PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913352

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913352

Polyhydroxyalkanoate (PHA) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

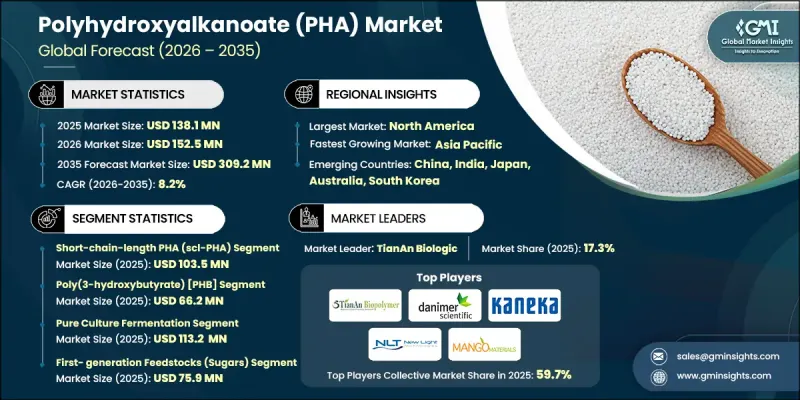

The Global Polyhydroxyalkanoate (PHA) Market was valued at USD 138.1 million in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 309.2 million by 2035.

PHAs are naturally occurring biodegradable polymers produced by microorganisms as energy-storage compounds. Under conditions of excess carbon and limited nutrients, microorganisms synthesize PHAs with properties closely resembling conventional plastics. These polymers have emerged as eco-friendly and biocompatible alternatives to petroleum-based plastics, making them highly relevant for sustainable applications. Advances in fermentation, genetic engineering, and the use of low-cost feedstocks have made commercial-scale PHA production economically feasible, bridging the gap between traditional plastics and biodegradable options. This technological progress has expanded PHA applications across packaging, medical, agricultural, and consumer products. The ability of PHAs to biodegrade in soil, freshwater, and marine environments reduces environmental pollution, while renewable feedstock utilization supports a circular bioeconomy. Growing demand for sustainable materials and regulatory emphasis on reducing plastic waste are driving market adoption and encouraging further innovation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $138.1 Million |

| Forecast Value | $309.2 Million |

| CAGR | 8.2% |

The short-chain-length PHAs (scl-PHA) segment accounted for USD 103.5 million in 2025. The high demand for scl-PHAs stems from their mechanical strength, biodegradability, and versatility across sectors such as packaging, agriculture, and veterinary applications. Their established production methods make them cost-efficient and readily scalable, positioning them as a preferred solution for industries aiming to reduce plastic waste.

The poly(3-hydroxybutyrate) [PHB] segment reached USD 66.2 million in 2025. PHB and its copolymers, such as Poly(3-hydroxybutyrate-co-3-hydroxyvalerate) (PHBV), are gaining traction due to favorable mechanical properties and biodegradability. PHB is primarily used in packaging and agricultural films, while PHBV's enhanced flexibility and toughness enable applications in medical and consumer goods. The combination of low production costs and steady demand ensures sustained market growth for these polymers.

North America Polyhydroxyalkanoate (PHA) Market generated USD 38.6 million in 2025. The region is witnessing increased adoption of renewable and biodegradable materials as brands focus on sustainability. Rising demand from food-service and consumer goods manufacturers, coupled with robust R&D ecosystems and pilot-scale optimization of fermentation processes, is accelerating market penetration. Interest from major retail chains is further reinforcing adoption trends.

Key players in the Global Polyhydroxyalkanoate (PHA) Market include Biomer, Bluepha, CJ BIO (CJ CheilJedang), Danimer Scientific, Full Cycle Bioplastics, Kaneka Corporation, Mango Materials, Newlight Technologies, Paques Biomaterials, PhaBuilder, Phangel Biotechnology, Tepha Inc., TianAn Biologic, Tianjin Green-Bio, Weining Biotechnology, and Yield10 Bioscience. Companies in the Global Polyhydroxyalkanoate (PHA) Market are strengthening their presence by investing heavily in R&D to improve fermentation efficiency, reduce production costs, and enhance polymer properties. Strategic partnerships with research institutions and industrial stakeholders enable the co-development of application-specific products. Expanding production capacities, adopting low-cost and renewable feedstocks, and developing scalable commercial processes help increase market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chain Length Classification

- 2.2.2 Copolymer Type

- 2.2.3 Production Method

- 2.2.4 Feedstock Type

- 2.2.5 Application

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biodegradable plastics

- 3.2.1.2 Technological advancements in microbial fermentation

- 3.2.1.3 Expansion of end-use industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production cost compared to fossil-based plastics

- 3.2.2.2 Competition from other bioplastics

- 3.2.3 Market opportunities

- 3.2.3.1 High-performance PHA blends

- 3.2.3.2 Premium eco-friendly products

- 3.2.3.3 Circular economy integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By chain length classification

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Chain Length Classification, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Short-Chain-Length PHA (scl-PHA)

- 5.3 Medium-Chain-Length PHA (mcl-PHA)

- 5.4 Long-Chain-Length PHA (lcl-PHA)

Chapter 6 Market Estimates and Forecast, By Copolymer Type, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Poly(3-hydroxybutyrate) [PHB]

- 6.3 Poly(3-hydroxybutyrate-co-3-hydroxyvalerate) [PHBV]

- 6.4 Poly(3-hydroxybutyrate-co-4-hydroxybutyrate) [P3H4B]

- 6.5 Poly(3-hydroxybutyrate-co-3-hydroxyhexanoate) [PHBH]

- 6.6 Other PHA Copolymers [P(3HB-co-3HP), P(3HB-co-LA)]

Chapter 7 Market Estimates and Forecast, By Production Method, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pure Culture Fermentation

- 7.3 Mixed Microbial Culture (MMC)

- 7.4 Halophilic/Extremophilic Production

- 7.5 Genetically Engineered Systems

Chapter 8 Market Estimates and Forecast, By Feedstock Type, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 First-Generation Feedstocks (Sugars)

- 8.3 Second-Generation Feedstocks (Vegetable Oils)

- 8.4 Third-Generation Feedstocks (Waste Streams)

- 8.5 Next-Generation Feedstocks (CO2, CO, CH4, C1 Compounds)

Chapter 9 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Packaging Applications

- 9.2.1 Rigid Packaging

- 9.2.2 Flexible Films

- 9.2.3 Others

- 9.3 Biomedical Applications

- 9.3.1 Medical Devices

- 9.3.2 Surgical Sutures

- 9.3.3 Others

- 9.4 Agricultural Applications

- 9.4.1 Mulch Films

- 9.4.2 Seed Coatings

- 9.4.3 Others

- 9.5 Textile Applications

- 9.5.1 Fibers & Yarns

- 9.5.2 Non-Wovens

- 9.5.3 Others

- 9.6 Consumer Goods

- 9.6.1 Cosmetic Packaging

- 9.6.2 Toys & Recreational Product

- 9.6.3 Others

- 9.7 Other Industrial Applications

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Biomer

- 11.2 Bluepha

- 11.3 CJ BIO (CJ CheilJedang)

- 11.4 Danimer Scientific

- 11.5 Full Cycle Bioplastics

- 11.6 Kaneka Corporation

- 11.7 Mango Materials

- 11.8 Newlight Technologies

- 11.9 Paques Biomaterials

- 11.10 PhaBuilder

- 11.11 Phangel Biotechnology

- 11.12 Tepha Inc.

- 11.13 TianAn Biologic

- 11.14 Tianjin Green-Bio

- 11.15 Weining Biotechnology

- 11.16 Yield10 Bioscience