PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910900

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910900

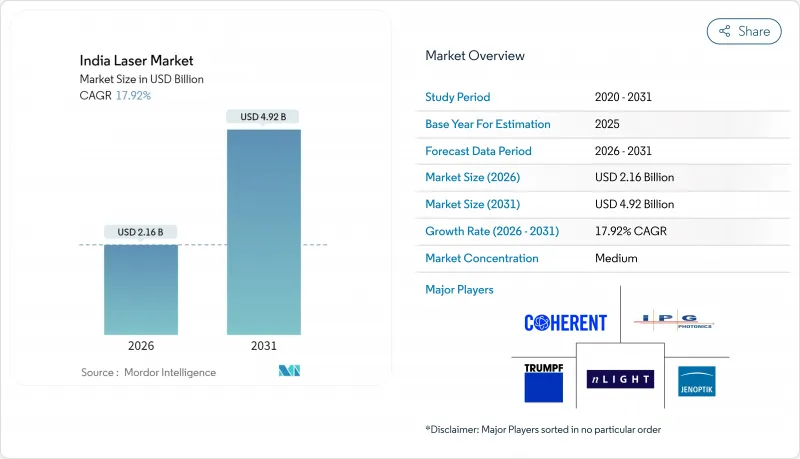

India Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India Laser Market size in 2026 is estimated at USD 2.16 billion, growing from 2025 value of USD 1.83 billion with 2031 projections showing USD 4.92 billion, growing at 17.92% CAGR over 2026-2031.

The growth outlook is sustained by government production-linked incentive (PLI) schemes, fiscal support for semiconductor fabs, and a widening installed base of industrial automation lines. Surging cluster-based electronics manufacturing, fast-rising demand for electric-vehicle battery welding, and policy-driven tax relief on imported laser machines are expanding the total addressable customer pool. Large end users are upgrading from legacy CO2 and Nd: YAG systems to high-power fiber platforms to improve throughput, while small manufacturers tap contract laser service providers to overcome capital barriers. International vendors deepen localization for after-sales support, and domestic builders introduce vertically integrated machines, together reinforcing technology diffusion across engineering hubs.

India Laser Market Trends and Insights

Surge in Domestic Electronics Manufacturing Clusters

Electronics output reached INR 11 lakh crore (USD 132 billion) in 2025 after a fivefold decade jump, and component-level schemes now underpin localized resistor and capacitor lines. Cluster concentration in Dholera (Gujarat) and the Hosur-Oragadam belt (Tamil Nadu) shortens logistics cycles, allowing just-in-time laser cutting and marking services. Small firms gain economical access through shared job-shops, while large OEMs integrate multi-kilowatt fiber benches for chassis trimming and enclosure welding. Service density lowers downtime, thus incentivizing higher-power upgrades. The outcome is steady demand acceleration for mid- and high-power fiber sources across the market.

Rapid Adoption of EV and Battery Fabrication Lines

Lithium-ion cell demand above 500 GWh by 2030 pushes OEMs to specify micro-second pulsed fiber welders for copper and aluminum joints. Domestic integrators such as Light Mechanics deploy turnkey benches that join cylindrical, prismatic, and pouch cells, fostering local supply resilience. Automotive tier-1 vendors embrace laser-based busbar welding to cut porosity and raise electrical integrity. Contract battery assemblers expand capex on 3-6 kW scanners, feeding a virtuous loop of training and service infrastructure that broadens the India Laser Market customer base.

High Capex of High-Power Fiber Lasers

Entry-level 1-6 kW cutters start near INR 40 lakh (USD 480,000) and integrated 30 kW lines top INR 4 crore (USD 4.8 million). MSMEs, 63 million strong, often lack collateral for such outlays and face added costs for chillers and fume extractors that raise total spend by as much as 50%. Leasing and shared-capacity models ease adoption, but penetration in tier-2 hubs lags metro centers, tempering short-term expansion of the India Laser Market.

Other drivers and restraints analyzed in the detailed report include:

- Lower GST on Laser Machine Imports from FY-2024

- Government Incentives for Semiconductor Fabs

- Rupee Volatility vs. USD / CNY

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber platforms held 40.95% of the India Laser Market share in 2025, with the subsegment expected to widen its lead on the strength of wall-plug efficiency and low maintenance. Ultrafast fiber varieties post the fastest 18.45% CAGR, finding uptake in through-glass vias and medical stent machining. CO2 units stay relevant in packaging and leather, while solid-state DPSS heads meet niche wavelength needs. Excimer and UV lines serve wafer dicing but remain cost-sensitive. Domestic OEMs utilize Technology Development Board grants to indigenize gantries while sourcing IPG or TRUMPF engines, illustrating hybrid value chains. This arrangement accelerates knowledge transfer and elevates fiber content per installation within the India Laser Market.

Second-tier integrators bundle diode and direct semiconductor emitters into compact coders for FMCG lines, lowering entry barriers for SMEs. Improved beam quality widens application to thin-sheet alloy cutting, reinforcing fiber's trajectory. With annual service contracts increasingly bundled at sale, buyers secure uptime, further entrenching fiber dominance.

Systems above 100 W captured 51.15% of 2025 revenue as automotive and rail car builders demand thick-plate throughput. The India Laser Market size for this tier will compound inline with infrastructure buildouts. Low-power machines under 1 W surge at 18.87% CAGR on medical PLI tailwinds that favor micro-cutting benches for cardiovascular implants. Mid-power 1-100 W tools remain workhorses in jewelry, mobile handset casing, and nameplate engraving.

SLTL Group offers a spectrum from 20 W markers to 60 kW gantries, ensuring buyers scale within a single brand. Handheld welders up to 2 kW enter sheet-metal fabrication, enabling point-of-use repairs that previously required TIG setups. This democratization of power categories fosters layered adoption across user sizes, deepening the market.

The India Laser Market Report is Segmented by Laser Type (Fiber, Solid-State, CO2, Diode, Excimer/UV, Ultrafast Fiber, and More), Power Output (Low, Medium, and High), Application (Material Processing, Medical, Communication, Defense, R&D, Electronics, and More), End-User (Automotive, Healthcare, Electronics, Aerospace and Defense, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IPG Photonics Corporation

- Coherent Corp.

- TRUMPF SE + Co. KG

- nLIGHT, Inc.

- Jenoptik AG

- Lumentum Holdings Inc.

- MKS Instruments, Inc. (Spectra-Physics)

- Han's Laser Technology Industry Group Co., Ltd.

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- Synrad Inc. (Novanta Inc.)

- SPI Lasers UK Ltd.

- Laserline GmbH

- Maxphotonics Co., Ltd.

- EKSPLA UAB

- EdgeWave GmbH

- Toptica Photonics AG

- Amplitude Laser Group (Amplitude SAS)

- Light Conversion UAB

- Bystronic Laser AG

- Litron Lasers Ltd.

- HUBNER Photonics GmbH

- Epilog Corporation

- Universal Laser Systems, Inc.

- JPT Opto-electronics Co., Ltd.

- IPG Laser India Pvt. Ltd.

- Sahajanand Laser Technology Ltd. (SLTL Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in domestic electronics-manufacturing clusters

- 4.2.2 Rapid adoption of EV and battery fabrication lines

- 4.2.3 Lower GST on laser machine imports from FY-2024

- 4.2.4 Government incentives for semiconductor fabs

- 4.2.5 Aerospace MRO corridor in South India

- 4.2.6 Export-linked PLI for medical devices

- 4.3 Market Restraints

- 4.3.1 High capex of high-power fiber lasers

- 4.3.2 Rupee volatility vs. USD / CNY

- 4.3.3 Shortage of skilled laser operators

- 4.3.4 Delays in customs clearance of photonics components

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Laser Type

- 5.1.1 Fiber Laser

- 5.1.2 Solid-State Laser (Nd:YAG, DPSS etc.)

- 5.1.3 CO2 Laser

- 5.1.4 Diode / Direct Semiconductor Laser

- 5.1.5 Excimer / UV Laser

- 5.1.6 Ultrafast Fiber Laser

- 5.1.7 Other Laser Types

- 5.2 By Power Output

- 5.2.1 Low-Power (less than 1 W)

- 5.2.2 Medium-Power (1-100 W)

- 5.2.3 High-Power (above 100 W)

- 5.3 By Application

- 5.3.1 Material Processing (Cutting, Welding, Marking)

- 5.3.2 Communication and Optical Storage

- 5.3.3 Medical and Aesthetic

- 5.3.4 Instrumentation and Measurement

- 5.3.5 Defense and Security

- 5.3.6 Research and Development

- 5.3.7 Consumer Electronics

- 5.3.8 Other Applications

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Electronics and Semiconductors

- 5.4.4 Healthcare

- 5.4.5 Telecommunications

- 5.4.6 Research Institutions

- 5.4.7 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IPG Photonics Corporation

- 6.4.2 Coherent Corp.

- 6.4.3 TRUMPF SE + Co. KG

- 6.4.4 nLIGHT, Inc.

- 6.4.5 Jenoptik AG

- 6.4.6 Lumentum Holdings Inc.

- 6.4.7 MKS Instruments, Inc. (Spectra-Physics)

- 6.4.8 Han's Laser Technology Industry Group Co., Ltd.

- 6.4.9 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- 6.4.10 Synrad Inc. (Novanta Inc.)

- 6.4.11 SPI Lasers UK Ltd.

- 6.4.12 Laserline GmbH

- 6.4.13 Maxphotonics Co., Ltd.

- 6.4.14 EKSPLA UAB

- 6.4.15 EdgeWave GmbH

- 6.4.16 Toptica Photonics AG

- 6.4.17 Amplitude Laser Group (Amplitude SAS)

- 6.4.18 Light Conversion UAB

- 6.4.19 Bystronic Laser AG

- 6.4.20 Litron Lasers Ltd.

- 6.4.21 HUBNER Photonics GmbH

- 6.4.22 Epilog Corporation

- 6.4.23 Universal Laser Systems, Inc.

- 6.4.24 JPT Opto-electronics Co., Ltd.

- 6.4.25 IPG Laser India Pvt. Ltd.

- 6.4.26 Sahajanand Laser Technology Ltd. (SLTL Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment