PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892819

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892819

Prostate Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

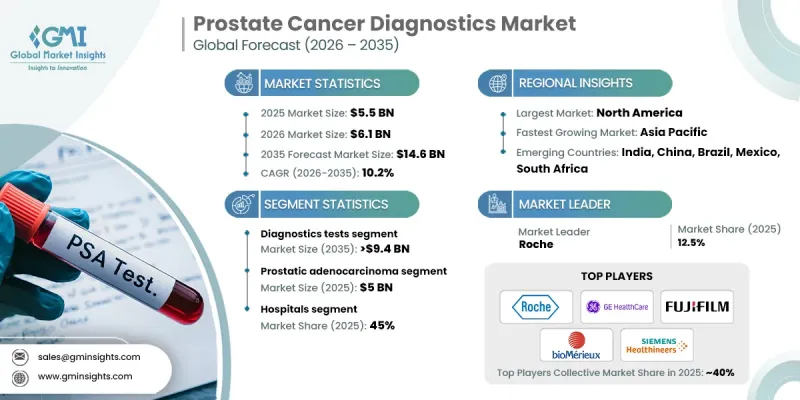

The Global Prostate Cancer Diagnostics Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 10.2% to reach USD 14.6 billion by 2035.

This growth is driven by continuous progress in diagnostic technologies, the increasing global burden of prostate cancer, wider awareness initiatives, and expanding screening programs, along with a rapidly aging male population. Prostate cancer diagnostics refers to a comprehensive range of clinical tests and medical procedures used to detect the disease, assess its progression, and guide treatment decisions. These diagnostics include blood-based assessments, advanced imaging techniques, and tissue analysis methods that support accurate disease identification and monitoring. Recent technological advancements, such as next-generation sequencing, liquid-based diagnostic approaches, multiparametric imaging, and AI-supported analysis tools, have significantly enhanced diagnostic precision while reducing unnecessary interventions. The industry continues to benefit from a shift toward more accurate, less invasive diagnostic pathways and greater reliance on molecular and genomic profiling, which together are improving early detection rates and clinical decision-making across healthcare settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 10.2% |

The diagnostic tests segment held a 63.6% share in 2025. This leadership position reflects rising utilization of screening and biomarker-based tests, increased preference for early-stage detection, and broader acceptance of non-invasive diagnostic methods. Growing disease prevalence and improved patient awareness continue to drive consistent demand for reliable and accurate testing solutions.

The hospitals segment held a 45% share in 2025 and is expected to reach USD 6.4 billion during 2025-2035. Hospitals remain central to prostate cancer diagnosis due to their role in initial patient evaluation, advanced imaging, and confirmatory procedures. Integrated diagnostic capabilities support comprehensive disease assessment and staging within a single care setting.

North America Prostate Cancer Diagnostics Market held a 40.4% share in 2025. Strong regional performance is supported by high disease incidence, established screening practices, and advanced healthcare infrastructure. The presence of well-equipped diagnostic facilities and early detection initiatives continues to drive the adoption of advanced diagnostic technologies across the region.

Key companies operating in the Global Prostate Cancer Diagnostics Market include Roche, Abbott, Siemens Healthineers, GE HealthCare, PHILIPS, Myriad Genetics, Becton, Dickinson and Company, Beckman Coulter, bioMerieux, Veracyte, FUJIFILM, OPKO Health, Proteomedix, Glycanostics, Metamark Genetics, KOELIS, and HEALGEN. Companies in the Global Prostate Cancer Diagnostics Market implement focused strategies to strengthen their competitive positioning. Continuous investment in research and development supports the launch of more accurate and clinically validated diagnostic tools. Firms emphasize integration of molecular diagnostics, advanced imaging analytics, and AI-driven interpretation to enhance diagnostic confidence. Strategic collaborations with healthcare providers and research institutions accelerate technology adoption and clinical validation. Expansion into emerging markets supports long-term growth, while regulatory alignment ensures timely product approvals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Cancer type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of prostate cancer

- 3.2.1.2 Advancements in imaging and biomarker-based diagnostics

- 3.2.1.3 Surging awareness and screening initiatives

- 3.2.1.4 Growing demand for minimally invasive diagnostic procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic modalities

- 3.2.2.2 Limited accessibility in low- and middle-income regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of AI-powered diagnostic tools

- 3.2.3.2 Growing adoption of personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Future market trends

- 3.8 Value chain analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics tests

- 5.2.1 PSA

- 5.2.2 Prostate biopsy

- 5.2.3 Molecular/ genomic test

- 5.2.4 Other diagnostics tests

- 5.3 Imaging tests

- 5.3.1 Transrectal Ultrasound (TRUS)

- 5.3.2 MRI

- 5.3.3 CT Scan

- 5.3.4 Other imaging tests

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Prostatic adenocarcinoma

- 6.3 Small cell carcinoma

- 6.4 Other cancer types

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Cancer research institutes

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Beckman Coulter

- 9.3 Becton, Dickinson and Company

- 9.4 bioMerieux

- 9.5 FUJIFILM

- 9.6 GE HealthCare

- 9.7 Glycanostics

- 9.8 HEALGEN

- 9.9 KOELIS

- 9.10 Metamark Genetics

- 9.11 Myriad Genetics

- 9.12 OPKO Health

- 9.13 PHILIPS

- 9.14 Proteomedix

- 9.15 Roche

- 9.16 SIEMENS Healthineers

- 9.17 Veracyte