PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892707

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892707

North America Centrifugal Blower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

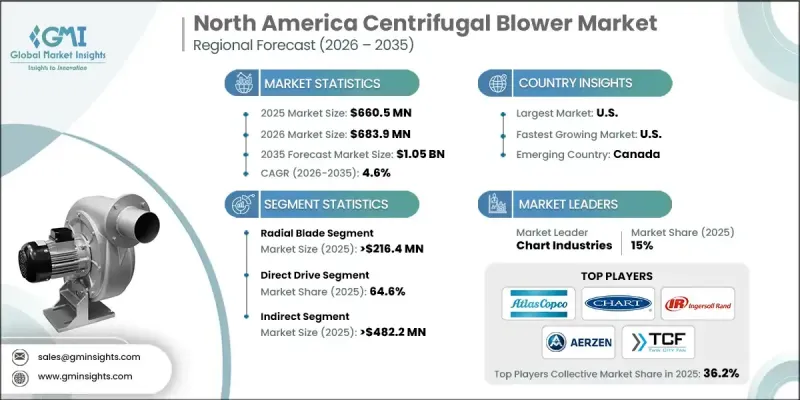

North America Centrifugal Blower Market was valued at USD 660.5 million in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 1.05 billion by 2035.

Market expansion is supported by broad adoption across major industries such as automotive, HVAC, chemicals, and power generation, where these systems are essential for cooling, ventilation, and controlled airflow. New generations of centrifugal blowers featuring higher efficiency and improved durability are also influencing market momentum. As industrial facilities accelerate their shift toward automation and smart operations, advanced blowers equipped with monitoring capabilities and predictive maintenance features are becoming increasingly important. Technology developments incorporating IoT connectivity, digital control systems, and variable-speed functionality are enabling industries to optimize energy use, reduce operational downtime, and improve overall performance. Growing expectations for energy-efficient equipment across manufacturing environments continue to fuel investments in upgraded blower technologies. As industrial modernization progresses throughout North America, these trends will reinforce demand for next-generation centrifugal blowers across both new installations and retrofit applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $660.5 Million |

| Forecast Value | $1.05 Billion |

| CAGR | 4.6% |

The radial blade segment reached USD 216.4 million in 2025. This design remains extensively used due to its reliability, durability, and ability to maintain consistent airflow in diverse operating environments. Its broad applicability across HVAC, chemical processing, food production, and water treatment reinforces its importance. Manufacturers continue expanding their product lines in response to rising demand for robust, multi-purpose blower systems capable of delivering stable performance.

The direct drive segment accounted for a 64.6% share in 2025. Direct drive systems enhance efficiency by eliminating energy loss associated with mechanical transmission components. These systems support energy conservation targets recognized by national regulatory authorities, prompting manufacturers to prioritize direct drive designs that help reduce power consumption across industrial operations. As efficiency standards become more stringent, adoption of direct drive blowers is expected to maintain strong momentum.

United States Centrifugal Blower Market held a 78.7% share in 2025. Its dominant position is supported by strong manufacturing, petrochemical, and HVAC sectors, all of which rely heavily on dependable airflow systems. Manufacturing plays a key role in the country's economic output, and centrifugal blowers remain essential to production processes across multiple industrial categories. Ongoing expansion of the petrochemical industry, supported by government-driven incentives, continues to amplify demand for advanced air-movement equipment.

Key companies operating in the North America Centrifugal Blower Market include Aerzen, AirPro Fan & Blower, Atlantic Blowers, Chart Industries, Chicago Blower, Cincinnati Fan, Clarage, Continental Blower, Greenheck, Hartzell Air Movement, Illinois Blower, Kaeser, New York Blower, Spencer Turbine, and Twin City Fan. Companies active in the North America Centrifugal Blower Market are implementing multiple strategies to strengthen their competitive position. Many are investing in high-efficiency blower designs that comply with evolving energy standards while lowering total operating costs for end users. Expanding digital capabilities, including IoT-based monitoring, sensor integration, and automated diagnostics, helps manufacturers deliver systems that support predictive maintenance and enhanced reliability. Firms are also broadening their distribution networks and offering customized solutions tailored to specific industrial needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Drive Mechanism

- 2.2.4 Pressure

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapidly growing construction industry

- 3.2.1.2 Strong product demand from power and mining industry

- 3.2.1.3 Growing food industry

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance and operational costs

- 3.2.2.2 Competitive pricing pressure

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient and smart systems

- 3.2.3.2 Growth in HVAC and pollution control applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8414.59.30)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Radial blade

- 5.3 Forward curved

- 5.4 Backwards curved

- 5.5 Mixed flow

- 5.6 Axial flow

- 5.7 Multi-stage

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Driver Mechanism, 2022-2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Direct drive

- 6.3 Belt drive

Chapter 7 Market Estimates & Forecast, By Pressure, 2022-2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 High

- 7.3 Medium

- 7.4 Low

Chapter 8 Market Estimates & Forecast, By Application, 2022-2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 HVAC

- 8.3 Industrial processes

- 8.4 Power generation

- 8.5 Pharmaceutical

- 8.6 Food processing

- 8.7 Mining

- 8.8 Agriculture

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Country, 2022-2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

Chapter 11 Company Profiles

- 11.1 Aerzen

- 11.2 AirPro Fan & Blower

- 11.3 Atlantic Blowers

- 11.4 Chart Industries

- 11.5 Chicago Blower

- 11.6 Cincinnati Fan

- 11.7 Clarage

- 11.8 Continental Blower

- 11.9 Greenheck

- 11.10 Hartzell Air Movement

- 11.11 Illinois Blower

- 11.12 Kaeser

- 11.13 New York Blower

- 11.14 Spencer Turbine

- 11.15 Twin City Fan