PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892710

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892710

Car-Sharing Platform Technologies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

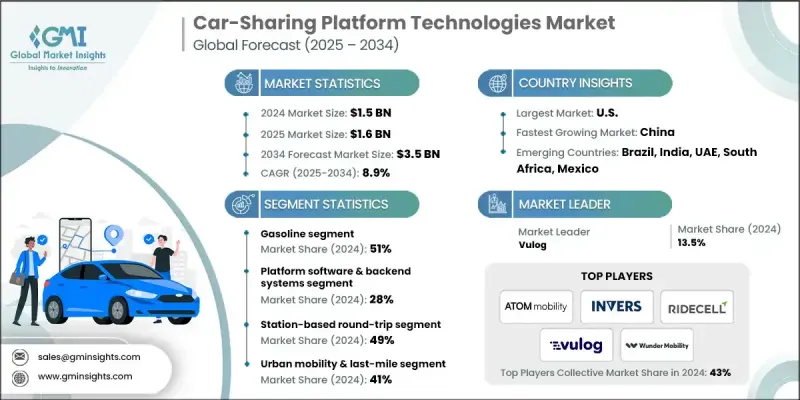

The Global Car-Sharing Platform Technologies Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 3.5 billion by 2034.

Growth is fueled by rising urban density and the increasing need for transportation models that provide greater convenience without adding more personal vehicles to crowded streets. With cities managing congestion, soaring parking demand, and shifting mobility preferences, consumers are gravitating toward shared fleets supported by digital ecosystems. Modern platform technologies ranging from telematics and connected vehicle systems to AI-powered fleet management are improving how operators maintain vehicles, monitor usage, and reduce operating costs. Data-driven insights support vehicle repositioning, dynamic pricing, and efficient dispatching, ultimately boosting fleet availability and reducing downtime. As shared mobility evolves, subscription-based and pay-per-use options appeal to users who prioritize flexibility over ownership. Seamless mobile applications, integrated payments, and social validation features further reduce adoption barriers. Younger users prefer convenient, on-demand transportation and are increasingly relying on shared mobility for both routine and off-peak travel, strengthening demand across urban and suburban areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 8.9% |

The gasoline vehicle segment held a 51% share in 2024 and is anticipated to grow at a CAGR of 8% from 2025 to 2034. Gasoline-powered fleets remain in demand due to dependable driving range and fast refueling, making them suitable for regions where charging networks are still limited. Platform technologies improve their performance through real-time vehicle monitoring, fuel-efficiency analytics, and intelligent routing that extends fleet life while lowering operational expenses.

The platform software and backend systems segment held a 28% share in 2024 and is expected to grow at a CAGR of 9.8% through 2034. Operators increasingly rely on automated software stacks that handle fleet dispatch, access control, routing, and driver verification. These systems significantly reduce manual labor, enhance accuracy, and support higher fleet utilization. Real-time analytics also make it possible to balance vehicles predictively and maintain consistent service levels across competitive markets.

U.S Car-Sharing Platform Technologies Market held an 86% share, generating USD 507.4 million in 2024. High population concentration, limited parking, and rising traffic costs are contributing to the demand for flexible transportation alternatives across major US metropolitan areas. Car-sharing technologies offer adaptable, cost-efficient options that align with sustainability goals and changing attitudes toward vehicle ownership.

Major companies in the Global Car-Sharing Platform Technologies Market include ATOM, Convadis, Fluctuo, INVERS, Karhoo, Ridecell, Smartcar, Unbound, Vulog, and Wunder. Companies in the Car-Sharing Platform Technologies Market are reinforcing their market presence by investing heavily in integrated mobility software, enhanced telematics, and scalable backend systems. Many firms focus on expanding real-time analytics capabilities to improve vehicle repositioning, optimize asset performance, and strengthen pricing strategies. Partnerships with automakers, urban mobility planners, and payment providers help broaden platform reach and support seamless service delivery. Providers are also adding modular and customizable software features to accommodate diverse fleet models and city regulations. Continuous upgrades to app interfaces, in-app payments, and user verification tools strengthen customer experience and retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Propulsion

- 2.2.4 Operational model

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & shift toward shared mobility

- 3.2.1.2 Growth in connected vehicle technologies

- 3.2.1.3 Rising adoption of EV-based shared fleets

- 3.2.1.4 Integration of multimodal mobility ecosystems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High deployment & integration costs

- 3.2.2.2 Regulatory compliance complexities

- 3.2.2.3 Vandalism, misuse & asset damage risks

- 3.2.2.4 Low profitability at low utilization

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging smart-city markets

- 3.2.3.2 EV and decarbonization mandates

- 3.2.3.3 Corporate mobility programs

- 3.2.3.4 MaaS and API monetization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Real-time fleet management platforms

- 3.9.1.2 Connected vehicle telematics

- 3.9.1.3 Mobile-based booking & access systems

- 3.9.1.4 Integrated payment & billing solutions

- 3.9.2 Emerging Technologies

- 3.9.2.1 AI-powered fleet optimization & predictive maintenance

- 3.9.2.2 autonomous vehicle integration

- 3.9.2.3 blockchain-based smart contracts

- 3.9.2.4 5g-enabled vehicle-to-everything (V2X) communication

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Market attractiveness analysis

- 3.13.1 Market attractiveness by technology type

- 3.13.2 Market attractiveness by business model

- 3.13.3 Market attractiveness by region

- 3.13.4 Market saturation index

- 3.13.5 Adoption barriers heatmap

- 3.14 Cost analysis & profitability insights

- 3.14.1 Total cost of ownership (tco) analysis

- 3.14.2 Return on investment (roi) analysis

- 3.14.3 Cost structure breakdown

- 3.14.4 Profitability models & unit economics

- 3.14.5 Cost reduction strategies & best practices

- 3.15 Industry benchmarks & key performance indicators

- 3.15.1 Operational performance metrics

- 3.15.2 User experience metrics

- 3.15.3 Financial performance indicators

- 3.15.4 Technology performance metrics

- 3.16 Strategy frameworks & decision tools

- 3.16.1 Technology selection framework

- 3.16.2 Build vs. Buy vs. Partner decision framework

- 3.16.3 Market entry strategy framework

- 3.16.4 Scaling & growth strategy framework

- 3.16.5 Digital transformation roadmap

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Platform software & backend systems

- 5.3 Mobile & user interface applications

- 5.4 Telematics & IoT hardware

- 5.5 Vehicle access control systems

- 5.6 Payment & billing systems

- 5.7 Fleet operations & optimization systems

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 BEV

- 6.5 PHEV

- 6.6 HEV

Chapter 7 Market Estimates & Forecast, By Operational Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Station-based round-trip

- 7.3 Station-based one-way

- 7.4 Home-zone car-sharing

- 7.5 Free-floating one-way

- 7.6 Peer-to-peer

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Urban mobility & last-mile

- 8.3 MaaS platform integration

- 8.4 Corporate fleet management

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Car-sharing operators

- 9.3 Automotive OEMs

- 9.4 Public transport authorities

- 9.5 Technology platform providers & integrators

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 ATOM

- 11.1.2 Getaround

- 11.1.3 INVERS

- 11.1.4 Ridecell

- 11.1.5 Smartcar

- 11.1.6 Turo

- 11.1.7 Unbound

- 11.1.8 Vulog

- 11.1.9 Wunder

- 11.1.10 Zipcar

- 11.2 Regional players

- 11.2.1. Car2 Go

- 11.2.2 DriveNow

- 11.2.3 Modo

- 11.2.4 GoGet

- 11.2.5 Car Club

- 11.2.6 GreenMobility

- 11.2.7 Sixt Share

- 11.2.8 ShareNow

- 11.2.9 BlueIndy

- 11.2.10 Communauto

- 11.2.11 Convadis

- 11.2.12 Fluctuo

- 11.3 Emerging Players

- 11.3.1 BluSmart

- 11.3.2 Zuch

- 11.3.3 Koenigsegg

- 11.3.4. P2 P CarShare

- 11.3.5 Ubeeqo

- 11.3.6 DriveMyCar

- 11.3.7 RidePark

- 11.3.8 Karhoo