PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928869

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928869

MEA Bulk Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

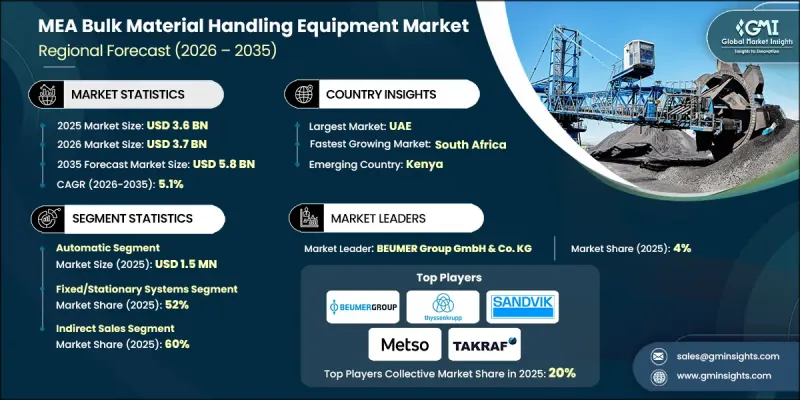

MEA Bulk Material Handling Equipment Market was valued at USD 3.6 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 5.8 billion by 2035.

The expansion is supported by rising mineral extraction activity across the region, which is accelerating capital spending on high-capacity systems designed to transport and manage bulk materials with greater speed and reliability. Market growth is also being reinforced by the need to reduce operational interruptions and improve productivity, which is driving adoption of advanced conveyor solutions, stacker systems, and reclaiming technologies. Environmental performance is increasingly shaping purchasing decisions, as operators focus on reducing emissions, lowering power consumption, and improving workplace safety. Large-scale industrial developments are contributing to stronger demand while also encouraging localized technological innovation, positioning the region as an important hub for bulk material handling solutions. Sustainability considerations are now embedded into project planning, with stricter regulatory frameworks prompting investments in cleaner, more energy-efficient equipment across mining, logistics, and industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.6 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.1% |

In 2025, the automatic systems accounted for USD 1.5 billion. Automated solutions are gaining traction across the MEA region as operators prioritize efficiency, consistency, and cost control. These systems allow large material volumes to be handled with limited manual involvement, helping reduce labor risks while maintaining stable throughput. Automation is also viewed as a critical tool for improving asset utilization and minimizing unplanned downtime in high-demand operating environments.

The fixed or stationary systems category held 52% share in 2025. Stationary installations remain the preferred option for long-term, high-volume operations due to their structural robustness and ability to operate continuously with minimal disruption. Compared to mobile alternatives, these systems deliver higher load capacities, longer service life, and lower overall maintenance requirements, making them well suited for permanent industrial facilities.

UAE Bulk Material Handling Equipment Market accounted for 39% share in 2025. Ongoing investment in logistics infrastructure, industrial zones, and transport connectivity continues to support strong demand for bulk material handling equipment in the country. Terminal upgrades and industrial expansion are driving adoption of automated, enclosed, and energy-efficient handling systems designed to support high material flows while reducing environmental impact. Demand is also being fueled by construction-related material movement, encouraging the use of durable solutions with predictive maintenance capabilities and efficient spare parts availability.

Key companies active in the MEA Bulk Material Handling Equipment Market include Metso Outotec, TAKRAF, Liebherr Group, Sandvik, BEUMER Group, AUMUND Group, Komatsu, Caterpillar, ThyssenKrupp, Continental, Tenova, Siwertell, CITIC Heavy Industries, Vigan Engineering, and KOCH Solutions. Companies operating in the MEA Bulk Material Handling Equipment Market are strengthening their positions by focusing on technological innovation, regional customization, and long-term service capabilities. Many players are investing in automation, digital monitoring, and energy-efficient designs to align with evolving operational and regulatory expectations. Strategic partnerships with local distributors and engineering firms are used to improve market access and after-sales responsiveness. Manufacturers are also expanding service networks to offer maintenance, retrofitting, and lifecycle support, helping customers reduce downtime and operating costs. Product portfolios are increasingly tailored to regional operating conditions, while investments in training and technical support are enhancing customer retention and brand credibility across the MEA region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Capacity

- 2.2.4 Installation type

- 2.2.5 Automation type

- 2.2.6 Commodity type

- 2.2.7 End use

- 2.2.8 Distribution sales

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion of mining operations in Southern Africa

- 3.2.1.2 Port infrastructure modernization in GCC Countries

- 3.2.1.3 Growth in cement manufacturing sector

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment requirements

- 3.2.2.2 Lack of skilled labor & technical expertise

- 3.2.3 Opportunities

- 3.2.3.1 Renewable energy projects (solar, wind) requiring handling systems

- 3.2.3.2 Railway infrastructure expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Conveyor systems

- 5.2.1 Belt conveyor systems

- 5.2.2 Pipe conveyor systems

- 5.2.3 Drag chain conveyor systems

- 5.2.4 Screw conveyor systems

- 5.3 Stacker-reclaimer systems (stockyard machines)

- 5.3.1 Circular stacker-reclaimers

- 5.3.2 Linear stacker-reclaimers

- 5.3.3 Combined stacker-reclaimers

- 5.4 Shiploader & shipunloader systems

- 5.4.1 Continuous shiploaders

- 5.4.2 Grab-type shipunloaders

- 5.4.3 Pneumatic shipunloaders

- 5.4.4 Wagon tippler & marshaling equipment

- 5.5 Bucket wheel excavators

- 5.5.1 Lignite mining end uses

- 5.5.2 Iron ore end uses

- 5.5.3 Overburden removal end uses

- 5.6 Feeders & feeding equipment

- 5.6.1 Vibratory feeders

- 5.6.2 Belt feeders

- 5.6.3 Apron feeders

- 5.7 Crushers & size reduction equipment

- 5.7.1 Jaw crushers

- 5.7.2 Cone crushers

- 5.7.3 Impact crushers

- 5.7.4 Hammer mills

- 5.8 Screening & separation equipment

- 5.8.1 Vibrating screens

- 5.8.2 Classifiers & separators

- 5.9 Storage systems

- 5.9.1 Hoppers & bins

- 5.9.2 Silos & storage facilities

- 5.10 Auxiliary & support equipment

- 5.10.1 Belt cleaners & scrapers

- 5.10.2 Take-up systems

- 5.10.3 Transfer equipment & chutes

- 5.10.4 Dust collection systems

- 5.10.5 Magnetic separators

Chapter 6 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small capacity systems (under 1,000 tph)

- 6.3 Medium capacity systems (1,000-5,000 tph)

- 6.4 High-capacity systems (5,000-8,000 tph)

- 6.5 Ultra-high-capacity systems (8,000+ tph)

Chapter 7 Market Estimates and Forecast, By Installation Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Fixed/stationary systems

- 7.3 Mobile systems

- 7.4 Portable/semi-mobile systems

Chapter 8 Market Estimates and Forecast, By Automation Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manual

- 8.3 Semi-automatic

- 8.4 Automatic

Chapter 9 Market Estimates and Forecast, By Commodity Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Iron ore

- 9.3 Coal

- 9.4 Copper

- 9.5 Fertilizers & chemicals

- 9.6 Multi-commodity systems

- 9.7 Other bulk commodities

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Mining operations

- 10.3 Port & terminal operations

- 10.4 Power generation

- 10.5 Cement manufacturing

- 10.6 Steel & metals processing

- 10.7 Agriculture & food processing

- 10.8 Construction & aggregates

- 10.9 Logistics & distribution centers

- 10.10 Other end use industries

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates and Forecast, By Country, 2022 - 2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 UAE

- 12.3 Saudi Arabia

- 12.4 Qatar

- 12.5 Egypt

- 12.6 Algeria

- 12.7 South Africa

- 12.8 Namibia

- 12.9 Kenya

- 12.10 Nigeria

Chapter 13 Company Profiles

- 13.1 AUMUND Group

- 13.2 BEUMER Group

- 13.3 Caterpillar

- 13.4 CITIC Heavy Industries

- 13.5 Continental

- 13.6 KOCH Solutions

- 13.7 Komatsu

- 13.8 Liebherr Group

- 13.9 Metso Outotec

- 13.10 Sandvik

- 13.11 Siwertell

- 13.12 TAKRAF

- 13.13 Tenova

- 13.14 ThyssenKrupp

- 13.15 Vigan Engineering