PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892842

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892842

Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

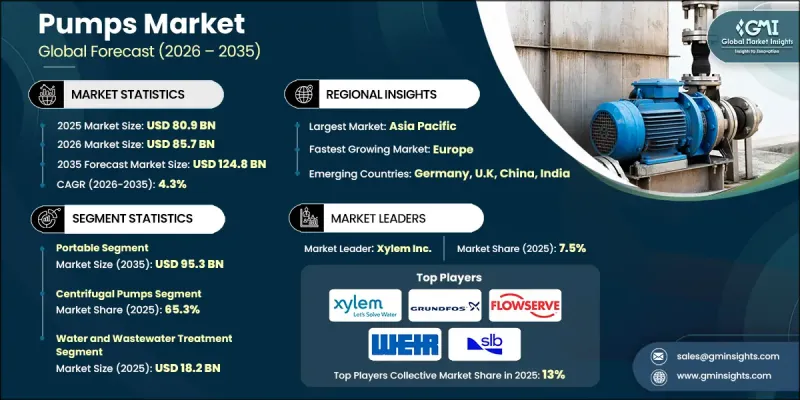

The Global Pumps Market was valued at USD 80.9 billion in 2025 and is estimated to grow at a CAGR of 4.3% to reach USD 124.8 billion by 2035.

Market expansion is driven by rapid industrialization and urbanization, which are increasing the demand for reliable pumping solutions worldwide. Emerging economies are witnessing significant infrastructure development, creating heightened requirements for pumps in domestic water supply, wastewater treatment, and industrial processes. Advances in pump technologies are enhancing efficiency and sustainability, enabling manufacturers to reduce energy consumption while meeting global environmental standards. Energy-efficient designs and innovative solutions are supporting operational cost savings for end-users and aligning with global efforts to reduce energy consumption. Increasing adoption across sectors such as municipal services, industrial facilities, and energy-intensive industries reinforces the steady growth of the pumps market over the forecast period. The oil & gas sector remains a key end-user of pumps, as these devices are essential for extraction, refining, and transportation activities. Pumps provide reliable performance even under fluctuating market conditions and evolving operational requirements.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $80.9 Billion |

| Forecast Value | $124.8 Billion |

| CAGR | 4.3% |

The portable pump segment generated USD 60.5 billion in 2025 and is projected to reach USD 95.3 billion by 2035. Their mobility, adaptability, and ease of use make portable pumps essential across industries, including construction, agriculture, mining, oil and gas, municipal services, and firefighting.

The centrifugal pump segment held 65.3% share in 2025, driven by their high efficiency, versatility, and ability to handle a wide range of fluids and flow rates, making them indispensable in industrial and municipal applications.

U.S. Pumps Market held an 85.7% share in 2025, supported by investments in water and wastewater treatment infrastructure and advancements in energy technologies, including hydrogen production and carbon capture. High-performance pumps are increasingly deployed for handling cryogenic and chemical fluids across these initiatives.

Key players in the Global Pumps Market include Xylem, KSB, Atlas Copco, Alfa Laval, Flowserve, SLB, Sulzer, ITT, Pentair, Wilo, Baker Hughes, Ebara, Kirloskar, Grundfos, and Weir Group. Companies in the Global Pumps Market strengthen their market presence by focusing on product innovation, including energy-efficient, durable, and high-capacity pumps. Expanding global manufacturing and distribution networks enables wider market reach and faster delivery to end-users. Strategic collaborations with industrial and municipal clients ensure long-term contracts and repeat business. R&D investments allow companies to develop solutions that meet evolving regulatory standards and sustainability goals. After-sales service, training programs, and digital monitoring solutions improve customer satisfaction and loyalty. Targeted marketing campaigns and participation in infrastructure development projects further consolidate their foothold and maintain competitiveness in regional and global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Position

- 2.2.4 Driving force

- 2.2.5 Technology

- 2.2.6 Capacity and pressure range

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial growth

- 3.2.1.2 Water and wastewater management

- 3.2.1.3 Infrastructure development

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Operational costs

- 3.2.3 Opportunities

- 3.2.3.1 Growth in water & wastewater infrastructure

- 3.2.3.2 Energy transition & industrial decarbonization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Type

- 3.6.2 By Region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 8431)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Portable

- 5.2 Stationary

Chapter 6 Market Estimates & Forecast, By Position, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Submersible

- 6.3 Non-submersible

- 6.3.1 Surface-mounted pumps

- 6.3.2 Inline pumps

- 6.3.3 Base-mounted pumps

Chapter 7 Market Estimates & Forecast, By Driving Force, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Engine-driven

- 7.3 Electric-driven

Chapter 8 Market Estimates & Forecast, By Technology, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Centrifugal pump

- 8.2.1 Axial flow pump

- 8.2.2 Radial flow pump

- 8.2.3 Mixed flow pump

- 8.2.4 Overhung impeller pumps

- 8.2.5 Between bearing pumps

- 8.2.6 Vertically suspended pumps

- 8.3 Positive displacement pump

- 8.3.1 Reciprocating

- 8.3.2 Rotary

- 8.3.3 Peristaltic pumps

- 8.4 Specialty and emerging technologies

- 8.4.1 Sealless and magnetic drive pumps

- 8.4.2 Canned motor pumps

- 8.4.3 Air-operated double diaphragm (AODD) pumps

- 8.4.4 Controlled-volume metering pumps

- 8.4.5 Regenerative turbine pumps

- 8.4.6 Smart pumps and IoT-enabled systems

Chapter 9 Market Estimates & Forecast, By Capacity And Pressure Range, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Flow rate capacity

- 9.2.1 Low flow

- 9.2.2 Medium flow

- 9.2.3 High flow

- 9.2.4 Very high flow

- 9.3 Pressure range

- 9.3.1 Low pressure

- 9.3.2 Medium pressure

- 9.3.3 High pressure

- 9.3.4 Ultra-high pressure

Chapter 10 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Mining

- 10.3 Building & construction

- 10.4 Oil & gas

- 10.5 General industries

- 10.6 Water & wastewater treatment

- 10.7 Chemicals

- 10.8 Power generation

- 10.9 Others (agriculture etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 UK

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Alfa Laval

- 13.2 Atlas Copco

- 13.3 Baker Hughes

- 13.4 Ebara

- 13.5 Flowserve

- 13.6 Grundfos

- 13.7 ITT

- 13.8 Kirloskar

- 13.9 KSB

- 13.10 Pentair

- 13.11 SLB

- 13.12 Sulzer

- 13.13 Weir Group

- 13.14 Wilo

- 13.15 Xylem