PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892797

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892797

Railway Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

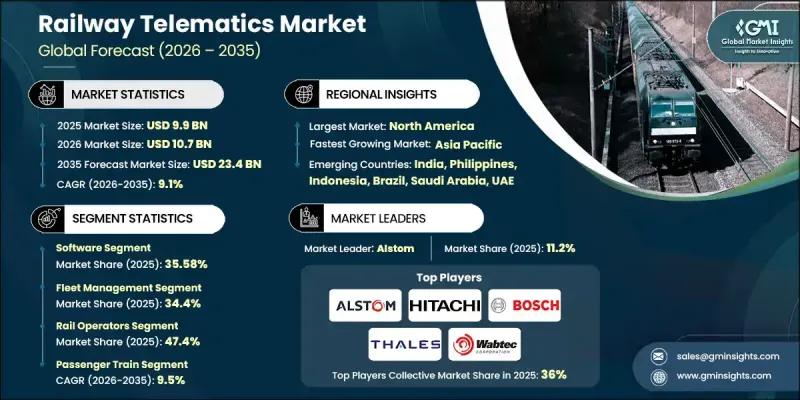

The Global Railway Telematics Market was valued at USD 9.9 billion in 2025 and is estimated to grow at a CAGR of 9.1% to reach USD 23.4 billion by 2035.

Rapid digitalization across the global rail industry is reshaping how operators manage assets, enhance safety, and optimize performance. Rail networks are shifting toward advanced telematics platforms that merge GNSS tracking, IoT-driven sensors, FRMCS or cellular connectivity, and AI-enabled analytics to deliver real-time insights. This transition supports predictive maintenance, improved traffic coordination, reduced operational delays, and better lifecycle outcomes for rolling stock. As the demand for smart, interconnected railways accelerates, the industry is moving closer to software-defined telematics architectures that support multimodal operations, seamless cross-border mobility, and high-speed rail automation. Connectivity technology providers, rail OEMs, and telematics solution developers are enlarging their investments to strengthen high-bandwidth communication systems, cloud analytics, and AI-powered diagnostics. To expand system capabilities, manufacturers are designing multi-constellation GNSS modules, adopting multi-band cellular and satellite links, and deploying edge processing devices that ensure uninterrupted communication along long-distance freight routes and remote rail corridors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.9 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 9.1% |

The software segment held a 35.58% share in 2024 and is anticipated to grow at a CAGR of 10% through 2035. Software remains central to the industry because real-time analytics, monitoring tools, and intelligent decision engines rely on it to manage key rail operations. Modern telematics systems depend on cloud-based platforms, machine learning diagnostics, and IoT data streams to boost asset visibility, forecast equipment failures, strategize routing, and enhance overall safety.

The fleet management segment held a 34.4% share in 2025 and is forecasted to grow at a CAGR of 10.4% from 2026 to 2035. This segment dominates due to the increased need for real-time supervision, accurate asset utilization data, and synchronized operations across large fleets. Fleet management solutions integrate GPS data, load and movement analytics, wagon performance diagnostics, and sensor-based insights to reduce congestion, streamline scheduling, and shorten turnaround durations.

U.S. Railway Telematics Market held an 85% share, generating USD 3.12 billion in 2024. Growth is fueled by modernization initiatives, rising freight transport demands, and increased adoption of advanced control systems. Operators in the country are implementing telematics to strengthen real-time oversight, maximize fleet efficiency, and improve safety across extensive freight networks. Government-driven support for automation, remote diagnostics, condition-based maintenance, and advanced connectivity systems is accelerating the deployment of sensors, GPS-enabled tools, and 5G communication technologies. Key freight industries rely heavily on telematics to boost reliability, reduce delays, and ensure stronger supply-chain performance.

Key companies operating in the Global Railway Telematics Market include Cisco Systems, Nexxiot, Wabtec, Siemens, Bosch, Alstom, Hitachi, Thales, Trimble, and Knorr-Bremse. Companies competing in the Railway Telematics Market strengthen their market position by expanding software capabilities, developing AI-driven analytics, and enhancing high-speed connectivity infrastructures. Many organizations invest in interoperable platforms that support seamless data exchange across rail networks, enabling unified fleet visibility and predictive diagnostics. Strategic collaborations with connectivity providers help integrate satellite, cellular, and GNSS technologies into telematics systems for uninterrupted coverage. Firms also prioritize modular designs, edge computing capabilities, and cloud-based telematics to deliver scalable, flexible solutions for operators.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Solution

- 2.2.4 Train

- 2.2.5 End Use

- 2.2.6 Communication

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising digitalization and automation in rail operations

- 3.2.1.2 Government investments in smart rail infrastructure

- 3.2.1.3 Demand for enhanced fleet visibility and safety compliance

- 3.2.1.4 Growth in freight rail and cross-border logistics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital costs and integration complexity

- 3.2.2.2 Network coverage limitations in remote rail corridors

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of predictive maintenance solutions

- 3.2.3.2 Integration with digital twins & rail automation

- 3.2.3.3 Growth in freight wagon & container telematics

- 3.2.3.4 Emerging hybrid connectivity (satellite + cellular)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Business Case & ROI Analysis

- 3.10.1 Total cost of ownership framework

- 3.10.2 ROI calculation methodologies

- 3.10.3 Implementation timeline & milestones

- 3.10.4 Risk assessment & mitigation strategies

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Future outlook & opportunities

- 3.12.1 Technology Roadmap & Evolution Timeline

- 3.12.2 Emerging Application Opportunities

- 3.12.3 Investment Requirements & Funding Sources

- 3.12.4 Risk Assessment & Mitigation Strategies

- 3.12.5 Strategic Recommendations for Market Participants

- 3.13 Investment & funding analysis

- 3.13.1 Government infrastructure investments

- 3.13.2 Private equity & venture capital activity

- 3.13.3 M&a transactions & valuations (2022-2025)

- 3.13.4 Railpulse coalition & industry consortia

- 3.14 Data Security, Privacy & Cybersecurity Frameworks

- 3.14.1 Cybersecurity threat landscape

- 3.14.2 Regulatory & compliance frameworks

- 3.14.3 Data privacy regulations

- 3.14.4 Cybersecurity architecture & best practices

- 3.14.5 Threat detection & incident response

- 3.14.6 Vendor & supply chain security

- 3.14.7 Emerging cybersecurity technologies

- 3.15 Product lifecycle & technology obsolescence

- 3.15.1 Railway industry technology adoption cycles

- 3.15.2 Hardware lifecycle management

- 3.15.3 Software lifecycle management

- 3.15.4 Communication technology obsolescence

- 3.15.5 Certification & safety approval lifecycles

- 3.15.6 Obsolescence management strategies

- 3.15.7 Emerging technology adoption timelines

- 3.16 Emerging business models & service innovations

- 3.16.1 Traditional business models

- 3.16.2 Subscription & saas models

- 3.16.3 Equipment-as-a-service (EAAS) & managed services

- 3.16.4 Outcome-based & performance contracts

- 3.16.5 Consumption-based & pay-per-use models

- 3.16.6 Ecosystem & platform business models

- 3.16.7 Public-private partnership (PPP) models

- 3.16.8 Innovative service delivery models

- 3.17 Rail infrastructure & corridor analysis

- 3.17.1 Global rail network overview

- 3.17.2 Dedicated freight corridors

- 3.17.3 Shared passenger-freight lines

- 3.17.4 High-speed rail corridors

- 3.17.5 Urban transit networks & metro systems

- 3.17.6 Cross-border & international corridors

- 3.17.7 Infrastructure capacity & utilization

- 3.17.8 Infrastructure condition & modernization needs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 GPS Devices

- 5.2.2 Sensors

- 5.2.3 Communication Modules

- 5.2.4 Onboard Units (OBU)

- 5.2.5 Telematics Control Units (TCU)

- 5.3 Software

- 5.3.1 Fleet Management

- 5.3.2 Predictive Maintenance

- 5.3.3 Data Analytics and Reporting

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Installation and Integration

- 5.4.2 Maintenance and Support

Chapter 6 Market Estimates & Forecast, By Solution, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Fleet Management

- 6.3 Train Tracking & Monitoring

- 6.4 Passenger Information Systems

- 6.5 Safety & Security Systems

- 6.6 Predictive Maintenance

Chapter 7 Market Estimates & Forecast, By Train, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Passenger Train

- 7.3 Freight Train

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Rail Operators

- 8.3 Rail Logistics Providers

- 8.4 Government Agencies

Chapter 9 Market Estimates & Forecast, By Communication, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 GPS/GNSS-Based Positioning Systems

- 9.3 Cellular Communication Technologies

- 9.4 Satellite Communication

- 9.5 Wi-Fi & Short-Range Communication

- 9.6 CBTC Radio Systems

- 9.7 IoT & Sensor Networks

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Alstom

- 11.1.2 Bosch

- 11.1.3 Hitachi Rail

- 11.1.4 Huawei Technologies

- 11.1.5 IBM

- 11.1.6 Knorr-Bremse

- 11.1.7 Siemens

- 11.1.8 Stadler Rail

- 11.1.9 Thales

- 11.1.10 Wabtec

- 11.2 Regional Players

- 11.2.1 Cisco Systems

- 11.2.2 Mitsubishi Electric

- 11.2.3 Nippon Signal

- 11.2.4 Progress Rail Services (Caterpillar)

- 11.2.5 Televic Rail

- 11.2.6 Trimble

- 11.3 Emerging Players

- 11.3.1 DOT

- 11.3.2 EKE-Electronics

- 11.3.3 Intermodal Telematics BV (IMT)

- 11.3.4 Nexxiot

- 11.3.5 ORBCOMM

- 11.3.6 Rail Vision

- 11.3.7 Railnova

- 11.3.8 SAVVY Telematic Systems

- 11.3.9 Wi-Tronix