policies such as grants, tax incentives, and subsidies are encouraging local governments and transit agencies to upgrade their existing fleets to electric buses while expanding the necessary charging infrastructure. Falling lithium-ion battery costs and improved energy density are reducing vehicle expenses and increasing operational range, allowing electric buses to compete more effectively with diesel alternatives. The growing trend toward electrified bus corridors, bus rapid transit (BRT) systems, and depot infrastructure is fueled by urbanization, sustainability goals, and air quality initiatives. Coordinated deployment strategies help transit authorities maximize efficiency while meeting environmental targets, further supporting market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $129.2 Billion |

| Forecast Value | $387.3 Billion |

| CAGR | 11.6% |

The electric buses segment generated USD 70.7 billion in 2024 and is expected to grow at a CAGR of 9.7% from 2025 to 2034. The widespread adoption of battery-electric buses is being driven by declining battery costs, extended driving ranges, and government incentives. Transit agencies are increasingly focusing on fleet electrification, which necessitates higher-capacity batteries and integration with smart grid systems for rapid charging.

The lithium iron phosphate (LFP) batteries segment held a 52% share in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2034. LFP batteries are favored for their long lifecycle, thermal stability, and cost efficiency. Many manufacturers, especially in Asia and Europe, are equipping all bus types, including standard and articulated models, with LFP batteries. Innovations such as cell-to-pack (CTP) structures enhance energy density, safety, and lifecycle performance, making them ideal for large-scale transit operations.

U.S. Electric Bus System Market will grow at an 86% share by 2034. Federal programs, including the Bipartisan Infrastructure Law and Low-No Emission Bus Program, are accelerating fleet transitions. As transit agencies invest in depot upgrades, workforce training, and new electric buses, U.S. manufacturers benefit from the "Buy America" provisions, strengthening domestic supply chains for batteries, chargers, and power electronics.

Key players in the Global Electric Bus System Market include ABB E-Mobility, Alstom, CATL, Forsee Power, IVECO Bus, NFI, RIDE, Siemens Smart Infrastructure, Solaris Bus & Coach, and Yutong Bus. Companies in the Global Electric Bus System Market are employing several strategies to reinforce their market position. They are investing heavily in R&D to enhance battery efficiency, increase vehicle range, and integrate smart charging solutions. Strategic partnerships with local transit authorities and global suppliers enable faster deployment of electric fleets and infrastructure. Manufacturers are focusing on modular and scalable designs to accommodate various city sizes and route requirements. Expansion into emerging markets and establishing regional production facilities reduces costs and improves delivery timelines. Companies are also leveraging government incentives and aligning with sustainability goals to strengthen brand credibility, while advanced maintenance and service programs ensure long-term operational efficiency and customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Battery Chemistry

- 2.2.3 Application

- 2.2.4 Region

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government fleet electrification mandates

- 3.2.1.2 Falling battery costs & improved energy density

- 3.2.1.3 Expansion of urban transit electrification programs

- 3.2.1.4 Growth of hydrogen infrastructure for fuel cell buses

- 3.2.1.5 OEM & technology innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront vehicle & infrastructure costs

- 3.2.2.2 Grid capacity & infrastructure limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart charging & energy management

- 3.2.3.2 Battery second-life & recycling programs

- 3.2.3.3 Expansion into intercity & coach services

- 3.2.3.4 Public-private partnerships & international funding

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Battery supply chain vulnerabilities & mineral sourcing

- 3.11.1 Global battery cell supply chain structure

- 3.11.2 Critical mineral dependencies

- 3.11.3 Supply chain disruption scenarios

- 3.11.4 Supply chain mitigation strategies

- 3.11.5 Logistics & lead times

- 3.12 Total cost of ownership (tco) modeling & financing mechanisms

- 3.12.1 Tco framework & methodology

- 3.12.2 Tco comparison: electric vs diesel/cng buses

- 3.12.3 Battery pack cost trajectory

- 3.12.4 Charging infrastructure economics

- 3.12.5 Financing mechanisms & capital structures

- 3.13 Charging infrastructure deployment economics & interoperability

- 3.13.1 Infrastructure investment requirements by charging strategy

- 3.13.2 Grid connection & utility costs

- 3.13.3 Charging interoperability challenges

- 3.13.4 Smart charging & load management economics

- 3.13.5 Charging network business models

- 3.14 Battery degradation, warranty management & lifecycle economics

- 3.14.1 Real-world degradation data & performance

- 3.14.2 Battery warranty structures & terms

- 3.14.3 Battery replacement economics

- 3.15 Customer adoption barriers & procurement model innovation

- 3.15.1 Technical adoption barriers

- 3.15.2 Economic adoption barriers

- 3.15.3 Organizational & operational barriers

- 3.15.4 Infrastructure & grid barriers

- 3.15.5 Procurement model innovations to overcome barriers

- 3.15.6 Risk mitigation strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric Buses

- 5.2.1 Battery Electric Buses (BEBs)

- 5.2.2 Plug-in Hybrid Electric Buses (PHEVs)

- 5.2.3 Fuel Cell Electric Buses (FCEBs)

- 5.2.4 Trolleybuses

- 5.3 Charging Method

- 5.3.1 Depot Charging

- 5.3.2 Opportunity Charging

- 5.3.3 Pantograph Charging

- 5.4 Energy Supply & Grid Integration

- 5.5 Fleet & Operations Management

- 5.6 Maintenance & Support System

Chapter 6 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium Iron Phosphate (LFP)

- 6.3 Nickel Manganese Cobalt (NMC)

- 6.4 Nickel Cobalt Aluminum (NCA)

- 6.5 Lithium Titanate (LTO)

- 6.6 Solid-State Batteries

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Urban Public Transit

- 7.3 Intercity & Regional Transport

- 7.4 Campus & Airport Shuttles

- 7.5 Corporate & Industrial Shuttles

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Netherlands

- 8.3.8 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 Singapore

- 8.4.6 Thailand

- 8.4.7 Vietnam

- 8.4.8 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 ABB E-Mobility

- 9.1.2 Alstom

- 9.1.3 BYD Company

- 9.1.4 CATL (Contemporary Amperex Technology)

- 9.1.5 Daimler Buses (Mercedes-Benz / Thomas Built Buses)

- 9.1.6 IVECO Bus

- 9.1.7 NFI Group (New Flyer Industries)

- 9.1.8 Proterra

- 9.1.9 Scania (TRATON)

- 9.1.10 Siemens Smart Infrastructure

- 9.1.11 Volvo Buses (Volvo)

- 9.1.12 Yutong Bus

- 9.2 Regional Players

- 9.2.1 Blue Bird

- 9.2.2 Gillig

- 9.2.3 Karsan

- 9.2.4 King Long United Automotive Industry

- 9.2.5 Lion Electric Company

- 9.2.6 Motor Coach Industries (MCI)

- 9.2.7 Solaris Bus & Coach

- 9.2.8 Tata Motors

- 9.2.9 VDL Bus & Coach

- 9.2.10 Zhongtong Bus

- 9.3 Emerging players and disruptors

- 9.3.1 Arrival

- 9.3.2 CaetanoBus

- 9.3.3 Ebusco

- 9.3.4 Forsee Power

- 9.3.5 GreenPower Motor Company

- 9.3.6 Lightning eMotors

- 9.3.7 Microvast

- 9.3.8 Phoenix Motor

- 9.3.9 RIDE

- 9.3.10 Vicinity Motor