PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892714

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892714

Autonomous Ride-Sharing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

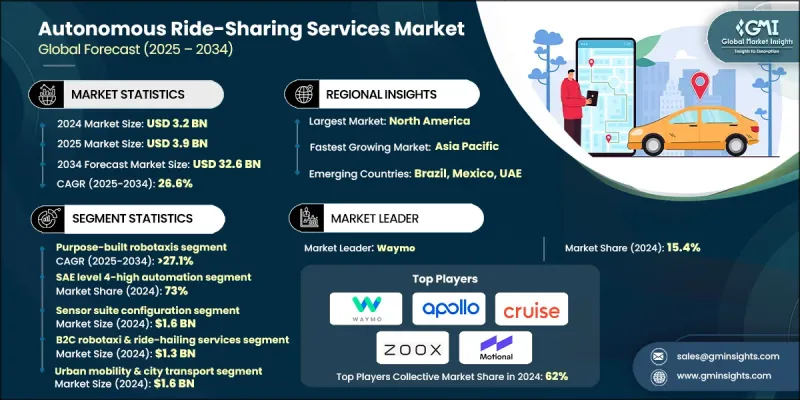

The Global Autonomous Ride-Sharing Services Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 26.6% to reach USD 32.6 billion by 2034.

Growth is fueled by fast-moving innovation in autonomous driving systems, increasing demand for affordable urban travel options, and expanding investment in intelligent transportation networks. As cities work toward reducing traffic pressure, cutting emissions, and improving mobility efficiency, autonomous ride-sharing platforms are becoming a scalable pillar of future transportation. The fusion of AI-based perception, advanced automation features, connected sensors, high-speed networks, and real-time fleet intelligence is reshaping how self-driving fleets function. These technologies support accurate maneuvering, predictive routing, collision-avoidance decision processes, and continuous monitoring of vehicle performance. Through adaptive learning models, route simulation environments, and cloud-coordinated fleet tools, operators improve safety outcomes, reduce operational disruptions, and deliver quicker and more dependable mobility on demand. Adoption is also gaining momentum with the expansion of autonomous ride-service platforms, orchestrated fleet management systems, integrated mobility-as-a-service frameworks, and automated dispatch technologies. These solutions streamline user onboarding, support responsive pricing, enhance communication with roadway infrastructure, and enable smoother coordination across multiple modes of travel. Collaboration among mobility providers, technology developers, and transportation agencies is further advancing autonomous mobility in both shared and private travel settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $32.6 Billion |

| CAGR | 26.6% |

The purpose-built robotaxis category held a 48% share in 2024 and is projected to grow at a 27.1% through 2034. This segment leads due to vehicles designed specifically for autonomous operation, engineered with high-redundancy sensing, optimized interiors for shared use, and efficient electric foundations. Their ability to achieve lower operating costs, higher utilization, and scalable deployment has reinforced their dominance across major metropolitan areas.

The SAE Level 4-High Automation segment accounted for a 73% share in 2024 and is set to grow at 26.2% from 2025 to 2034. This category leads because it supports fully autonomous service within predefined operating zones, enabling dependable commercial fleets across structured environments. Operators increasingly choose Level 4 systems due to their consistent performance, reduced reliance on human monitors, and compatibility with existing mobility infrastructure.

US Autonomous Ride-Sharing Services Market held an 88% share, generating USD 1.1 billion in 2024. The region's strong position reflects robust digital capabilities, a highly developed mobility ecosystem, and early adoption of autonomous technologies. Supportive regulatory pathways, extensive testing programs, and significant investment in large-scale fleet rollout have positioned North America as a global leader, strengthened by rising user interest in safer, cleaner, and more efficient mobility options.

Major companies active in the Autonomous Ride-Sharing Services Market include Hyundai Motor Group, Zoox, Cruise, Waymo, Baidu Apollo, Motional, General Motors, AutoX, Pony.ai, and Jaguar Land Rover. Companies in the Autonomous Ride-Sharing Services Market are enhancing their market foothold by accelerating development of autonomous driving stacks, investing in scalable electric fleet platforms, and expanding AI-based operational intelligence. Many firms focus on forming alliances with automakers, software developers, and mobility partners to secure technology integration and broaden deployment opportunities. Continuous testing across controlled environments helps improve system reliability and regulatory acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Automation level

- 2.2.3 Technology platform

- 2.2.4 Service model

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid advancements in autonomous driving technologies

- 3.2.1.2 Rising demand for cost-efficient urban mobility

- 3.2.1.3 Government push for smart transportation & low-emission mobility

- 3.2.1.4 Increasing investments from tech giants & mobility operators

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of autonomous fleet deployment

- 3.2.2.2 Regulatory & safety uncertainty

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into smart cities & mobility-as-a-service (maas)

- 3.2.3.2 Adoption of electric autonomous fleets

- 3.2.3.3 Corporate, campus, and closed-environment mobility

- 3.2.3.4 Technological advancements and AI integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Federal regulations (NHTSA, FMCSA, FTA guidance)

- 3.4.2 State-level permitting & testing requirements

- 3.4.3 Local ordinances (curb management, geofencing, operating hours)

- 3.4.4 Ada compliance & accessibility mandates

- 3.4.5 Safety standards & voluntary self-assessments

- 3.4.6 Liability & insurance framework

- 3.4.7 Data privacy & cybersecurity regulations

- 3.4.8 International regulatory harmonization

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Sensor technology evolution (lidar, radar, camera, fusion)

- 3.7.2 Perception & localization algorithms

- 3.7.3 Motion planning & control systems

- 3.7.4 HD mapping & map-less navigation approaches

- 3.7.5. V2 X communication & cooperative automation

- 3.7.6 Remote operations & teleoperation systems

- 3.7.7 Cybersecurity & data privacy technologies

- 3.7.8 Accessible vehicle design & automated securement systems

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Best case scenarios

- 3.13 Patent & Intellectual Property Analysis

- 3.13.1 Patent filing trends by technology domain

- 3.13.2 Leading patent holders (waymo, cruise, zoox, motional, aurora)

- 3.13.3 Sensor fusion & perception patent landscape

- 3.13.4 Motion planning & control patent clusters

- 3.13.5 HD mapping & localization IP

- 3.13.6 Patent litigation & licensing dynamics

- 3.14 Investment & Funding Analysis

- 3.14.1 Venture capital & private equity investment trends

- 3.14.2 Corporate strategic investments

- 3.14.3 Federal grant programs

- 3.14.4 Public market activity

- 3.14.5 Funding by development stage

- 3.14.6 Geographic distribution of investment

- 3.15 Operational Design Domain (ODD) Analysis

- 3.15.1 Geographic ODD Constraints (Geofencing, City Coverage)

- 3.15.2 Road Type ODD (Urban Arterials, Highways, Residential Streets)

- 3.15.3 Speed Range ODD

- 3.15.4 Weather & Environmental ODD

- 3.15.5 ODD Expansion Strategies & Timelines

- 3.16 Accessibility & Universal Design Implementation Standards

- 3.16.1 ADA compliance requirements for autonomous ride-sharing

- 3.16.2 Accessible vehicle design requirements

- 3.16.3 Accessible human-machine interface

- 3.16.4 Wayfinding & navigation assistance

- 3.16.5 Federal accessibility research & funding

- 3.16.6 Universal design principles for autonomous vehicles

- 3.16.7 Compliance monitoring & enforcement

- 3.17 Remote Operations & Teleoperation Infrastructure Analysis

- 3.17.1 Remote operations architecture & use cases

- 3.17.2 Teleoperation vs. Remote assistance distinction

- 3.17.3 NHTSA research on remote operations safety

- 3.17.4 Network infrastructure requirements

- 3.17.5 Remote operations center design

- 3.17.6 Regulatory requirements for remote operations

- 3.17.7 Economic considerations

- 3.18 Infrastructure Dependencies & Ecosystem Readiness Assessment

- 3.18.1 Road infrastructure requirements

- 3.18.2 Vehicle-to-infrastructure (V2I) communication

- 3.18.3 Charging infrastructure for electric autonomous fleets

- 3.18.4 HD mapping infrastructure & maintenance

- 3.18.5 Curb space management & pick-up/drop-off zones

- 3.18.6 Telecommunications infrastructure

- 3.18.7 Ecosystem readiness assessment framework

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 SAE level 4-high automation

- 5.3 SAE level 5-full automation

Chapter 6 Market Estimates & Forecast, By Technology Platform, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Sensor suite configuration

- 6.2.1 Lidar-primary system

- 6.2.2 Radar-evolving system

- 6.2.3 Multi-modal sensor fusion

- 6.3 Compute architecture

- 6.4 Connectivity type

- 6.5 Mapping & localization approach

Chapter 7 Market Estimates & Forecast, By Service Model, 2021 - 2034 ($ Bn, Fleet Size)

- 7.1 Key trends

- 7.2 B2C robotaxi & ride-hailing services

- 7.3 B2B corporate & campus shuttle services

- 7.4 B2G municipal & transit-integrated services

- 7.5 Airport & specialized corridor shuttles

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Purpose-built robotaxis

- 8.3 Passenger cars & sedans

- 8.4 Vans & multi-purpose vehicles

- 8.5 Low-speed automated shuttles

- 8.6 Full-size transit buses (40-ft+)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Urban mobility & city transport

- 9.3 First/last-mile transit connectivity

- 9.4 Campus & closed-environment transport

- 9.5 Rural & underserved area mobility

- 9.6 Paratransit & accessibility services

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Cruise LLC

- 11.1.2 Geely/Zeekr

- 11.1.3 General Motors

- 11.1.4 Hyundai Motor Group

- 11.1.5 Jaguar Land Rover

- 11.1.6 Motional

- 11.1.7 Toyota Motor Corporation

- 11.1.8 Volkswagen Group

- 11.1.9 Waymo LLC

- 11.1.10 Zoox Inc.

- 11.2 Regional Player

- 11.2.1 Alphabet Inc.

- 11.2.2 Amazon

- 11.2.3 Aptiv PLC

- 11.2.4 Continental AG

- 11.2.5 EasyMile

- 11.2.6 Intel/Mobileye

- 11.2.7 May Mobility

- 11.2.8 New Flyer

- 11.2.9 NVIDIA Corporation

- 11.2.10 Qualcomm

- 11.3 Emerging Players

- 11.3.1 Aurora Innovation

- 11.3.2 Beep Inc.

- 11.3.3 Innoviz Technologies

- 11.3.4 Luminar Technologies

- 11.3.5 Perrone Robotics