PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913385

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913385

Chlorinated Polyvinyl Chloride (CPVC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

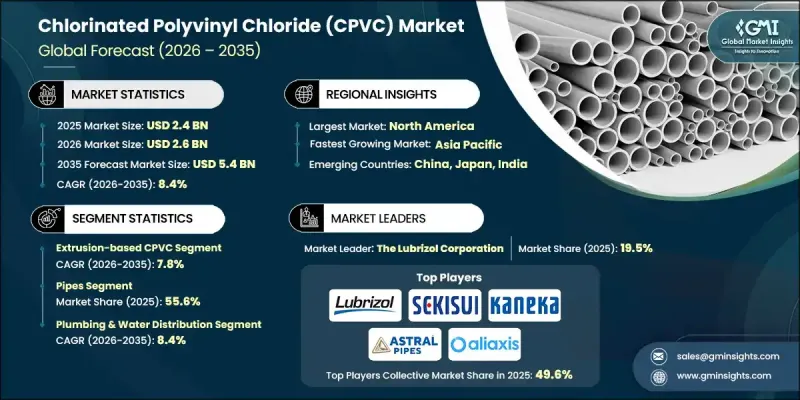

The Global Chlorinated Polyvinyl Chloride (CPVC) Market was valued at USD 2.4 billion in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 5.4 billion by 2035.

Market growth reflects rising adoption of CPVC across residential, commercial, and industrial construction due to its strong performance characteristics and long service life. Increasing demand for durable piping solutions that can withstand elevated temperatures, internal pressure, and chemically aggressive environments continues to support widespread acceptance. CPVC is increasingly selected as a unified material solution that simplifies construction planning by reducing material variation while maintaining safety and performance standards. Engineers and contractors value CPVC for its installation efficiency, reliability, and lifecycle cost advantages. Ongoing infrastructure development, system upgrades, and modernization projects are reinforcing long-term demand. Advances in material formulation are further improving performance consistency and application flexibility. As building codes evolve and durability requirements become more stringent, CPVC remains well-positioned as a preferred thermoplastic material across global construction and infrastructure markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 8.4% |

The extrusion-based manufacturing segment generated USD 1.7 billion in 2025 and continues to lead the market due to its ability to deliver uniform dimensions, high production efficiency, and cost control. This process supports large-scale projects that require consistent quality and volume output.

The pipes segment accounted for 55.6% share in 2025 and is expected to grow at a CAGR of 8.1% through 2034. Strong demand is driven by durability, thermal stability, and long-term performance advantages compared to alternative materials.

North America Chlorinated Polyvinyl Chloride (CPVC) Market reached USD 865.2 million in 2025. Regional growth is supported by infrastructure renewal, stricter safety standards, and replacement of aging systems across the U.S. and Canada. Continuous improvements in CPVC formulations are further strengthening market confidence.

Key companies operating in the Global Chlorinated Polyvinyl Chloride (CPVC) Market include Lubrizol Corporation, Aliaxis Group S.A., Kaneka Corporation, Georg Fischer Ltd., IPEX Inc., Astral Limited, Sekisui Chemical Co., Ltd., Prince Pipes and Fittings, Supreme Industries Limited, and Charlotte Pipe and Foundry. Companies in the Global Chlorinated Polyvinyl Chloride (CPVC) Market are strengthening their market position through capacity expansion, formulation innovation, and strategic partnerships. Manufacturers are investing in research to enhance thermal performance, pressure resistance, and long-term durability. Geographic expansion into high-growth construction markets is improving revenue diversification. Collaboration with contractors and system designers supports early-stage specification and repeat demand. Companies are also focusing on compliance with evolving safety and building regulations to reinforce product acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Manufacturing Process

- 2.2.3 Product Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for durable and corrosion-resistant piping materials

- 3.2.1.2 Rising construction activity across residential and commercial infrastructure

- 3.2.1.3 Preference for high-temperature and chemically stable plastic materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material availability and pricing structures

- 3.2.2.2 Competition from alternative piping materials and technologies

- 3.2.3 Market opportunities

- 3.2.3.1 Rapid urbanization and infrastructure development in emerging economies

- 3.2.3.2 Technological improvements enhancing CPVC performance characteristics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Manufacturing Process, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Extrusion-Based CPVC

- 5.3 Injection Molding-Based CPVC

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Resin & Compound

- 6.3 Pipes

- 6.4 Fittings & Valves

- 6.4.1 Couplings & Adapters

- 6.4.2 Elbows & Tees

- 6.4.3 Unions & Reducers

- 6.4.4 Valves (Ball, Gate, Check)

- 6.5 Sheets, Panels & Profiles

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Plumbing & Water Distribution

- 7.2.1 Hot Water Systems

- 7.2.2 Cold Water Systems

- 7.2.3 Recirculation Systems

- 7.3 Fire Protection Systems

- 7.3.1 Residential Fire Sprinklers (NFPA 13D)

- 7.3.2 Commercial Fire Sprinklers (NFPA 13)

- 7.3.3 Multifamily Fire Sprinklers (NFPA 13R)

- 7.4 Industrial Process Piping

- 7.4.1 Chemical Processing & Handling

- 7.4.2 Water & Wastewater Treatment

- 7.4.3 Desalination Plants

- 7.4.4 Power Generation

- 7.4.5 Oil & Gas Operations

- 7.4.6 Mineral Processing

- 7.5 HVAC & Chilled Water Systems

- 7.5.1 Hydronic Heating

- 7.5.2 Chilled Water Distribution

- 7.5.3 Cooling Towers

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Aliaxis Group S.A.

- 9.2 Astral Limited

- 9.3 Charlotte Pipe and Foundry

- 9.4 Georg Fischer Ltd.

- 9.5 IPEX Inc.

- 9.6 Kaneka Corporation

- 9.7 Lubrizol Corporation

- 9.8 Prince Pipes and Fittings

- 9.9 Sekisui Chemical Co., Ltd.

- 9.10 Supreme Industries Limited