PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892850

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892850

Automotive Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

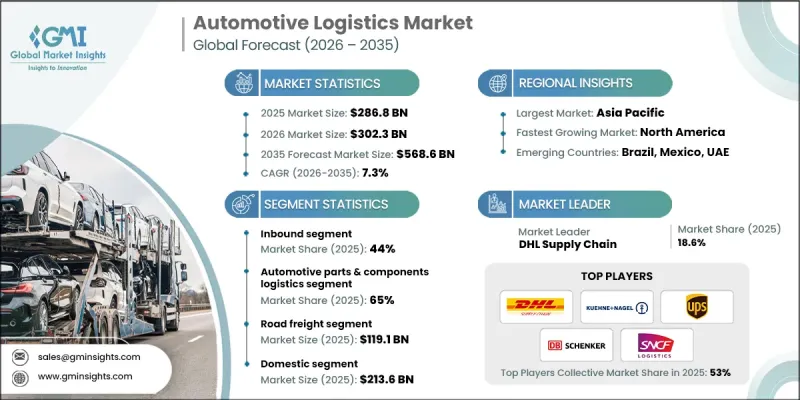

The Global Automotive Logistics Market was valued at USD 286.8 billion in 2025 and is estimated to grow at a CAGR of 7.3% to reach USD 568.6 billion by 2035.

The expanding automotive industry has increased the need for efficient logistics solutions to transport vehicles, parts, and components across the supply chain. Companies are recognizing the importance of software that can optimize transportation routes, manage inventory, and provide real-time shipment tracking. Many automakers still rely on outdated software and legacy systems for logistics management, which makes integration of modern solutions challenging, requiring extensive data migration and customization. Limited real-time visibility into the end-to-end supply chain, complex transportation networks, and varying data transparency among partners pose additional hurdles. To address these challenges, software providers are incorporating AI and machine learning to improve route planning, automate repetitive tasks, and enhance decision-making. Predictive analytics and demand forecasting capabilities allow companies to anticipate future demand, optimize inventory, and allocate resources more efficiently, enabling proactive solutions to supply chain disruptions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $286.8 Billion |

| Forecast Value | $568.6 Billion |

| CAGR | 7.3% |

The inbound logistics segment held a 44% share in 2025 and is projected to grow at a CAGR of 8% between 2026 and 2035. Inbound logistics plays a critical role in the automotive logistics market by efficiently transporting raw materials, components, and subassemblies from suppliers to OEM assembly plants. Its high-frequency, high-volume operations ensure smooth production flows while supporting just-in-time (JIT) and just-in-sequence (JIS) manufacturing, reducing inventory carrying costs. The use of multimodal transportation, including road, rail, air, and sea, further enhances the speed, reliability, and cost-efficiency of inbound supply chains.

The automotive parts and components logistics segment accounted for a 65% share in 2025 and is expected to grow at a CAGR of 7.6% from 2026 to 2035. This segment dominates due to the complexity, volume, and frequency of part movements across OEMs and Tier-1 and Tier-2 supplier networks. It ensures that parts are delivered securely, on time, and cost-effectively to assembly plants, regional distribution centers, and aftermarket service networks, maintaining seamless production and operations.

China Automotive Logistics Market held a 39% share, generating USD 43.2 billion in 2025. China's dominance is driven by rapid growth in vehicle production, strong demand for passenger and commercial vehicles, and large-scale investments in advanced logistics technologies. The region benefits from well-developed transportation networks, extensive warehousing and distribution infrastructure, and rising adoption of digital supply chain solutions, IoT-based tracking, and automated material handling systems.

Key players in the Global Automotive Logistics Market include Bosch Service Solutions GmbH, Basware Oy, Blue Yonder, SAP SE, Kinaxis, Inc., Infor Corporation, Oracle Corporation, Ceres Technology Inc., and Manhattan Associates, Inc. Companies in the Global Automotive Logistics Market are strengthening their position by investing in AI and ML integration to enhance predictive capabilities and operational efficiency. They are prioritizing cloud-based platforms to offer scalable and flexible solutions that meet evolving customer demands. Strategic partnerships with technology providers and industry stakeholders help expand market reach and ensure seamless software integration. Firms are also focusing on continuous R&D to innovate features such as real-time tracking, advanced analytics, and automated workflow management, creating a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Product

- 2.2.4 Mode of Transportation

- 2.2.5 Distribution

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production & aftermarket expansion

- 3.2.1.2 Adoption of digital & intelligent logistics technologies

- 3.2.1.3 Growth of EV manufacturing & battery logistics

- 3.2.1.4 Expansion of globalized supply chains & cross-border trade

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions & capacity bottlenecks

- 3.2.2.2 High operational costs & complexity of handling EV components

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for sustainable & green logistics

- 3.2.3.2 Rapid growth in aftermarket e-commerce distribution

- 3.2.3.3 Integration of advanced technologies

- 3.2.3.4 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMCSA, NHTSA, EPA Emissions Standards

- 3.4.1.2 Transport Canada Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 Germany EU Vehicle Safety Regulations, TUV Certification

- 3.4.2.2 France CNRS Emissions & Safety Standards

- 3.4.2.3 United Kingdom DVSA Vehicle Safety & Compliance

- 3.4.2.4 Italy Ministry of Transport Vehicle Regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China Ministry of Transport Safety Rules, NEV Policies

- 3.4.3.2 Japan JAMA Vehicle Safety Regulations, Emission Standards

- 3.4.3.3 South Korea MOTIE Safety & Environmental Compliance

- 3.4.3.4 India AIS (Automotive Industry Standards)

- 3.4.4 Latin America

- 3.4.4.1 CONTRAN Vehicle Safety & Emission Rules

- 3.4.4.2 NOM Automotive Safety Standards

- 3.4.5 Middle East and Africa

- 3.4.5.1 Emirates Authority for Standardization & Metrology Vehicle Regulations

- 3.4.5.2 SASO Vehicle Safety & Environmental Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2022 - 2035 ($ Bn, TEU)

- 5.1 Key trends

- 5.2 Inbound Logistics

- 5.3 Outbound

- 5.4 Reverse

- 5.5 Aftermarket

Chapter 6 Market Estimates & Forecast, By Product, 2022 - 2035 ($ Bn, TEU)

- 6.1 Key trends

- 6.2 Finished Vehicle

- 6.2.1 Passenger car

- 6.2.1.1 Hatchback

- 6.2.1.2 Sedan

- 6.2.1.3 SUV

- 6.2.2 Commercial vehicle

- 6.2.2.1 Light duty

- 6.2.2.2 Medium duty

- 6.2.2.3 Heavy duty

- 6.2.1 Passenger car

- 6.3 Automotive Parts & Components

- 6.3.1 Wheels and tires

- 6.3.2 Electrical and electronic

- 6.3.3 Body and chassis

- 6.3.4 Suspension and steering

- 6.3.5 Braking system

- 6.3.6 Engine and powertrain

Chapter 7 Market Estimates & Forecast, By Mode of Transportation, 2022 - 2035 ($ Bn, TEU)

- 7.1 Key trends

- 7.2 Road Freight

- 7.3 Sea Freight

- 7.4 Air Freight

- 7.5 Rail Freight

Chapter 8 Market Estimates & Forecast, By Distribution, 2022 - 2035 ($ Bn, TEU)

- 8.1 Key trends

- 8.2 Domestic

- 8.3 International

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, TEU)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 C.H. Robinson Worldwide

- 10.1.2 CEVA Logistics

- 10.1.3 DHL Supply Chain & Global Forwarding

- 10.1.4 DSV-Schenker

- 10.1.5 Expeditors International of Washington

- 10.1.6 GEODIS (SNCF)

- 10.1.7 Hellmann Worldwide Logistics

- 10.1.8 Kuehne+Nagel International

- 10.1.9 Penske Logistics

- 10.1.10 XPO Logistics

- 10.2 Regional Player

- 10.2.1 BLG Logistics

- 10.2.2 Hyundai Glovis

- 10.2.3 Kintetsu World Express

- 10.2.4 Mosolf

- 10.2.5 Nippon Express

- 10.2.6 Schnellecke Logistics

- 10.2.7 Toll

- 10.2.8 Yusen Logistics

- 10.3 Emerging Players

- 10.3.1 Flexport

- 10.3.2 FourKites

- 10.3.3 Hodlmayr International

- 10.3.4 project44

- 10.3.5 Uber Freight