PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892910

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892910

Laser Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

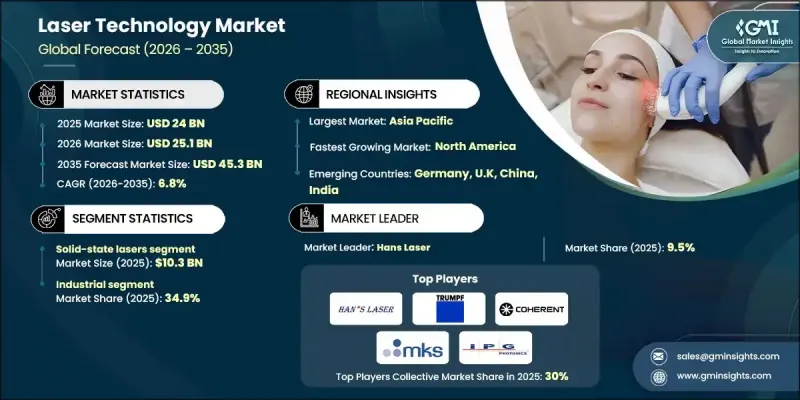

The Global Laser Technology Market was valued at USD 24 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 45.3 billion by 2035.

Growth in this industry is accelerating as lasers become essential tools across manufacturing, telecommunications, defense, healthcare, automotive, and consumer electronics. Their precision, speed, and ability to enhance automation have supported wider adoption, particularly in production environments where consistency and accuracy are critical. Expanding industrial workloads and rising interest in advanced fabrication processes continue to drive demand for laser-based systems. At the same time, healthcare, communications, and security-related applications are all experiencing significant digital transformation, further boosting the need for high-performance laser platforms. Advancements in laser design, combined with investments in research, are enabling new capabilities for industrial processing, diagnostics, and specialized applications. This increasing reliance on sophisticated optical technologies underscores the market's strong outlook over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $24 Billion |

| Forecast Value | $45.3 Billion |

| CAGR | 6.8% |

The solid-state lasers segment generated USD 10.3 billion in 2025 and is forecast to reach USD 19.9 billion by 2035. These lasers remain among the most widely used solutions due to their high power efficiency, durability, and suitability for diverse applications ranging from medical treatments to scientific analysis and defense technologies. Their ability to support precision-driven tasks makes them indispensable in environments that require reliable and accurate optical performance.

The industrial sector held a 34.9% share in 2025, reflecting the extensive role of lasers in cutting, marking, welding, surface treatment, drilling, and additive manufacturing. Industries such as textiles, automotive, metalworking, and aerospace depend heavily on laser systems for highly controlled, repeatable, and efficient operations, making industrial applications the largest consumer group for laser-based technologies.

U.S. Laser Technology Market held 74.9% share in 2024, supported by substantial investment in advanced manufacturing and defense-focused innovation. Federal initiatives and research programs have accelerated adoption across precision machining, fabrication, and energy systems. Growth in healthcare and aesthetic medicine also contributes to the market, with rising demand for minimally invasive procedures and expanded approvals for medical laser devices. Hospitals and clinics are consistently incorporating laser platforms to support modern diagnostics, surgical treatment, and dermatology services.

Key companies participating in the Global Laser Technology Market include AIDA, Beckwood Press, Bliss-Bret, Amada Press System, Bruderer, Komatsu, Nidec Minster, Macrodyne Technologies, Schuler Group, Shieh Yih Machinery Industry, SMS Group, Stamtec, Sutherland Presses, Yangli Group, and Isgec Heavy Engineering. Companies in the Global Laser Technology Market are adopting targeted strategies to reinforce their market position and expand global reach. Many are focusing on product innovation by developing lasers with higher power efficiency, improved beam quality, and compact architectures suitable for emerging industrial and medical applications. Strategic partnerships with manufacturing firms, research institutions, and technology integrators help accelerate the commercialization of next-generation laser systems. Firms are also investing in automation-ready platforms to support Industry 4.0 initiatives, enhancing compatibility with robotics, AI-driven monitoring, and smart factory environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Configuration

- 2.2.4 Application

- 2.2.5 Power Range

- 2.2.6 Wavelength

- 2.2.7 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing applications across industries

- 3.2.1.2 Demand for precision and efficiency

- 3.2.1.3 Rising use in communication technology

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Technical complexity

- 3.2.2.2 Limited awareness and adoption

- 3.2.3 Opportunities

- 3.2.3.1 Growth in medical & aesthetic applications

- 3.2.3.2 Expansion in industrial automation & smart manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Type

- 3.6.2 By Region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Solid-state lasers

- 5.3 Gas lasers

- 5.4 Liquid lasers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Configuration, 2022-2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Moving

- 6.4 Hybrid

- 6.5 Rack-integrated systems

Chapter 7 Market Estimates & Forecast, By Power range, 2022-2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Low Power (<1 kW)

- 7.3 Medium Power (1-10 kW)

- 7.4 High Power (>10 kW)

Chapter 8 Market Estimates & Forecast, By Wavelength, 2022-2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Infrared

- 8.3 Visible

- 8.4 Ultraviolet

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Laser processing

- 9.3 Optical communication

- 9.4 Optoelectronic devices

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2022-2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Telecommunication

- 10.3 Industrial

- 10.4 Semiconductor & Electronics

- 10.5 Commercial

- 10.6 Aerospace

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 UK

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AIDA

- 12.2 Amada Press System

- 12.3 Beckwood Press

- 12.4 Bliss-Bret

- 12.5 Bruderer

- 12.6 Isgec Heavy Engineering

- 12.7 Komatsu

- 12.8 Macrodyne Technologies

- 12.9 Nidec Minster

- 12.10 Schuler Group

- 12.11 Shieh Yih Machinery Industry

- 12.12 SMS Group

- 12.13 Stamtec

- 12.14 Sutherland Presses

- 12.15 Yangli Group