PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892765

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892765

Bulk Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

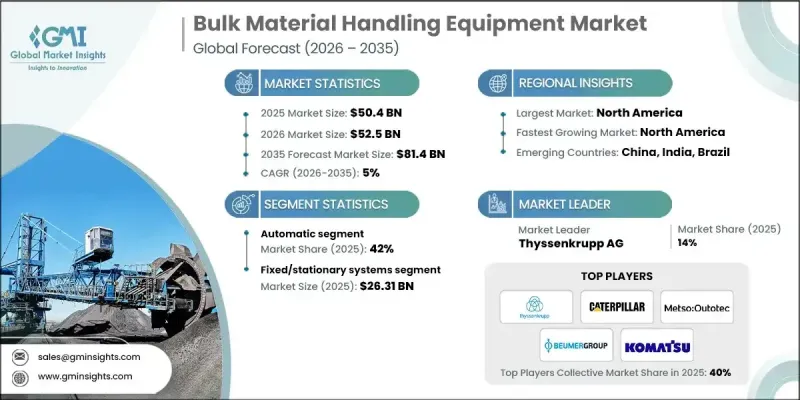

The Global Bulk Material Handling Equipment Market was valued at USD 50.4 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 81.4 billion by 2035.

The transition toward automated bulk handling continues to reshape the industry as companies move beyond traditional manual systems and adopt advanced solutions designed for today's supply chain challenges. Automation is no longer viewed simply as a method to cut labor costs; it has become essential for improving workflow efficiency, enhancing workplace safety, minimizing operational disruptions, and building a more resilient and adaptable logistics network. Modern automated systems support businesses as they respond to fluctuating demand and help maintain consistency across high-volume operations. Rapid growth in e-commerce has also significantly influenced the landscape of bulk material handling by expanding the range of industries that rely on these systems. What was once centered around industrial sectors such as mining, shipping, and manufacturing is now a core component of the infrastructure needed to support large-scale digital commerce and accelerated delivery expectations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $50.4 Billion |

| Forecast Value | $81.4 Billion |

| CAGR | 5% |

The automatic segment held a 42% share in 2025. Demand for automated bulk handling solutions remains strong because these systems enhance performance and reduce operating expenses. Automated tools, including streamlined material routing and intelligent movement technologies, help ensure accurate flow and delivery of goods.

The fixed and stationary systems segment held a 52% share and generated USD 26.31 billion in 2025. These systems dominate because they are indispensable in operations that handle uninterrupted, high-volume material processing. Stationary equipment, such as stackers, conveyor structures, and hoppers, enables continuous movement of bulk goods without relocation, making them essential for industries that depend on long-duration material transfer.

U.S. Bulk Material Handling Equipment Market was valued at USD 486.4 million in 2025. North America continues to show strong growth due to the widespread adoption of automation and sustained investment in modernizing industrial facilities. The U.S. market benefits from a diverse industrial base and rising demand from mining, construction, and logistics sectors, helping the region maintain one of the fastest-expanding market environments worldwide.

Key companies in the Global Bulk Material Handling Equipment Market include KOCH Solutions GmbH, Caterpillar Inc., Komatsu Ltd., Metso Outotec Corporation, thyssenkrupp AG, Sandvik AB, BEUMER Group GmbH & Co. KG, AUMUND Group, TAKRAF GmbH, CITIC Heavy Industries Co., Ltd., Tenova S.p.A., Siwertell AB, Vigan Engineering S.A., Liebherr Group, and Continental AG. Companies in the Bulk Material Handling Equipment Market are strengthening their competitive position by expanding automated product portfolios and integrating digital technologies such as smart monitoring, predictive maintenance, and advanced control systems. Many manufacturers are prioritizing energy-efficient equipment designs, reflecting the demand for lower operating costs and reduced environmental impact. Strategic partnerships with mining, construction, and logistics operators help companies deliver customized handling systems that fit high-volume applications. Firms are also investing in modular and scalable equipment platforms, enabling customers to upgrade as capacity needs grow.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment Type

- 2.2.3 Capacity

- 2.2.4 Installation Type

- 2.2.5 Automation Type

- 2.2.6 Commodity

- 2.2.7 End Use

- 2.2.8 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for precision in packaging and printing

- 3.2.1.2 Automation and technological advancements

- 3.2.1.3 Expansion of e-commerce and customization trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Skill gap and operational complexity

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Conveyor systems

- 5.2.1 Belt conveyor systems

- 5.2.2 Pipe conveyor systems

- 5.2.3 Drag chain conveyor systems

- 5.2.4 Screw conveyor systems

- 5.3 Stacker-reclaimer systems

- 5.3.1 Circular stacker-reclaimers

- 5.3.2 Linear stacker-reclaimers

- 5.3.3 Combined stacker-reclaimers

- 5.4 Shiploader & shipunloader systems

- 5.4.1 Continuous shiploaders

- 5.4.2 Grab-type shipunloaders

- 5.4.3 Pneumatic shipunloaders

- 5.5 Bucket wheel excavators

- 5.5.1 Lignite mining applications

- 5.5.2 Iron ore applications

- 5.5.3 Overburden removal applications

- 5.6 Feeders & feeding equipment

- 5.6.1 Vibratory feeders

- 5.6.2 Belt feeders

- 5.6.3 Apron feeders

- 5.7 Crushers & size reduction equipment

- 5.7.1 Jaw crushers

- 5.7.2 Cone crushers

- 5.7.3 Impact crushers

- 5.7.4 Hammer mills

- 5.8 Screening & separation equipment

- 5.8.1 Vibrating screens

- 5.8.2 Classifiers & separators

- 5.9 Storage systems

- 5.9.1 Hoppers & bins

- 5.9.2 Silos & storage facilities

- 5.10 Auxiliary & support equipment

- 5.10.1 Belt cleaners & scrapers

- 5.10.2 Take-up systems

- 5.10.3 Transfer equipment & chutes

- 5.10.4 Dust collection systems

- 5.10.5 Magnetic separators

Chapter 6 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small capacity systems (under 1,000 tph)

- 6.3 Medium capacity systems (1,000-5,000 tph)

- 6.4 High-capacity systems (5,000-8,000 tph)

- 6.5 Ultra-high-capacity systems (8,000+ tph)

Chapter 7 Market Estimates and Forecast, By Installation Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Fixed/stationary systems

- 7.3 Mobile systems

- 7.4 Portable/semi-mobile systems

Chapter 8 Market Estimates and Forecast, By Automation Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manual

- 8.3 Semi-automatic

- 8.4 Automatic

Chapter 9 Market Estimates and Forecast, By Commodity Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Iron ore

- 9.3 Coal

- 9.4 Copper

- 9.5 Fertilizers & chemicals

- 9.6 Multi-commodity systems

- 9.7 Other bulk commodities

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Mining operations

- 10.3 Port & terminal operations

- 10.4 Power generation

- 10.5 Cement manufacturing

- 10.6 Steel & metals processing

- 10.7 Agriculture & food processing

- 10.8 Construction & aggregates

- 10.9 Logistics & distribution centers

- 10.10 Other end-use industries

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 KOCH Solutions GmbH

- 13.2 Caterpillar Inc.

- 13.3 Komatsu Ltd.

- 13.4 Metso Outotec Corporation

- 13.5 thyssenkrupp AG

- 13.6 Sandvik AB

- 13.7 BEUMER Group GmbH & Co. KG

- 13.8 AUMUND Group

- 13.9 TAKRAF GmbH

- 13.10 CITIC Heavy Industries Co., Ltd.

- 13.11 Tenova S.p.A.

- 13.12 Siwertell AB

- 13.13 Vigan Engineering S.A.

- 13.14 Liebherr Group

- 13.15 Continental AG