PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892911

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892911

Field Service Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

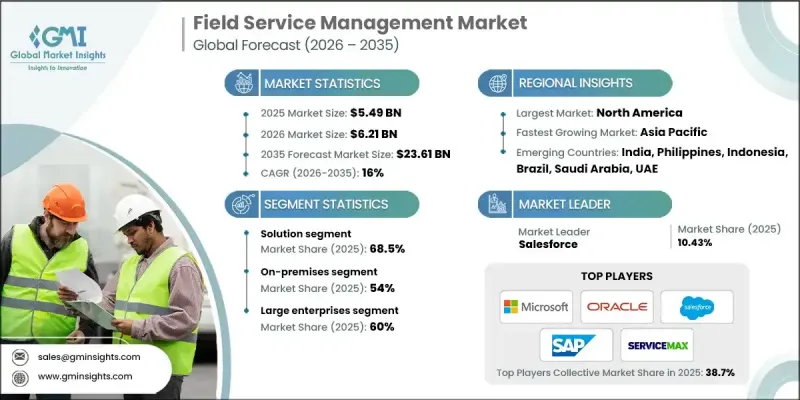

The Global Field Service Management Market was valued at USD 5.49 billion in 2025 and is estimated to grow at a CAGR of 16% to reach USD 23.61 billion by 2035.

The market is reshaped by the rapid adoption of digital-first operations, intelligent workforce automation, and connected asset networks. Modern FSM platforms now combine mobile workforce management apps, AI-driven scheduling engines, IoT-enabled asset diagnostics, and cloud-native service orchestration. These capabilities enable companies to minimize downtime, boost technician efficiency, improve first-time fix rates, and elevate customer satisfaction. Sectors such as utilities, telecom, healthcare, manufacturing, HVAC, and oil & gas are embracing FSM to meet stricter service expectations, comply with safety regulations, and modernize decentralized field operations. The shift away from manual paperwork toward predictive maintenance, digital workflows, and automated dispatching is driving strong adoption. Collaborative partnerships between FSM providers, IoT vendors, ERP firms, and cloud hyperscalers create integrated ecosystems for seamless field operations, augmented reality support, real-time monitoring, and low-code customization, making enterprise service management more efficient and scalable.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.49 Billion |

| Forecast Value | $23.61 Billion |

| CAGR | 16% |

The solution segment held 68.5% share in 2025 and is expected to grow at a CAGR of 15.5% through 2035. Businesses increasingly rely on comprehensive FSM platforms for scheduling, work order management, asset tracking, and technician performance monitoring. Integration of AI, IoT, GPS, and automation tools enables companies to eliminate inefficiencies, optimize first-time fixes, and scale operations efficiently. Organizations across utilities, telecom, healthcare, energy, and manufacturing prioritize unified digital solutions over fragmented or manual processes, fueling sustained growth in FSM solutions adoption.

The on-premises segment held a 54% share in 2025 and is projected to grow at a CAGR of 15.1% through 2035. Industries that manage sensitive operational data, critical assets, and mission-critical field information, such as defense, healthcare, utilities, oil & gas, and manufacturing, prefer on-premises FSM deployments. These systems offer complete control over servers, customizable security protocols, and compliance-aligned governance. On-premises solutions also ensure uninterrupted access to field data in low-connectivity environments while minimizing risks associated with third-party cloud vulnerabilities.

US Field Service Management Market held an 85% share, generating USD 1.81 billion in 2025. Growth in the US market is fueled by enterprises adopting digital platforms to streamline operations, reduce service response times, and enhance customer experiences. Companies across IT, telecom, healthcare, and manufacturing leverage FSM tools for workforce optimization, real-time technician tracking, and automated service processes. The expansion of IoT devices and predictive maintenance solutions further accelerates the need for advanced field service management systems.

Major companies operating in the Global Field Service Management Market include Salesforce, SAP, Microsoft, Oracle, IFS, Jobber, Zinier, ServiceMax, Trimble, and Housecall. To strengthen their foothold in the Field Service Management Market, companies are investing in advanced digital solutions that integrate AI, IoT, and cloud capabilities to optimize field operations. They are expanding platform functionalities to include predictive maintenance, augmented reality support, and real-time analytics to improve technician productivity and first-time fix rates. Strategic partnerships with IoT manufacturers, ERP providers, and cloud service vendors enable the creation of interoperable ecosystems for seamless workflow automation. Firms are also focusing on on-premises deployments for data-sensitive clients and offering flexible subscription-based models to attract SMEs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Enterprise Size

- 2.2.4 Deployment Mode

- 2.2.5 Industry Vertical

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in equipment complexity requiring advanced field service solutions.

- 3.2.1.2 Rise in predictive maintenance adoption across industrial sectors.

- 3.2.1.3 Surge in demand for faster service resolution and SLA compliance.

- 3.2.1.4 Increase in digital transformation initiatives in utilities, telecom, and manufacturing. transportation solutions

- 3.2.1.5 Rise in after-sales service models and long-term maintenance contracts.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexities in the existing CRM or ERP systems

- 3.2.2.2 Insufficient skilled technicians

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in adoption of AI copilots and generative AI for field automation.

- 3.2.3.2 Increase in IoT-connected asset installations driving predictive service opportunities.

- 3.2.3.3 Rise in remote and autonomous maintenance tools, including drones and AR support.

- 3.2.3.4 Growing demand for cost-effective cloud FSM solutions in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US: HIPAA (Health Insurance Portability & Accountability Act) impacts FSM handling of protected health information for healthcare service visits.

- 3.4.1.2 Canada: PIPEDA (Personal Information Protection and Electronic Documents Act) governs national personal data processing by FSM vendors.

- 3.4.2 Europe

- 3.4.2.1 Germany: BSI IT Security Act / BSI-Guidelines national cybersecurity rules for critical infrastructure and software vendors.

- 3.4.2.2 UK: UK GDPR & Data Protection Act 2018 governs data use and transfer post-Brexit for FSM providers operating in the UK

- 3.4.2.3 France: GDPR (EU) / CNIL guidance (data protection & geolocation).

- 3.4.2.4 Italy: Testo Unico sulla Sicurezza sul Lavoro (occupational safety law)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Cybersecurity Law (network products / critical information infrastructure)

- 3.4.3.2 India: DPDP Act / Digital Personal Data Protection Act (2023) (and IT Act provisions)

- 3.4.3.3 Japan: APPI (Act on the Protection of Personal Information)

- 3.4.3.4 Australia: Safe Work Australia codes (workplace & technician safety)

- 3.4.4 Latin America

- 3.4.4.1 Brazil: LGPD (Lei Geral de Protecao de Dados / General Data Protection Law)

- 3.4.4.2 Mexico: LFPDPPP (Federal Law on Protection of Personal Data Held by Private Parties)

- 3.4.4.3 Argentina: Provincial EV Taxi Regulations (Buenos Aires)

- 3.4.5 MEA

- 3.4.5.1 UAE: Federal Decree-Law No. 45 / Personal Data Protection Law (PDPL) (and DIFC/ADGM data rules)

- 3.4.5.2 Saudi Arabia: National Cybersecurity Authority / SASO standards and workplace safety rules

- 3.4.5.3 South Africa: POPIA (Protection of Personal Information Act)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Future outlook & opportunities

- 3.10.1 Technology roadmap & evolution timeline

- 3.10.2 Emerging application opportunities

- 3.10.3 Investment requirements & funding sources

- 3.10.4 Risk assessment & mitigation strategies

- 3.10.5 Strategic recommendations for market participants

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Mobile field execution

- 5.2.2 Service contract management

- 5.2.3 Warranty management

- 5.2.4 Workforce management

- 5.2.5 Customer management

- 5.2.6 Inventory management

- 5.2.7 Others

- 5.3 Services

- 5.3.1 Implementation

- 5.3.2 Training & support

- 5.3.3 Consulting & advisory

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Industry Vertical, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Energy & utilities

- 7.3 IT and Telecom

- 7.4 Manufacturing

- 7.5 Healthcare

- 7.6 BFSI

- 7.7 Transportation & logistics

- 7.8 Retail and E-commerce

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Work Order Management

- 9.3 Contract Management

- 9.4 Mobile Workforce Management

- 9.5 Asset Management

- 9.6 Fleet Monitoring

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Salesforce

- 11.1.2 Microsoft

- 11.1.3 SAP

- 11.1.4 Oracle

- 11.1.5 IFS

- 11.1.6 ServiceMax (PCT)

- 11.1.7 Trimble

- 11.1.8 Accruent

- 11.2 Regional Players

- 11.2.1 Zinier

- 11.2.2 KloudGin

- 11.2.3 Zuper

- 11.2.4 FieldAware

- 11.2.5 Praxedo

- 11.2.6 simPRO

- 11.2.7 OverIT

- 11.2.8 ProntoForms

- 11.3 Emerging Players

- 11.3.1 FieldEZ Technologies

- 11.3.2 Jobber

- 11.3.3 Housecall

- 11.3.4 ServicePower