PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913288

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913288

U.S. Home Standby Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

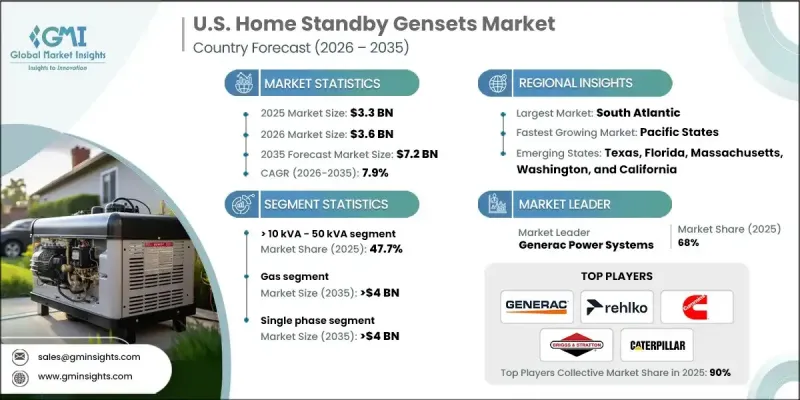

U.S. Home Standby Gensets Market was valued at USD 3.3 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 7.2 billion by 2035.

The market growth is fueled by rising investments in modernizing traditional power generation systems and adopting sustainable, cleaner solutions. Homeowners are increasingly prioritizing reliable backup power with smart monitoring features, driving higher product adoption. Home standby gensets are permanently installed systems that automatically provide electricity when the main power supply fails, operating on fuels such as natural gas, propane, or diesel. Rising focus on eco-friendly designs and stringent emission regulations is shaping manufacturing strategies. Integration of IoT-enabled controls with predictive maintenance capabilities is enhancing system reliability. Consumer preference for natural gas-powered gensets, compact and modular designs, and plug-and-play configurations is redefining fuel selection and installation trends. Additionally, developments in battery-assisted gensets and energy storage integration are enabling seamless power continuity and improving emergency response capabilities.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 7.9% |

The 10 kVA home standby gensets segment is expected to reach USD 2.5 billion by 2035. Innovations in modular, compact designs and simplified installation options are meeting the needs of small homes, condominiums, and essential circuit coverage, while plug-and-play solutions are facilitating first-time installations.

The gas segment accounted for 57.3% share in 2025 and is projected to reach USD 4 billion by 2035, driven by smart controls, remote diagnostics, and the growing popularity of propane-ready units offering flexible siting for rural and suburban households.

South Atlantic Home Standby Gensets Market held a 20.3% share in 2025, generating USD 675.8 million. High exposure to hurricanes and coastal storms, combined with resilience-focused residential designs, is driving genset adoption. The need for corrosion-resistant enclosures in areas with saline air is prompting material innovations.

Leading players in the Global U.S. Home Standby Gensets Market include Generac Power Systems, Cummins, Caterpillar, Honda Motor, Atlas Copco, Briggs and Stratton, Aurora Generators, Blue Star Power Systems, Absolute Generators, FG Wilson, FIRMAN Power Equipment, Gillette Generators, HIMOINSA, HIPOWER SYSTEMS, Honeywell International, Kirloskar, KUBOTA Corporation, Multiquip, Rehlko, Westinghouse Electric Corporation, WINCO, and Xylem. Companies in the U.S. Home Standby Gensets Market are focusing on expanding their product portfolios with modular, compact, and fuel-efficient designs to address diverse consumer requirements. They are investing in IoT-enabled smart monitoring, predictive maintenance, and battery-assisted integration to enhance reliability and operational efficiency. Strategic collaborations with distributors, contractors, and residential developers help strengthen market presence and expand geographic reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by country

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Power rating trends

- 2.4 Fuel trends

- 2.5 Phase trends

- 2.6 Product trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of home standby gensets

- 3.8 Price trend analysis

- 3.8.1 By power rating

- 3.8.2 By fuel

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 East North Central

- 4.2.2 West South Central

- 4.2.3 South Atlantic

- 4.2.4 North East

- 4.2.5 East South Central

- 4.2.6 West North Central

- 4.2.7 Pacific States

- 4.2.8 Mountain States

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 10 kVA

- 5.3 > 10 kVA - 50 kVA

- 5.4 > 50 kVA - 100 kVA

- 5.5 > 100 kVA

Chapter 6 Market Size and Forecast, By Fuel, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Phase, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Product, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Air cooled

- 8.3 Liquid cooled

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 East North Central

- 9.2.1 Illinois

- 9.2.2 Indiana

- 9.2.3 Michigan

- 9.2.4 Ohio

- 9.2.5 Wisconsin

- 9.3 West South Central

- 9.3.1 Arkansas

- 9.3.2 Louisiana

- 9.3.3 Oklahoma

- 9.3.4 Texas

- 9.4 South Atlantic

- 9.4.1 Delaware

- 9.4.2 Florida

- 9.4.3 Georgia

- 9.4.4 Maryland

- 9.4.5 North Carolina

- 9.4.6 South Carolina

- 9.4.7 Virginia

- 9.4.8 West Virginia

- 9.4.9 Washington D.C.

- 9.5 North East

- 9.5.1 Connecticut

- 9.5.2 Maine

- 9.5.3 Massachusetts

- 9.5.4 New Hampshire

- 9.5.5 Rhode Island

- 9.5.6 Vermont

- 9.5.7 New Jersey

- 9.5.8 New York

- 9.5.9 Pennsylvania

- 9.6 East South Central

- 9.6.1 Alabama

- 9.6.2 Kentucky

- 9.6.3 Mississippi

- 9.6.4 Tennessee

- 9.7 West North Central

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 Pacific States

- 9.8.1 Alaska

- 9.8.2 California

- 9.8.3 Hawaii

- 9.8.4 Oregon

- 9.8.5 Washington

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 Absolute Generators

- 10.2 Atlas Copco

- 10.3 Aurora Generators

- 10.4 Blue Star Power Systems

- 10.5 Briggs and Stratton

- 10.6 Caterpillar

- 10.7 Champion Power Equipment

- 10.8 Cummins

- 10.9 Eaton

- 10.10 FG Wilson

- 10.11 FIRMAN Power Equipment

- 10.12 Generac Power Systems

- 10.13 Gillette Generators

- 10.14 HIMOINSA

- 10.15 HIPOWER SYSTEMS

- 10.16 Honda Motor

- 10.17 Honeywell International

- 10.18 Kirloskar

- 10.19 KUBOTA Corporation

- 10.20 Multiquip

- 10.21 Rehlko

- 10.22 Westinghouse Electric Corporation

- 10.23 WINCO

- 10.24 Xylem