PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913332

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913332

Wireless Charging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

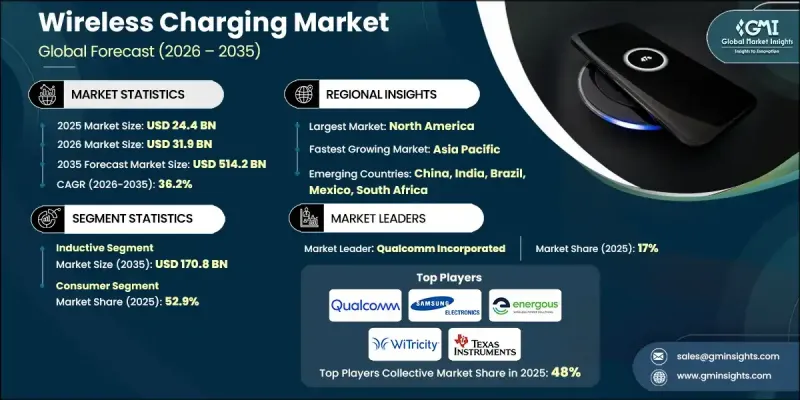

The Global Wireless Charging Market was valued at USD 24.4 billion in 2025 and is estimated to grow at a CAGR of 36.2% to reach USD 514.2 billion by 2035.

Market expansion is fueled by rising adoption of consumer electronics, rapid technological advancements, increasing deployment in electric vehicles, and supportive government policies promoting charging infrastructure development. As EV adoption accelerates, the demand for convenient, cable-free charging solutions continues to rise. Wireless charging technologies, such as pads and dynamic in-road systems, simplify the process by eliminating the need for physical connectors. Innovations enhancing speed, efficiency, and flexibility-including resonant and radio frequency-based solutions-are making wireless charging increasingly practical for smartphones, laptops, wearables, and other electronics. These advancements address previous limitations, expand application opportunities, and accelerate commercialization across consumer and automotive sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $24.4 Billion |

| Forecast Value | $514.2 Billion |

| CAGR | 36.2% |

The resonant wireless charging segment accounted for USD 8.2 billion in 2025 and is expected to grow at a CAGR of 38.8% during 2025-2034. Resonant technology allows mid-range power transfer without precise alignment, making it suitable for both consumer electronics and automotive applications, including parking-based and dynamic EV charging systems.

The consumer segment held a 52.9% share in 2025. Rapid adoption of wireless charging across smartphones, earbuds, wearables, and portable devices is being driven by multi-coil solutions, high-efficiency chargers, and seamless integration into homes, offices, and public spaces. Standardization initiatives such as Qi2 and increasing consumer awareness are further enhancing adoption, while companies continue to offer innovative products like furniture-embedded and aesthetically integrated charging systems.

North America Wireless Charging Market held a 34% share in 2025. Growth in the region is supported by strong adoption in consumer electronics and electric vehicles, driven by advancements in high-efficiency inductive technologies and improved user experience. The U.S., as a hub of innovation, hosts key technology firms and research centers developing cutting-edge wireless charging systems, while favorable regulations and growing EV infrastructure further support market expansion.

Key companies operating in the Global Wireless Charging Market include Samsung Electronics Co., Ltd., Qualcomm Incorporated, Infineon Technologies, Powermat Technologies, Mojo Mobility, Inc., Wiferion GmbH, Evatran LLC (Plugless Power), Powercast Corporation, Energizer Holdings Inc., WiTricity Corporation, WiBotic, Murata Manufacturing Co. Ltd., Convenient Power Ltd., Renesas Electronics, OSSIA, Texas Instruments, Inc., MediaTek, Inc., and Leggett & Platt, Inc. Companies in the Global Wireless Charging Market are employing several strategies to strengthen their presence and expand market share. Investments in research and development are enhancing charging efficiency, reducing power loss, and enabling faster wireless energy transfer. Firms are forming partnerships with automotive manufacturers, consumer electronics brands, and infrastructure providers to integrate wireless charging solutions across devices and EVs. Market players are also expanding regional production and distribution networks to reach emerging economies. Additionally, companies focus on standardization compliance, user-friendly designs, and multifunctional products to improve adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology trends

- 2.2.2 Application trends

- 2.2.3 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased adoption in consumer electronics

- 3.2.1.2 Advancements in wireless charging technology

- 3.2.1.3 Growth of electric vehicles (EVs)

- 3.2.1.4 Government initiatives and regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Higher cost of wireless charging systems

- 3.2.2.2 Limited charging range

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in long-range and dynamic charging technologies

- 3.2.3.2 Opportunities for managed wireless charging services in commercial spaces

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Emerging business models

- 3.8 Compliance requirements

- 3.9 Patent and IP analysis

- 3.10 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Inductive

- 5.3 RF

- 5.4 Resonant

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Consumer

- 6.4 Industrial

- 6.5 Healthcare

- 6.6 Aerospace & Defense

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Global Key Players

- 8.1.1 Qualcomm Incorporated

- 8.1.2 Samsung Electronics, Co., Ltd.

- 8.1.3 Texas Instruments, Inc.

- 8.1.4 Infineon Technologies

- 8.2 Regional Key Players

- 8.2.1 North America

- 8.2.1.1 Energizer Holdings Inc.

- 8.2.1.2 Powermat Technologies

- 8.2.1.3 Evatran LLC (Plugless Power)

- 8.2.2 Europe

- 8.2.2.1 Wiferion GmbH

- 8.2.2.2 Renesas Electronics

- 8.2.2.3 Leggett & Platt, Inc

- 8.2.3 APAC

- 8.2.3.1 MediaTek, Inc.

- 8.2.3.2 Murata Manufacturing Co. Ltd.

- 8.2.3.3 Semtech Corporation

- 8.2.1 North America

- 8.3 Niche Players / Disruptors

- 8.3.1 Convenient Power Ltd.

- 8.3.2 Mojo Mobility, Inc.

- 8.3.3 OSSIA

- 8.3.4 Powercast Corporation

- 8.3.5 WiBotic

- 8.3.6 WiTricity Corporation