PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892701

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892701

Wireless EV Battery Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

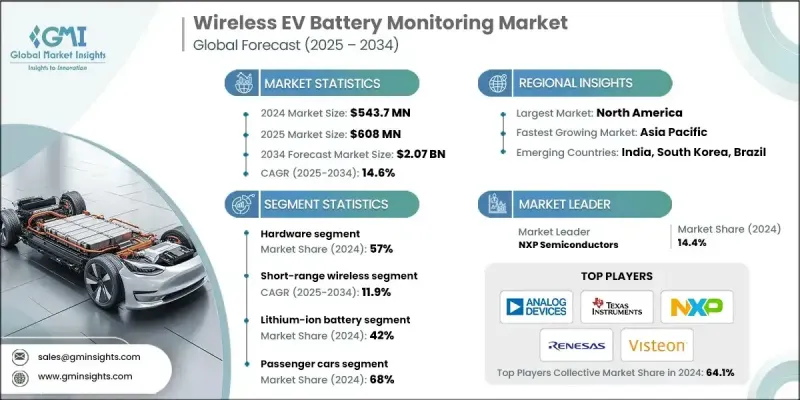

The Global Wireless EV Battery Monitoring Market was valued at USD 543.7 million in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 2.07 billion by 2034.

The automotive sector is increasingly redesigning electric vehicle platforms to reduce weight, improve energy density, and allow modular battery configurations. Wireless battery monitoring eliminates heavy wiring, speeds up assembly, and supports flexible, modular architecture, making it a preferred solution for next-generation EV platforms. Software-defined vehicles demand deeper data visibility, secure cloud connectivity, and over-the-air update capabilities. Wireless BMS systems offer rich telemetry and predictive analytics support, enabling advanced safety modeling and efficient energy management. OEMs transitioning to data-driven architectures find wireless monitoring aligned with their strategic goals. Additionally, monitoring second-life EV batteries for grid, home, and industrial storage applications is gaining importance. Wireless solutions reduce integration complexity, minimize costs, and meet the growing demand for adaptable energy storage monitoring, smart charging solutions, and optimized energy delivery for fleets and individual consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $543.7 Million |

| Forecast Value | $2.07 Billion |

| CAGR | 14.6% |

The hardware segment held 57% share in 2024. Rising battery electrification and the growing complexity of high-capacity packs are driving demand for robust sensor nodes, gateway modules, antennas, and processing units capable of withstanding harsh automotive environments.

The short-range wireless segment is expected to grow at a CAGR of 11.9% through 2034. Bluetooth, BLE, and other low-power short-range protocols remain vital for internal battery-pack communications, offering stable data transfer, low energy consumption, and compatibility with modular designs. These technologies address challenges such as electromagnetic interference, increasing cell counts, and stringent safety standards.

U.S. Wireless EV Battery Monitoring Market held a 75.8% share, generating USD 142.6 million in 2024. Strong federal and state initiatives are accelerating EV adoption, with programs providing incentives for EV purchases and charging infrastructure deployment. Policy targets lower battery costs and faster charging further drive demand for advanced monitoring technologies.

Key players operating in the Global Wireless EV Battery Monitoring Market include Analog Devices, Texas Instruments, LG Innotek, Marelli, NXP Semiconductors, Renesas, Visteon, ABB E-mobility, BP Pulse, and Siemens eMobility. Companies in the Wireless EV Battery Monitoring Market are strengthening their position by investing in R&D to develop advanced sensor nodes, gateway modules, and antenna systems that can handle high-capacity EV batteries. Many firms focus on short-range wireless protocols and IoT-enabled solutions to improve modularity, data accuracy, and energy efficiency. Strategic collaborations with OEMs, fleet operators, and energy providers help expand deployment and secure long-term contracts. Cloud integration and predictive analytics capabilities are being enhanced to support software-defined vehicles and over-the-air updates.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Communication technology

- 2.2.4 Battery chemistry

- 2.2.5 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerating Global EV Adoption

- 3.2.1.2 Regulatory Mandates for Battery Safety & Monitoring

- 3.2.1.3 Cost Reduction Imperatives

- 3.2.1.4 Weight & Volume Optimization

- 3.2.1.5 Thermal Runaway Safety Concerns

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Implementation Costs & R&D Investment

- 3.2.2.2 Lack of Standardization & Interoperability

- 3.2.3 Market opportunities

- 3.2.3.1 Multi-Modal Sensor Fusion for Superior Thermal Runaway Detection

- 3.2.3.2 Energy-Autonomous Wireless Nodes with Energy Harvesting

- 3.2.3.3 AI-Driven Predictive Maintenance & Prognostics

- 3.2.3.4 Blockchain for Secure Battery Passport & Traceability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.8.3 Market Pricing Strategy & Economics

- 3.8.3.1 Pricing models comparison (capex vs. opex, subscription vs. perpetual)

- 3.8.3.2 Cost-plus and value-based pricing strategies

- 3.8.3.3 Volume discounts and tiered pricing structures

- 3.8.3.4 Regional pricing variations and localization factors

- 3.8.3.5 Unit economics and margin analysis by customer segment

- 3.8.3.6 Return on Investment (ROI) and payback period calculations

- 3.8.3.7 Bundling and cross-selling opportunities

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.9.4 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 System Architecture Analysis

- 3.13 Battery Monitoring Requirements

- 3.13.1 By chemistry

- 3.13.2 By application

- 3.14 Battery Form Factor & Monitoring Implications

- 3.15 Battery Degradation Mechanisms & Monitoring Implications

- 3.16 Thermal Management Integration with Wireless Monitoring

- 3.17 Manufacturing & Quality Control Considerations

- 3.17.1 Wireless BMS Integration in Battery Manufacturing

- 3.17.2 In-Line Testing & Commissioning

- 3.17.3 Manufacturing Yield & Defect Detection

- 3.17.4 Scalability & Automation

- 3.18 Total Cost of Ownership (TCO) Models

- 3.18.1 Upfront Cost Components

- 3.18.2 Manufacturing Cost Savings

- 3.18.3 Operational Cost Savings

- 3.18.4 End-of-Life Value

- 3.18.5 TCO Breakeven Analysis

- 3.19 Interoperability & Standardization Landscape

- 3.19.1 Communication Protocol Standards

- 3.19.2 BMS Data Standards

- 3.19.3 Functional Safety Standards

- 3.19.4 Cybersecurity Standards

- 3.19.5 Industry Collaboration Initiatives

- 3.19.6 Regional Regulatory Harmonization Efforts

- 3.20 Data Management & Analytics Frameworks

- 3.20.1 Data Acquisition & Preprocessing

- 3.20.2 Edge vs Cloud Processing Architecture

- 3.20.3 Battery State Estimation Algorithms

- 3.20.4 Anomaly Detection & Diagnostics

- 3.20.5 Predictive Maintenance & Fleet Analytics

- 3.20.6 Digital Twin Implementation

- 3.21 Testing & Validation Protocols

- 3.21.1 Wireless Link Performance Testing

- 3.21.2 Environmental Testing

- 3.21.3 EMI/EMC Testing

- 3.21.4 Functional Safety Testing

- 3.21.5 Cybersecurity Testing

- 3.21.6 Accelerated Life Testing

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Communication technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Short-range wireless (Bluetooth)

- 6.3 Long-range / LPWAN

- 6.4 Proprietary RF stacks

- 6.5 Hybrid architecture

Chapter 7 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Lithium-ion battery

- 7.3 Lead-acid battery

- 7.4 Nickel-metal hydride battery

- 7.5 Solid-state battery

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial Vehicles

- 8.3.1 Light duty

- 8.3.2 Medium duty

- 8.3.3 Heavy-duty

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Analog Devices (ADI)

- 10.1.2 Texas Instruments (TI)

- 10.1.3 NXP Semiconductors

- 10.1.4 Infineon Technologies

- 10.1.5 Renesas Electronics

- 10.1.6 STMicroelectronics

- 10.1.7 Dukosi

- 10.1.8 Cavli Wireless

- 10.1.9 u-blox

- 10.1.10 Quectel Wireless Solutions

- 10.1.11 Robert Bosch

- 10.1.12 Continental

- 10.1.13 Denso

- 10.1.14 Hitachi Astemo

- 10.1.15 Marelli

- 10.1.16 LG Innotek

- 10.1.17 Visteon

- 10.1.18 ABB E-mobility

- 10.1.19 BP Pulse

- 10.1.20 Siemens eMobility

- 10.2 Regional Players

- 10.2.1 Sunwoda EVB

- 10.2.2 EVE Energy

- 10.2.3 Ficosa

- 10.2.4 Sensata Technologies

- 10.2.5 Hyundai Mobis

- 10.3 Emerging Players

- 10.3.1 Dragonfly Energy

- 10.3.2 WeaveGrid

- 10.3.3 Twaice

- 10.3.4 VoltaIQ

- 10.3.5 Ampeco