PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913300

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913300

Sodium Sulphate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

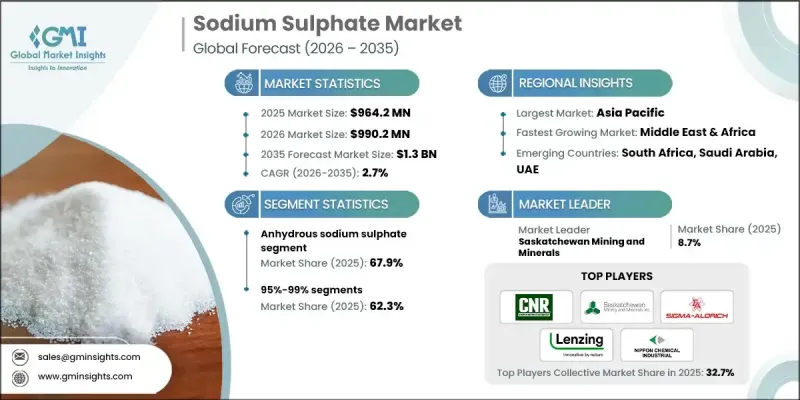

The Global Sodium Sulphate Market was valued at USD 964.2 million in 2025 and is estimated to grow at a CAGR of 2.7% to reach USD 1.3 billion by 2035.

Sodium sulphate is a versatile inorganic compound widely used across industries, including glass manufacturing, detergents, and pharmaceuticals. Its chemical properties are essential for purifying glass and producing colon-cleansing products. The rising adoption of thermal energy storage systems in sustainable construction and industrial energy management is driving demand, as sodium sulphate offers excellent thermal stability and heat retention. With energy efficiency becoming a global priority, investments in storage technologies are accelerating, while sustainability initiatives in packaging and green production practices, particularly in glass, are further boosting market growth. The compound's role in minimizing carbon footprints and supporting emerging technologies highlights its increasing relevance across industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $964.2 Million |

| Forecast Value | $1.3 billion |

| CAGR | 2.7% |

The anhydrous sodium sulphate segment held 67.9% share and is expected to grow at a CAGR of 2.7% through 2035. Its widespread application in powdered detergents, textile dyeing, glass fining, and kraft pulping ensures steady demand, driven by both industrial and export-oriented activities.

The 95-99% purity segment held a 62.3% share in 2025, owing to its balanced impurity levels and versatility. This grade is crucial in container and flat glass production, providing controlled impurities for quality output. It also supports large-scale textile dyeing and printing, benefiting from modernization in textile industries worldwide.

North America Sodium Sulphate Market is anticipated to grow at a CAGR of 2.6% between 2026 and 2035. Growth is fueled by innovations in industrial processes, wastewater recycling, and circular economy initiatives. Emerging applications in bioenergy and biodegradable packaging, combined with rising consumer demand for environmentally friendly products, are driving the adoption of sodium sulphate across industries, particularly in cleaning and personal care sectors.

Key players in the Global Sodium Sulphate Market include Nippon Chemical Industrial Co., Ltd., Sigma-Aldrich, Shikoku Chemicals Corporation, Lenzing Group, Atul Limited, Saltex LLC, Hemadri Chemicals, Cooper Natural Resources Inc., Nikunj Chemicals, Saskatchewan Mining and Minerals, and TCI Chemicals. Companies in the Global Sodium Sulphate Market are employing a mix of strategies to enhance their presence and market share. They are investing heavily in R&D to develop high-purity and application-specific products, expanding production capacities to meet rising global demand, and entering strategic partnerships with industrial end-users. Additionally, firms are emphasizing sustainable sourcing and eco-friendly processes to align with global environmental regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product form

- 2.2.3 Purity grade

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand from emerging thermal energy storage applications

- 3.2.1.2 Increasing glass production for sustainable packaging

- 3.2.1.3 Rising pharmaceutical demand for colon cleansing products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Structural decline in powdered detergent demand (shift to liquids)

- 3.2.2.2 High transportation costs limiting market expansion

- 3.2.3 Market opportunities

- 3.2.3.1 Phase change material market growth for building energy efficiency

- 3.2.3.2 Expansion in sodium-ion battery production

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product form

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Anhydrous sodium sulphate

- 5.3 Decahydrate

- 5.4 Heptahydrate

Chapter 6 Market Estimates and Forecast, By Purity Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 95%

- 6.3 95%-99%

- 6.4 ≥ 99.5%

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Household & personal care

- 7.2.1 Detergents & cleaning products

- 7.2.2 Cosmetics & personal care products

- 7.2.3 Carpet fresheners & deodorizers

- 7.2.4 Others

- 7.3 Construction & building materials

- 7.3.1 Glass manufacturing

- 7.3.2 Concrete additives

- 7.3.3 Thermal energy storage systems

- 7.3.4 Others

- 7.4 Pulp & paper

- 7.5 Textile & apparel

- 7.6 Food & beverage

- 7.6.1 Food processing

- 7.6.2 Beverage packaging

- 7.6.3 Others

- 7.7 Pharmaceutical & healthcare

- 7.7.1 Pharmaceutical manufacturing

- 7.7.2 Medical device & laboratory applications

- 7.7.3 Others

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Atul Limited

- 9.2 Cooper Natural Resources Inc.

- 9.3 Hemadri Chemicals

- 9.4 Lenzing Group

- 9.5 Nikunj Chemicals

- 9.6 Nippon Chemical Industrial Co., Ltd.

- 9.7 Saltex LLC

- 9.8 Saskatchewan Mining and Minerals

- 9.9 Shikoku Chemicals Corporation

- 9.10 Sigma-Aldrich

- 9.11 TCI Chemicals