PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892873

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892873

Monoclonal Antibodies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

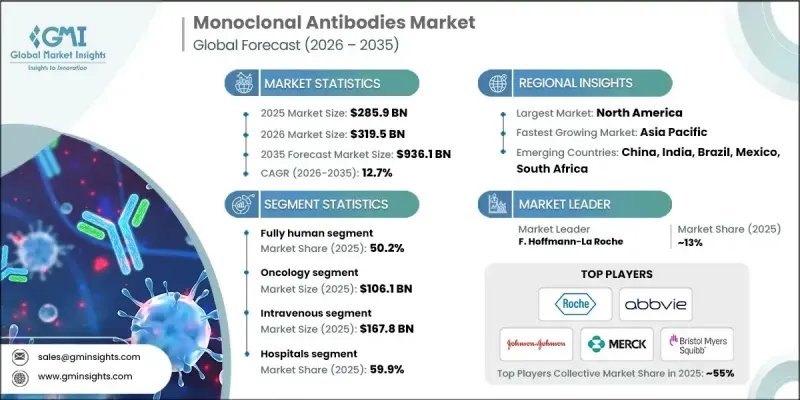

The Global Monoclonal Antibodies Market was valued at USD 285.9 billion in 2025 and is estimated to grow at a CAGR of 12.7% to reach USD 936.1 billion by 2035.

The market is witnessing strong growth due to the rising prevalence of chronic, autoimmune, and cancer-related diseases worldwide. Monoclonal antibodies are lab-engineered molecules designed to mimic the immune system's ability to recognize and combat harmful pathogens, including cancer cells and viruses. They target specific antigens, providing highly precise treatments with reduced off-target effects compared to conventional therapies. These biologics are increasingly applied in oncology, immunology, infectious diseases, and other therapeutic areas. The market is driven by the growing adoption of precision medicine, improved treatment outcomes, and the development of targeted therapies. Strategic collaborations, partnerships, and acquisitions among leading players are reshaping the competitive landscape, strengthening supply chains, and supporting global expansion, particularly in emerging markets, while addressing rising demand in both developed and developing regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $285.9 Billion |

| Forecast Value | $936.1 Billion |

| CAGR | 12.7% |

The fully human segment held a 50.2% share in 2025 and is expected to grow at a CAGR of 12.8%. Fully human monoclonal antibodies are preferred due to their safety, minimal immunogenicity, and high therapeutic efficacy. They closely resemble natural human immunoglobulins, reducing anti-drug antibody responses and enabling sustained effectiveness in long-term therapies. The clinical success of major fully human therapies has further reinforced the dominance of this segment.

The oncology segment generated USD 106.1 billion in 2025, growing at a CAGR of 12.5%. The increasing global incidence of cancer and the adoption of targeted therapies drive growth in this segment. Monoclonal antibodies are widely used in oncology because they selectively target tumor-associated antigens, minimize off-target toxicity, and improve survival outcomes. Innovations in antibody-drug conjugates, bispecific antibodies, and checkpoint inhibitors have further strengthened their role in precision oncology.

North America Monoclonal Antibodies Market held a 41.5% share in 2025, driven by advanced healthcare infrastructure, high prevalence of chronic and infectious diseases, and the presence of leading biopharmaceutical companies. Early adoption of next-generation antibody technologies, extensive use of personalized therapies, strong research investments, favorable reimbursement policies, increasing biosimilar penetration, and higher diagnostic rates for infectious diseases contribute to robust market demand.

Key companies active in the Global Monoclonal Antibodies Market include Johnson & Johnson, Takeda Pharmaceutical, Amgen, AbbVie, BioArctic, Eli Lilly and Company, AstraZeneca, Regeneron Pharmaceuticals, Novartis AG, F. Hoffmann-La Roche, GlaxoSmithKline, Arcus Biosciences, Bristol Myers Squibb, UCB Pharma, and Sanofi. Companies in the Global Monoclonal Antibodies Market are strengthening their market presence through several strategies. They are heavily investing in research and development to discover next-generation antibodies with enhanced efficacy and safety profiles. Strategic partnerships and collaborations with biotech firms and research institutions are expanding their global footprint. Companies are also focusing on geographic expansion, particularly into emerging markets, to capture rising demand. Additionally, mergers and acquisitions are used to enhance product portfolios and accelerate market penetration. Adoption of digital platforms for clinical trial management, patient engagement, and supply chain optimization is also being leveraged to improve operational efficiency and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Source type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases worldwide

- 3.2.1.2 Growing research and development activities

- 3.2.1.3 High adoption and accelerated approvals in developed markets

- 3.2.1.4 The booming biologics market and rising applications of monoclonal antibodies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of monoclonal antibody therapeutics

- 3.2.2.2 Stringent regulatory framework and compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of next-generation antibody technologies

- 3.2.3.2 Expansion into emerging markets with improved healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Chimeric

- 5.3 Murine

- 5.4 Fully human

- 5.5 Humanized

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Autoimmune diseases

- 6.4 Infectious diseases

- 6.5 Neurological diseases

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

- 7.4 Intramuscular

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Arcus Biosciences

- 10.4 AstraZeneca

- 10.5 BioArctic

- 10.6 Bristol Myers Squibb

- 10.7 Eli Lilly and Company

- 10.8 F. Hoffmann-La Roche

- 10.9 GlaxoSmithKline

- 10.10 Johnson & Johnson

- 10.11 Merck & Co.

- 10.12 Novartis AG

- 10.13 Regeneron Pharmaceuticals

- 10.14 Sanofi

- 10.15 Takeda Pharmaceutical Company

- 10.16 UCB Pharma