PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892768

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892768

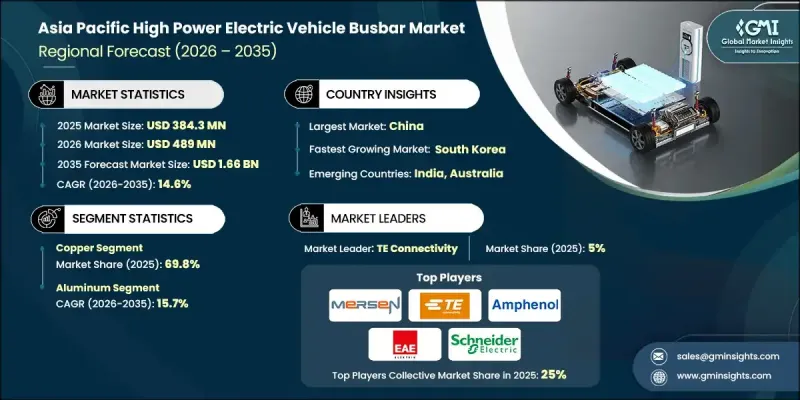

Asia Pacific High Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

Asia Pacific High Power Electric Vehicle Busbar Market was valued at USD 384.3 million in 2025 and is estimated to grow at a CAGR of 14.6% to reach USD 1.66 billion by 2035.

The rapid shift toward electrified public transportation and the adoption of higher voltage systems are transforming the regional market landscape. Countries across Asia Pacific are accelerating the deployment of battery electric buses, prompting OEMs and Tier-1 suppliers to focus on high-voltage architectures ranging from 800 to 1000V. High-power busbars, whether rigid laminated, flexible, or copper/aluminum hybrid, are critical for safely transmitting high-density currents between batteries, inverters, DC link capacitors, junction boxes, and fast-charging stations while controlling thermal rise and minimizing inductance. Increasing route lengths and tighter depot schedules demand higher continuous current capacities and enhanced creepage and clearance management. Public procurement initiatives reduce financing risks and scale electric bus orders, encouraging investments in upgraded depot infrastructure, including transformers, DC chargers, and switchgear. Aggregation of components helps standardize technical specifications and optimize busbar current ratings. Payment security measures and long-term operational frameworks instill confidence among OEMs to invest in high-power drivetrains and thermally managed power distribution. As tender evaluations evolve, focus on arc mitigation, insulation coordination, and multi-model interoperability is driving demand for reliably engineered busbar assemblies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $384.3 Million |

| Forecast Value | $1.66 Billion |

| CAGR | 14.6% |

The copper-based high-power EV busbars segment held a 69.8% share in 2025 and is anticipated to grow at a CAGR of 14.1% through 2035. Copper is preferred due to its superior electrical conductivity, excellent thermal performance, and reliability under high current loads. In Asia Pacific, where electric buses and heavy-duty EVs are rapidly scaling, copper busbars play a pivotal role in reducing resistive losses and ensuring efficient power transfer in 800V+ architectures.

China High Power Electric Vehicle Busbar Market accounted for a 95% share in 2025. The country continues to lead global electrification with aggressive targets for public transport and intercity fleets. Its 2025 roadmap emphasizes high-voltage systems to support ultra-fast charging and battery-swapping strategies. This transition is fueling demand for laminated copper busbars with superior thermal and electrical performance and advanced insulation systems that comply with national GB standards.

Key players driving the Asia Pacific High Power Electric Vehicle Busbar Market include Amphenol Corporation, Connor Manufacturing Services, EMS Group, EG Electronics, Legrand, Littelfuse, Inc., RHI Electric (Zhejiang RHI), Brar Elettromeccanica SpA, Mersen SA, TE Connectivity, Siemens, Infineon Technologies AG, EAE Group, Intercable Automotive Solutions, Bridgold Copper Tech, Schneider Electric, Rogers Corporation, Mitsubishi Electric Corporation, Weidmuller Interface GmbH & Co. KG, and Zhejiang Zhongyan New Energy. Companies in the Asia Pacific High Power Electric Vehicle Busbar Market are strengthening their presence by investing in research and development to improve the thermal and electrical efficiency of busbars. Strategic partnerships and joint ventures with OEMs and Tier-1 suppliers enable scalable production and faster adoption of high-voltage architectures. Firms are also focusing on modular and flexible busbar designs to enhance compatibility with diverse EV platforms. Standardization of technical specifications and adherence to regulatory safety standards build credibility and reduce procurement risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Material trends

- 2.1.3 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Country, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 China

- 6.3 India

- 6.4 Japan

- 6.5 South Korea

- 6.6 Australia

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 Connor Manufacturing Services

- 7.4 EAE Group

- 7.5 EG Electronics

- 7.6 EMS Group

- 7.7 Infineon Technologies AG

- 7.8 Intercable Automotive Solutions

- 7.9 Legrand

- 7.10 Littelfuse, Inc.

- 7.11 Mersen SA

- 7.12 Mitsubishi Electric Corporation

- 7.13 RHI Electric (Zhejiang RHI)

- 7.14 Rogers Corporation

- 7.15 Schneider Electric

- 7.16 Siemens

- 7.17 TE Connectivity

- 7.18 Weidmuller Interface GmbH & Co. KG

- 7.19 Bridgold Copper Tech

- 7.20 Zhejiang Zhongyan New Energy