PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910713

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910713

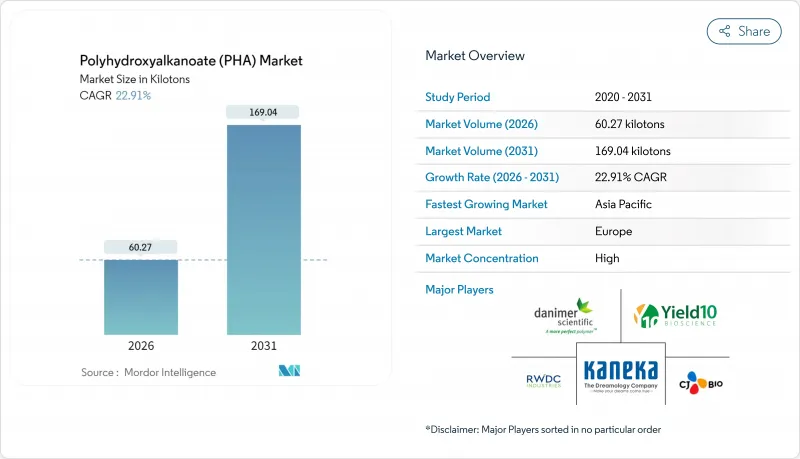

Polyhydroxyalkanoate (PHA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Polyhydroxyalkanoate market is expected to grow from 49.04 kilotons in 2025 to 60.27 kilotons in 2026 and is forecast to reach 169.04 kilotons by 2031 at 22.91% CAGR over 2026-2031.

Regulatory restrictions on single-use plastics, sizeable investments in production capacity and continuing material-science advances are reinforcing a rapid substitution dynamic in packaging, biomedical and agricultural uses. Europe commands early-mover advantage on account of strict waste-reduction directives, while the Asia-Pacific supply base is scaling fast in response to industrial growth and abundant feedstock. Mixed microbial culture processing is gaining credibility by cutting sterilisation demands, potentially lowering unit costs and broadening the feedstock slate. Competitive intensity remains moderate; established chemical groups such as BASF share the stage with specialist producers and venture-backed start-ups that differentiate through feedstock innovation and application-specific resin design.

Global Polyhydroxyalkanoate (PHA) Market Trends and Insights

Regulatory bans on single-use plastics accelerating PHA demand

Mounting national and municipal restrictions are translating directly into procurement targets for compostable materials. California's Senate Bill 54 established an Extended Producer Responsibility program mandating that all covered materials be recyclable or compostable by 2032, explicitly including PHA in its definition of plastics subject to recycling and reduction targets . Despite classification debates, the EU Single-Use Plastics Directive exerts similar pressure, spurring rapid brand reformulations in food service articles. Hawaii's phased bans on non-biodegradable containers reinforce the trend. Major consumer-goods companies now pilot PHA-based straw, cutlery, and lid programmes to pre-empt penalties, thereby anchoring early-volume contracts for resin suppliers.

Growing demand for sustainable polymers

Corporate decarbonisation targets and updated eco-design metrics push converters toward materials that can degrade in soil and aquatic environments. PHAs fulfil this requirement because they mineralise without specialised industrial composting, differentiating them from starch blends and polylactic acid. Life-cycle studies record up to 50% lower environmental footprints when PHAs derive their carbon from waste substrates. Packaging, agricultural films, consumer electronics casings and medical disposables therefore constitute growing addressable volume, especially as recent compatibiliser chemistries boost tensile strength and barrier performance.

Higher price compared to conventional polymers

Commodity plastics trade at roughly USD 1.00-1.30 per kg, whereas commercial PHA grades range from USD 2.25-2.75 per lb, constraining uptake in thin-margined packaging. Process optimisation studies project a possible 30-40% cost reduction when switching to food-waste feedstocks, yet parity remains elusive in the near term. Consequently, end-users prioritise high-value or regulation-driven niches until volumes rise and economies of scale materialise.

Other drivers and restraints analyzed in the detailed report include:

- Growing awareness over sustainability in FMCG industry

- Rising demand for bio-resorbable implants amid ageing populations

- Limited production capacity and scalability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The polyhydroxyalkanoate market size for co-polymers reached a leading 25.21 kilotons in 2025, translating into 51.40% share. Co-polymer grades such as PHBV deliver flexibility and oxygen barrier performance that meet chilled-food packaging standards. Recent work blending 50% PHBV with polybutylene adipate terephthalate improved elongation at break and cut water-vapour transmission, paving the way for thermoformed trays in meat and cheese packs. Product formulators also value the ease of downstream conversion on conventional extrusion lines, which curtails capital expenditure.

Terpolymers command only a modest volume base today yet outpace all other resin families at a 23.70% CAGR, underscoring their role in specialised biomedical and electronics housings. Production breakthroughs that boost 4HB content above 50% have enhanced elasticity and slow-release characteristics, useful for absorbable drug-delivery films. As scale grows, terpolymer production will lift the overall polyhydroxyalkanoate market by opening differentiated niches where mechanical demands previously favoured petrochemical elastomers.

Sugar and molasses contributed 56.60% of polyhydroxyalkanoate market share in 2025 on the back of predictable yields and established logistics. Fermentation platforms tethered to sugar-cane or beet supply in Brazil and Thailand create integrated agro-industrial hubs with captive raw materials. Nonetheless, feedstock cost remains the single largest expense at commercial plants. Rising competition for sucrose among ethanol and food markets has sparked a strategic pivot toward waste oils and glycerol, a stream forecast to expand volume at 23.95% CAGR.

Waste-oil pathways lower carbon intensity and deliver up to 40% cost relief, according to trials where Priestia megaterium achieved 42% intracellular PHA content from crude glycerol. Agricultural residues are also gaining traction; cabbage trimmings from kimchi production now feed proof-of-concept bioreactors in South Korea, pointing to regional circular-economy synergies. Methane and direct COa utilisation remain embryonic yet could confer true carbon-negative credentials once phototrophic mixed-culture systems mature.

The Polyhydroxyalkanoate Market Report Segments the Industry by Product Type (Monomers, Copolymers, and Terpolymers), Feedstock (Sugar/Molasses, Plant Oils and Fatty Acids, and More), Production Method (Bacterial Fermentation and More), End-User Industry (Packaging, Agriculture, and More) and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Europe retained leadership with 43.80% share in 2025 as eco-design rules, landfill taxes and consumer preference converged to accelerate deployment. The Single-Use Plastics Directive mandates steep reduction of petroleum-based cutlery and plates, prompting retail chains across Germany, France and the Nordics to use PHA for ready-meal lids and fruit nets. R&D initiatives such as the COM4PHA consortium bundle public grants with private know-how to scale PHBV compounds targeting cosmetic jars and agricultural twines, further anchoring regional expertise.

Asia-Pacific is the fastest-growing arena, expanding at 24.10% CAGR to 2031. China champions the transition by integrating PHA capacity into existing sugar and palm-oil processing complexes, thereby hedging against supply risk. TotalEnergies and Bluepha's collaboration exemplifies how multinational and domestic groups pool capital and downstream channels. Japan continues to edge performance thresholds; Kaneka's plant upgrade pushes annual output past 20 kt while pioneering grades tailored for biodegradable fishing gear. South Korea's waste-to-PHA demonstration at the World Institute of Kimchi showcases how feedstock innovation solves disposal headaches and fuels polymer volume.

North America exhibits robust growth supported by regulatory momentum and venture funding. California, New York and several coastal municipalities impose EPR fees that effectively subsidise compostable materials. Danimer Scientific's Georgia expansion will lift local output and offer brand owners shorter supply lines. Canada's forthcoming single-use regulation and Mexico's city-level bans on styrene foams present additional traction points. Regional academics widen the talent pipeline, ensuring sustained process optimisation.

- BASF

- BIO ON SpA

- Bluepha Co,. Ltd.

- CJ CheilJedang Corp.

- Danimer Scientific

- Genecis Bioindustries Inc.,

- Kaneka Corporation

- Mango Materials

- PolyFerm Canada

- RWDC Industries

- Terraverdae Bioworks Inc.

- Yield10 Bioscience, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Bans on Single Use Plastics Accelerating PHA Demand

- 4.2.2 Growing Demand for Sustainable Polymers

- 4.2.3 Growing Awareness over Sustainability in FMCG Industry

- 4.2.4 Rising Demand for Bio Resorbable Implants Amid Ageing Populations

- 4.2.5 Growing Usage of PHA in Agriculture Industry

- 4.3 Market Restraints

- 4.3.1 Higher Price Compared to the Conventional Polymers

- 4.3.2 Limited Production Capacity and Scalability

- 4.3.3 Lack of Consumer Awareness and Education Deficits

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Monomer

- 5.1.2 Copolymer

- 5.1.3 Terpolymer

- 5.2 By Feedstock

- 5.2.1 Sugar / Molasses

- 5.2.2 Plant Oils & Fatty Acids

- 5.2.3 Waste Oils & Glycerol

- 5.2.4 Methane / CO2

- 5.2.5 Agricultural & Food Waste

- 5.3 By Production Method

- 5.3.1 Bacterial Fermentation

- 5.3.2 Mixed Microbial Culture

- 5.3.3 Engineered Plants / Algae

- 5.4 By End-user Industry

- 5.4.1 Packaging

- 5.4.2 Agriculture

- 5.4.3 Biomedical

- 5.4.4 Other (Infrastructure, Oil and Gas, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share(%)/Ranking Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 BASF

- 6.3.2 BIO ON SpA

- 6.3.3 Bluepha Co,. Ltd.

- 6.3.4 CJ CheilJedang Corp.

- 6.3.5 Danimer Scientific

- 6.3.6 Genecis Bioindustries Inc.,

- 6.3.7 Kaneka Corporation

- 6.3.8 Mango Materials

- 6.3.9 PolyFerm Canada

- 6.3.10 RWDC Industries

- 6.3.11 Terraverdae Bioworks Inc.

- 6.3.12 Yield10 Bioscience, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment