PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892820

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892820

Steam Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

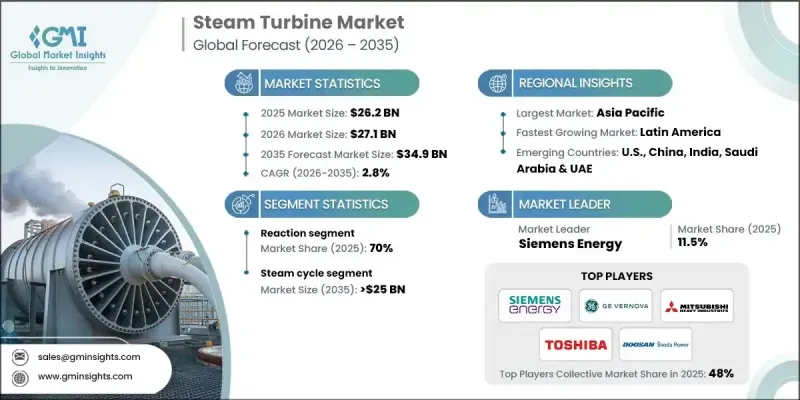

The Global Steam Turbine Market was valued at USD 26.2 billion in 2025 and is estimated to grow at a CAGR of 2.8% to reach USD 34.9 billion by 2035.

The market's expansion is driven by rising demand for reliable and efficient electricity alongside the construction of new power plants and the modernization of existing energy infrastructure. Steam turbines convert high-pressure steam into rotational mechanical energy, making them integral to industrial power generation. Increasing industrial electricity requirements, widespread adoption of combined heat and power systems, and integration of advanced control technologies are encouraging new turbine installations. The growing need for high-capacity units to support large-scale power generation further reinforces market growth. Industrialization, expansion of heavy manufacturing, and cogeneration integration continue to shape demand patterns. Energy transition policies are influencing deployment, with renewable applications like biomass and geothermal projects offering opportunities for turbines due to their high thermal efficiency and reliability. Sectors such as chemicals, petrochemicals, refineries, and district heating increasingly depend on turbines for efficient power and heat management.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $26.2 Billion |

| Forecast Value | $34.9 Billion |

| CAGR | 2.8% |

The impulse segment is expected to reach USD 5 billion by 2035, driven by demand for compact, high-efficiency, and low-maintenance turbines suited for industrial and utility applications. Its adoption is rising due to robust performance in high-pressure environments and suitability for captive power and process industries.

The >3 MW-100 MW segment generated USD 3.9 billion in 2025. This capacity range supports medium-scale industrial facilities, biomass and waste-to-energy plants, and district heating systems. It balances efficiency, flexibility, and cost, aiding the modernization of captive power infrastructure and ensuring reliable energy output across varied applications.

North America Steam Turbine Market is projected to reach USD 900 million by 2035. Growing adoption in biomass and geothermal plants, along with government programs supporting efficiency improvements, upgrades, and emissions control, will further drive the region's market growth.

Key players in the Global Steam Turbine Market include Siemens Energy, Mitsubishi Heavy Industries, Fuji Electric, Bharat Heavy Electricals Limited, Sumitomo Heavy Industries, Kawasaki Heavy Industries, Triveni Turbine, GE Vernova, Dongfang Turbine, ANSALDO Energia, Doosan Skoda Power, Hangzhou Turbine Power Group, Shin Nippon Machinery, Trillium Flow Technologies, NCON Turbo Tech, Ebara Corporation, Turbotech Precision Engineering, Chart Industries, and Toshiba Energy Systems & Solutions. Companies in the Global Steam Turbine Market are strengthening their position by investing in research and development to enhance the efficiency, reliability, and emissions performance of turbines. Strategic collaborations with power plant operators and technology providers enable deployment in renewable and hybrid energy projects. Firms are also focusing on digitalization, predictive maintenance, and smart control systems to optimize operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Design trends

- 2.1.3 Exhaust trends

- 2.1.4 Fuel trends

- 2.1.5 End use trends

- 2.1.6 Capacity trends

- 2.1.7 Technology trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of steam turbine

- 3.8 Price trend analysis (USD/MW)

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & industry 4.0 integration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2022 - 2035 (USD Million & MW)

- 5.1 Key trends

- 5.2 Reaction

- 5.3 Impulse

Chapter 6 Market Size and Forecast, By Exhaust, 2022 - 2035 (USD Million & MW)

- 6.1 Key trends

- 6.2 Condensing

- 6.3 Non-condensing

Chapter 7 Market Size and Forecast, By Fuel, 2022 - 2035 (USD Million & MW)

- 7.1 Key trends

- 7.2 Fossil fuel

- 7.3 Biomass

- 7.4 Geothermal

Chapter 8 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million & MW)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Refinery

- 8.2.2 Chemical plant

- 8.2.3 Sugar plant

- 8.2.4 Pulp & paper

- 8.2.5 Others

- 8.3 Utility

Chapter 9 Market Size and Forecast, By Capacity, 2022 - 2035 (USD Million & MW)

- 9.1 Key trends

- 9.2 ≤ 3 MW

- 9.3 > 3 MW - 100 MW

- 9.4 > 100 MW

Chapter 10 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million & MW)

- 10.1 Key trends

- 10.2 Steam cycle

- 10.3 Combined cycle

- 10.4 Cogeneration

Chapter 11 Market Size and Forecast, By Region, 2022 - 2035 (USD Million & MW)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 France

- 11.3.3 Russia

- 11.3.4 Germany

- 11.3.5 Spain

- 11.3.6 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 South Korea

- 11.4.4 India

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.4.8 Thailand

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Iran

- 11.5.4 Egypt

- 11.5.5 South Africa

- 11.5.6 Nigeria

- 11.5.7 Turkey

- 11.5.8 Morocco

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

- 11.6.3 Chile

Chapter 12 Company Profiles

- 12.1 Ansaldo Energia

- 12.2 Bharat Heavy Electricals Limited

- 12.3 Chart Industries

- 12.4 Dongfang Turbine

- 12.5 Doosan Skoda Power

- 12.6 EBARA CORPORATION

- 12.7 Fuji Electric

- 12.8 GE Vernova

- 12.9 Hangzhou Turbine Power Group

- 12.10 Kawasaki Heavy Industries

- 12.11 MAN Energy Solutions

- 12.12 Mitsubishi Heavy Industries

- 12.13 NCON Turbo Tech

- 12.14 Shin Nippon Machinery

- 12.15 Siemens Energy

- 12.16 Sumitomo Heavy Industries

- 12.17 Toshiba Energy Systems & Solutions

- 12.18 Trillium Flow Technologies

- 12.19 Triveni Turbine

- 12.20 Turbotech Precision Engineering