PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913302

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913302

Structural Adhesive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

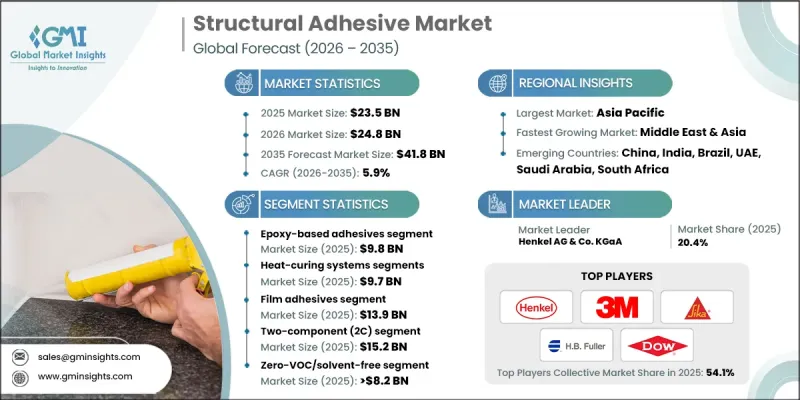

The Global Structural Adhesive Market was valued at USD 23.5 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 41.8 billion by 2035.

Structural adhesives are experiencing significant growth as multiple industries, including automotive, aerospace, electronics, marine, wind energy, and construction, increasingly adopt them. These adhesives are gradually replacing welding and mechanical fasteners in applications that require evenly distributed stresses and lightweight assemblies. The surge in electric vehicle production and the integration of composite materials in aircraft have accelerated this transition. Additionally, regulatory frameworks are steering the market toward environmentally friendly chemistries, such as water-based, low-VOC, and zero-VOC formulations, aligning with sustainability and compliance standards. Market growth is driven by large-scale vehicle production, creating high demand for structural adhesives in body-in-white, glazing, and battery assembly, alongside stringent environmental regulations encouraging solvent-free and low-emission alternatives. These factors compel manufacturers to innovate and develop formulations that meet compliance while delivering high performance and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.5 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 5.9% |

The epoxy-based adhesives segment generated USD 9.8 billion in 2025. Epoxy structural adhesives are highly valued for their exceptional tensile and shear strength, as well as chemical and thermal resistance. These properties make them ideal for critical applications, including electric vehicle battery packs, aerospace composites, and body-in-white assemblies. Toughened epoxy adhesives are widely used for reinforcement and bonding applications, while high-modulus systems in wind energy applications help withstand cyclic loads across long spans. The acrylic structural adhesives segment is also witnessing growing adoption across various industries.

The heat-curing systems segment was valued at USD 9.7 billion in 2025 and is seeing rising demand in challenging operating environments, such as aerospace composites and automotive body-in-white applications that require oven baking. These systems offer lower cross-link density and high durability, making them suitable for long-lasting applications. However, two-component, room-temperature curing epoxies and polyurethanes (PUs) are gaining traction due to their flexibility, ease of field and line assembly, and elimination of labor-intensive installations. These systems are increasingly used in industrial and construction projects, providing a balance between performance and convenience.

U.S. Structural Adhesive Market reached USD 5 billion in 2025, owing to a strong aerospace sector and growing adoption of electric vehicles in the automotive industry. Manufacturing capabilities in the U.S. play a leading role, while Canada contributes through aerospace and construction applications. Mexico's growing automotive production also supports regional market expansion. The evolving regulatory landscape promotes low and zero-VOC chemistries, driving innovation in structural glazing and specialty adhesive applications.

Key players in the Global Structural Adhesive Market include 3M, Arkema S.A., Ashland Global Holdings Inc., Dow Inc., Bostik (Arkema), Dymax Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, Huntsman Corporation, Kangda New Materials, Kisling AG, Master Bond Inc., Panacol-Elosol GmbH, Parson Adhesives, PPG Industries, Sika AG, ThreeBond Holdings Co., Ltd., Toagosei Co., Ltd., and Weiss Chemie + Technik GmbH & Co. KG. Companies in the Global Structural Adhesive Market are implementing several strategies to strengthen their market presence and enhance competitiveness. Investments in research and development focus on creating high-performance, environmentally friendly formulations, including low- and zero-VOC adhesives. Strategic partnerships with automotive, aerospace, and electronics manufacturers facilitate product integration into large-scale production. Firms are expanding regional manufacturing capacities to serve emerging markets and enhance supply chain resilience. Emphasis on sustainability, regulatory compliance, and innovative product design helps companies differentiate their offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology platform

- 2.2.2 Curing mechanism

- 2.2.3 Form

- 2.2.4 Component system

- 2.2.5 VOC content

- 2.2.6 Application

- 2.2.7 End use industry

- 2.2.8 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Lightweighting in automotive & aerospace

- 3.2.1.2 Rising construction & infrastructure projects

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long curing times

- 3.2.2.2 High cost compared to fasteners

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in electric vehicles (EVS)

- 3.2.3.2 3D printing & additive manufacturing

- 3.2.3.3 Repair & maintenance applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By technology platform

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Platform, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy-based adhesives

- 5.3 Polyurethane (PU) adhesives

- 5.4 Acrylic adhesives

- 5.5 Cyanoacrylate adhesives

- 5.6 Silicone adhesives

- 5.7 Other technologies

Chapter 6 Market Estimates and Forecast, By Curing Mechanism, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Heat-curing systems

- 6.2.1 High-temperature cure (>150°C)

- 6.2.2 Medium-temperature cure (120-150°C)

- 6.2.3 Low-temperature cure (70-120°C)

- 6.3 Room-temperature curing systems

- 6.4 Moisture-curing systems

- 6.5 UV & radiation-curing systems

- 6.6 Dual-cure systems

Chapter 7 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Film adhesives

- 7.3 Paste adhesives

- 7.4 Liquid & low-viscosity adhesives

Chapter 8 Market Estimates and Forecast, By Component System, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Single-component (1C) systems

- 8.3 Two-component (2C) systems

Chapter 9 Market Estimates and Forecast, By VOC Content, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Low-VOC adhesives (<50 g/L)

- 9.3 Zero-VOC/solvent-free adhesives

- 9.4 Water-based adhesives

- 9.5 Bio-based/renewable content

Chapter 10 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Metal-to-metal bonding

- 10.3 Composite bonding

- 10.4 Mixed-material bonding

- 10.5 Plastic bonding

- 10.6 Wood & engineered wood bonding

- 10.7 Concrete & masonry bonding

- 10.8 Glass bonding

- 10.9 Others

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Automotive

- 11.3 Aviation & aerospace

- 11.4 Wind energy

- 11.5 Marine & shipbuilding

- 11.6 Construction & infrastructure

- 11.7 Electronics & electrical

- 11.8 Water & wastewater

- 11.9 Others

Chapter 12 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 3M Company

- 13.2 Arkema S.A.

- 13.3 Ashland Global Holdings Inc.

- 13.4 Bostik (Arkema)

- 13.5 Cemedine Co., Ltd.

- 13.6 Dow Inc.

- 13.7 Dymax Corporation

- 13.8 Henkel AG & Co. KGaA

- 13.9 H.B. Fuller Company

- 13.10 Huntsman Corporation

- 13.11 Kangda New Materials

- 13.12 Kisling AG

- 13.13 Master Bond Inc.

- 13.14 Panacol-Elosol GmbH

- 13.15 Parson Adhesives

- 13.16 PPG Industries

- 13.17 Sika AG

- 13.18 ThreeBond Holdings Co., Ltd.

- 13.19 Toagosei Co., Ltd.

- 13.20 Weiss Chemie + Technik GmbH & Co. KG