PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913314

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913314

Aerospace Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

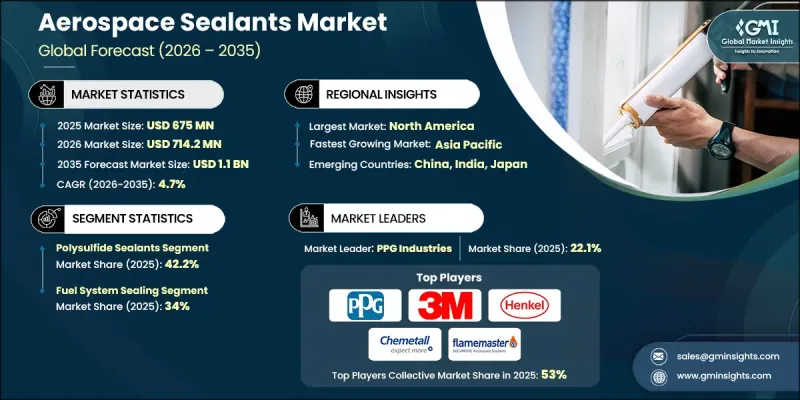

The Global Aerospace Sealants Market was valued at USD 675 million in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 1.1 billion by 2035.

Market growth is driven by the increasing performance demands placed on aircraft operating across extreme temperature environments. Aerospace sealants must maintain adhesion, elasticity, and chemical resistance while withstanding repeated thermal cycling, ranging from high heat exposure in engine zones to subzero conditions at cruising altitudes. This requirement is accelerating the shift toward advanced chemistries delivering long-term durability, fuel resistance, and mechanical stability. Weight reduction targets set by aircraft manufacturers are also influencing material selection, with sealant formulations increasingly optimized for lower density, improved spreadability, and reduced application thickness. Even modest weight savings achieved through sealant optimization can generate measurable fuel efficiency gains over extended service periods. In parallel, tightening environmental regulations focused on emissions and material safety are pushing manufacturers toward low-VOC, high-solids, and solvent-free solutions. The market is also benefiting from rising maintenance activity, as operators seek sealants that support faster curing, improved handling, and safer working conditions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $675 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.7% |

The polysulfide sealants segment accounted for 42.2% share in 2025. This segment continues to lead due to its proven resistance to fuels and hydraulic fluids, combined with its ability to retain performance after prolonged exposure to temperature fluctuations and operational stress. These properties make polysulfide formulations a preferred choice across demanding aerospace sealing applications.

The fuel system sealing segment held 34% share in 2025. This category includes sealing requirements across fuel containment and transfer components, where long-term chemical stability and property retention under thermal and immersion conditions remain critical performance criteria. The continued reliance on established sealing chemistries reflects the stringent qualification standards applied to fuel-related aerospace components.

North America Aerospace Sealants Market accounted for 38% share in 2025. The region maintains its leading position due to strong aircraft manufacturing activity, a large installed commercial and defense fleet, and a well-developed maintenance and overhaul ecosystem. Ongoing fleet expansion continues to support recurring demand for high-performance sealants across both production and aftermarket applications.

Key companies active in the Global Aerospace Sealants Market include Henkel, PPG Industries, 3M, Dow Corning, Flamemaster, Chemetall, Cytec Industries, Royal Adhesives & Sealants, Master Bond, and Permatex. Companies operating in the Global Aerospace Sealants Market are strengthening their competitive position through sustained investment in material innovation and regulatory compliance. Manufacturers are focusing on developing advanced formulations that meet evolving thermal, chemical, and mechanical performance requirements while aligning with stricter environmental standards. Portfolio optimization is a key strategy, with companies refining product lines to balance performance reliability and sustainability. Strategic collaboration with aircraft manufacturers and maintenance providers is supporting early adoption and long-term supply relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chemistry type

- 2.2.2 Application

- 2.2.3 Aircraft type

- 2.2.4 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Chemistry Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Polysulfide sealants

- 5.2.1 Cured polysulfide

- 5.2.2 Non-cured (uncured) polysulfide

- 5.3 Silicone sealants

- 5.3.1 RTV silicone (non-corrosive)

- 5.3.2 Low-outgassing silicone

- 5.3.3 High-temperature silicone

- 5.4 Fluorosilicone sealants

- 5.5 Polyurethane sealants

- 5.5.1 Polyether polyurethane

- 5.5.2 Polyester polyurethane

- 5.6 Polyacrylate sealants

- 5.7 Epoxy sealants

- 5.8 Others

Chapter 6 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Fuel system sealing

- 6.2.1 Integral fuel tank sealing

- 6.2.2 Fuel line & fitting sealing

- 6.3 Airframe structural sealing

- 6.4 Fuselage sealing

- 6.5 Aircraft windshield & canopy sealing

- 6.6 Flight line repair & field maintenance

- 6.7 Engine & propulsion system sealing

- 6.8 Hydraulic & pneumatic system sealing

- 6.9 Avionics & electrical system sealing

- 6.10 Environmental control system (ECS) sealing

- 6.11 Antenna & radome sealing

- 6.12 Corrosion protection & faying surface sealing

- 6.13 Others

Chapter 7 Market Size and Forecast, By Aircraft Type, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial aircraft

- 7.2.1 Narrow-body aircraft

- 7.2.2 Wide-body aircraft

- 7.3 Regional aircraft

- 7.4 Business & general aviation

- 7.5 Military aircraft

- 7.5.1 Fighter & combat aircraft

- 7.5.2 Transport & tanker aircraft

- 7.6 Rotorcraft (helicopters)

- 7.6.1 Civil helicopters

- 7.6.2 Military helicopters

- 7.7 Unmanned aerial vehicles (UAVs) / drones

- 7.7.1 Military UAVs

- 7.7.2 Commercial UAVs

- 7.8 Others

Chapter 8 Market Size and Forecast, By End Use Industry , 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial aviation

- 8.3 Military & defense

- 8.4 Space & satellite

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Chemetall

- 10.3 Cytec Industries

- 10.4 Dow Corning

- 10.5 Flamemaster

- 10.6 Henkel

- 10.7 Master Bond

- 10.8 Permatex

- 10.9 PPG Industries

- 10.10 Royal Adhesives & Sealants