PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892812

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892812

Nail Guns Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

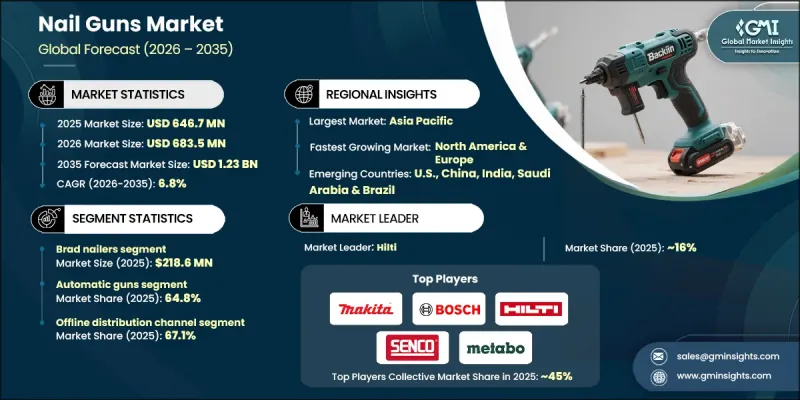

The Global Nail Guns Market was valued at USD 646.7 million in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 1.23 billion by 2035.

The market continues to gain momentum as demand rises for faster, more efficient fastening solutions across construction-related activities. Growth is supported by expanding building activity, rising investment in infrastructure, and the need to improve productivity while controlling labor expenses. Nail guns are increasingly preferred over manual fastening methods due to their ability to deliver speed, uniform results, and reduced physical effort. Contractors and professional users are adopting these tools to meet tighter schedules and ensure consistent quality across projects. At the same time, broader access to simplified product designs and better user awareness is supporting wider adoption among non-professional users. The market is also benefiting from ongoing advancements in power systems, ergonomics, and safety mechanisms, which continue to improve tool performance and reliability. As construction practices evolve and efficiency becomes a priority, nail guns are being positioned as essential equipment rather than optional tools, strengthening long-term demand across both professional and consumer segments. Growing interest in personal improvement projects is further supporting market expansion. Consumers increasingly rely on powered fastening tools to achieve clean, durable results with minimal effort. Manufacturers are responding by offering user-friendly models designed for convenience, safety, and precision, which is helping this segment sustain steady growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $646.7 Million |

| Forecast Value | $1.23 Billion |

| CAGR | 6.8% |

The brad nailers segment generated USD 218.6 million in 2025 and is forecast to grow at a CAGR of 7.3% from 2026 to 2035. This category is widely adopted for applications that require accuracy and surface protection, where smaller fasteners help preserve material integrity. Rising renovation activity and consumer preference for professional-quality finishes continue to support demand for this segment.

The automatic nail guns segment held 64.8% share in 2025 and is expected to grow at a CAGR of 6.9% through 2035. These tools support continuous operation, making them well-suited for high-output environments where efficiency and labor optimization are critical. Advancements in automation, digital integration, and compatibility with smart systems are enhancing their appeal among professional and industrial users.

US Nail Guns Market reached USD 136.7 million in 2025 and is projected to grow at a CAGR of 6.8% from 2026 to 2035. Market growth is supported by sustained construction activity, ongoing property development, and strong demand for productivity-enhancing tools. Investment in infrastructure and continued renovation activity further reinforces the need for efficient fastening solutions.

Major companies operating in the Global Nail Guns Market include DEWALT, Makita Corporation, Stanley Black & Decker, Milwaukee Tool, Bosch Tool Corporation, Hilti Corporation, Paslode, Ryobi, Metabo, Bostitch, Senco, Freeman Tools, Ridgid, Max Corporation, and Hitachi. Companies in the Nail Guns Market are strengthening their competitive position through continuous product innovation, expanded distribution channels, and targeted branding strategies. Manufacturers are investing in lightweight designs, improved power efficiency, and enhanced safety features to meet evolving user expectations. Strategic partnerships with retailers and professional networks are helping companies broaden market reach and improve customer access. Many players focus on differentiating their portfolios through specialized tools that address distinct user needs while maintaining durability and performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Power source

- 2.2.4 Operation

- 2.2.5 Price

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion in construction & infrastructure

- 3.2.1.2 Rising demand for efficiency & productivity

- 3.2.1.3 DIY & home improvement trend

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs and maintenance requirements

- 3.2.2.2 Battery life limitations for cordless models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Framing nailers

- 5.3 Brad nailers

- 5.4 Pin nailers

- 5.5 Roofing nailers

- 5.6 Flooring nailers

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Power Source, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Pneumatic nail guns

- 6.3 Combustion-powered / gas nail guns

- 6.4 Electric nail guns

- 6.5 Battery operated

Chapter 7 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Handheld guns

- 7.3 Automatic guns

Chapter 8 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction & infrastructure

- 9.3 Furniture & home improvement

- 9.4 Automotive

- 9.5 Packaging

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce platforms

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Home improvement centers

- 10.3.2 Specialty tool stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Bostitch

- 12.2 DEWALT

- 12.3 Freeman Tools

- 12.4 Hilti Corporation

- 12.5 Hitachi

- 12.6 Makita Corporation

- 12.7 Max Corporation

- 12.8 Metabo

- 12.9 Milwaukee Tool

- 12.10 Paslode

- 12.11 Ridgid

- 12.12 Robert Bosch Tool Corporation

- 12.13 Ryobi

- 12.14 Senco

- 12.15 Stanley Black & Decker