PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892733

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892733

Intermodal Transportation Hubs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

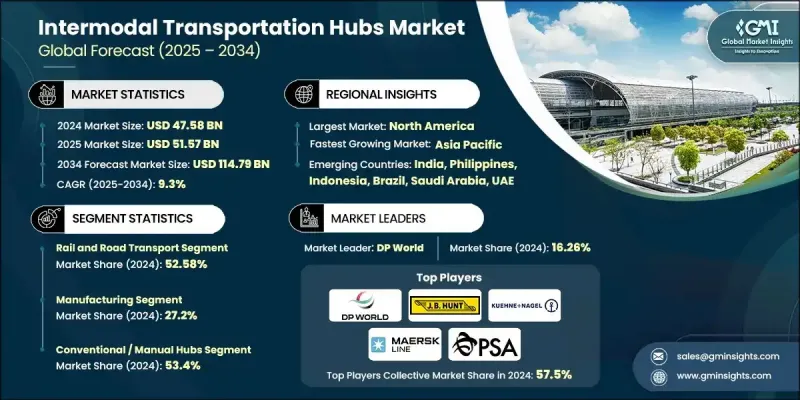

The Global Intermodal Transportation Hubs Market was valued at USD 47.58 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 114.79 billion by 2034.

Growth is shaped by a worldwide shift toward freight systems that can seamlessly combine rail, road, air, and maritime networks into a coordinated logistics ecosystem. Modern intermodal hubs allow cargo operators, infrastructure developers, and supply chain organizations to move shipments more efficiently by reducing dependence on a single mode. This model lowers transportation expenses, shortens delivery windows, and increases overall routing flexibility. Rising global trade activity, expanding cross-border operations, and the acceleration of e-commerce continue to amplify the need for multimodal connectivity supported by strong digital tracking and smooth handoffs between transport modes. Supply chains that handle high-volume industrial flows also require dependable, resilient routes, pushing demand for hubs that can manage complex freight transitions with better visibility and reliability. Momentum is further reinforced by global sustainability goals, large-scale infrastructure upgrades, and the push for low-emission logistics. The rapid development of clean energy systems, electric vehicle freight solutions, and critical mineral transport networks is creating opportunities for long-distance freight optimization. Intermodal nodes help streamline these flows by combining the efficiency of rail and maritime transport with road-based flexibility for final delivery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.58 Billion |

| Forecast Value | $114.79 Billion |

| CAGR | 9.3% |

The rail and road transport segment held a 52.58% share in 2024 and is projected to grow at a CAGR of 9.6% through 2034. This segment remains dominant because the combination of rail for long-distance freight and road for flexible local distribution allows operators to reduce transit time and keep operating costs predictable. Railroad connectivity remains central to industrial corridors, supporting the movement of bulk materials, manufactured goods, parts, and consumer products with consistent reliability.

The manufacturing segment held a 27.2% share in 2024 and is expected to grow at a CAGR of 9.4% from 2025 to 2034. Manufacturers rely heavily on intermodal hubs to move high volumes of raw materials and finished products efficiently. Integrated rail, road, and port networks help reduce bottlenecks, stabilize delivery schedules, and improve cost control for sectors including machinery, automotive, electronics, and heavy equipment. The ability to manage standardized containers and heavy freight loads strengthens the segment's leadership position.

US Intermodal Transportation Hubs Market held an 85% share, generating USD 13.97 billion in 2024. Continued investment in expanding rail capacity, automating terminals, and modernizing port infrastructure is driving strong adoption nationwide. Growing e-commerce activity, manufacturing output, and cross-border trade within the region are pushing demand for multimodal connectivity that improves visibility and reduces delays. Advanced digital tools, including IoT monitoring, RFID-based freight tracking, and integrated logistics software, are becoming central to optimizing cargo coordination across major US hubs.

Major companies active in the Global Intermodal Transportation Hubs Market include BNSF Railway, C.H. Robinson Worldwide, DHL Global, DP World, J.B. Hunt Transport Services, Kuehne + Nagel, Maersk Line, Norfolk Southern, PSA International, and Union Pacific Railroad. Companies competing in the Intermodal Transportation Hubs Market are strengthening their position by expanding multimodal infrastructure, enhancing cargo visibility technologies, and forming strategic partnerships with logistics providers. Many are investing in automated terminals, digital freight platforms, and analytics-driven routing tools that streamline container handling and accelerate turnaround times. Firms also prioritize integrating IoT tracking, smart yard management systems, and cloud-based coordination tools to improve transparency throughout the supply chain. Collaborative agreements with rail operators, port authorities, and trucking networks help optimize cross-modal transitions and stabilize capacity during peak demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transportation mode

- 2.2.3 Hub

- 2.2.4 End Use

- 2.2.5 Operation Model

- 2.2.6 Automation Level

- 2.2.7 Throughput Capacity

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion of cross-border trade & global supply chains

- 3.2.1.2 Increase in government investments in rail corridors, smart ports, and multimodal logistics parks

- 3.2.1.3 Surge in e-commerce and retail distribution

- 3.2.1.4 Increase in industrial corridors, SEZs, and smart city developments

- 3.2.1.5 Rise in sustainability and emission-reduction mandates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure for terminal construction & automation

- 3.2.2.2 Operational fragmentation between multiple transport modes

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in adoption of AI-driven terminal operating systems (TOS)

- 3.2.3.2 Increase in development of strategic trade corridors

- 3.2.3.3 Surge in demand for electrified and automated cargo-handling equipment

- 3.2.3.4 Rise in deployment of digital customs, blockchain, and smart gate systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Automation & robotics in cargo handling

- 3.7.1.2 Digital twin & simulation technologies

- 3.7.1.3 Iot & sensor networks for asset tracking

- 3.7.2 Emerging technologies

- 3.7.2.1 Artificial intelligence & predictive analytics

- 3.7.2.2 Blockchain for documentation & traceability

- 3.7.2.3 5g connectivity & edge computing

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By type

- 3.10 Cost breakdown analysis

- 3.11 Business Case & ROI Analysis

- 3.11.1 Total cost of ownership framework

- 3.11.2 ROI calculation methodologies

- 3.11.3 Implementation timeline & milestones

- 3.11.4 Risk assessment & mitigation strategies

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & Funding Analysis

- 3.13.1 Infrastructure investment & jobs act (IIJA) impact

- 3.13.2 Public-private partnership (PPP) models

- 3.13.3 Private equity & venture capital activity

- 3.13.4 Green finance & sustainability-linked funding

- 3.14 Infrastructure capacity utilization & bottleneck analysis

- 3.14.1 Port congestion metrics & dwell time analysis

- 3.14.2 Rail terminal capacity constraints

- 3.14.3 Chassis availability & pool management challenges

- 3.14.4 Gate processing throughput limitations

- 3.14.5 On-dock rail capacity vs. Demand gap

- 3.14.6 Storage yard utilization rates

- 3.14.7 Peak season surge capacity requirements

- 3.14.8 Intermodal connector bottleneck identification

- 3.15 Landside accessibility & first/last-mile infrastructure connectivity

- 3.15.1 Intermodal connector program (FHWA) investment priorities

- 3.15.2 Grade-separated crossings & congestion relief projects

- 3.15.3 Drayage trucking capacity & driver shortages

- 3.15.4 Urban freight corridors & truck route restrictions

- 3.15.5 Rail network capacity & class i railroad congestion

- 3.15.6 Short-line railroad connectivity & infrastructure condition

- 3.15.7 Dedicated freight corridors & high-speed rail conflicts

- 3.15.8 Last-mile delivery infrastructure for e-commerc3

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Transportation Mode, 2021 - 2034 ($Bn, TEU)

- 5.1 Key trends

- 5.2 Rail and road transport

- 5.3 Air and road transport

- 5.4 Maritime and road transport

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Hub, 2021 - 2034 ($Bn, TEU)

- 6.1 Key trends

- 6.2 Seaport Intermodal Hubs

- 6.3 Rail-Road Intermodal Terminals

- 6.4 Dry Ports / Inland Container Depots (ICDs)

- 6.5 Air Cargo Intermodal Hubs

- 6.6 Urban Multimodal Logistics Centers

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, TEU)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Oil & gas

- 7.4 Construction

- 7.5 Consumer goods and retail

- 7.6 Automotive

- 7.7 Food and beverages

- 7.8 Pharmaceuticals and healthcare

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Operation Model, 2021 - 2034 ($Bn, TEU)

- 8.1 Key trends

- 8.2 Public/Government-Operated

- 8.3 Private-Operated

- 8.4 PPP (Public-Private Partnership)

- 8.5 Concession-Based / BOT

- 8.6 3PL / 4PL Operated

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Bn, TEU)

- 9.1 Key trends

- 9.2 Conventional / Manual Hubs

- 9.3 Semi-Automated Hubs

- 9.4 Fully Automated

Chapter 10 Market Estimates & Forecast, By Throughput Capacity, 2021 - 2034 ($Bn, TEU)

- 10.1 Key trends

- 10.2 Low Capacity

- 10.3 Medium Capacity

- 10.4 High Capacity

- 10.5 Mega Hubs

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, TEU)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 APM Terminals (A.P. Moller-Maersk)

- 12.1.2 BNSF Railway

- 12.1.3 C.H. Robinson Worldwide

- 12.1.4 Canadian National Railway

- 12.1.5 China Merchants Port

- 12.1.6 CMA CGM Terminal Link

- 12.1.7 COSCO SHIPPING Ports

- 12.1.8 DHL Global

- 12.1.9 DP World

- 12.1.10 Hutchison Ports

- 12.1.11 J.B. Hunt Transport Services

- 12.1.12 Kalmar

- 12.1.13 Konecranes

- 12.1.14 Kuehne + Nagel

- 12.1.15 Maersk Line

- 12.1.16 MSC Terminal & Logistics (TIL)

- 12.1.17 Navis

- 12.1.18 PSA International

- 12.1.19 Union Pacific Railroad

- 12.1.20 Zebra Technologies

- 12.2 Regional Players

- 12.2.1 Georgia Ports Authority

- 12.2.2 Mi-Jack Products

- 12.2.3 Port of Los Angeles

- 12.2.4 Port of Rotterdam

- 12.2.5 Port of Singapore Authority (MPA)

- 12.2.6 South Carolina Ports Authority

- 12.2.7 Tideworks Technology

- 12.2.8 Virginia Port Authority

- 12.2.9 Norfolk Southern

- 12.3 Emerging Players

- 12.3.1 Kaleris

- 12.3.2 Portchain

- 12.3.3 TuSimple