PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907270

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907270

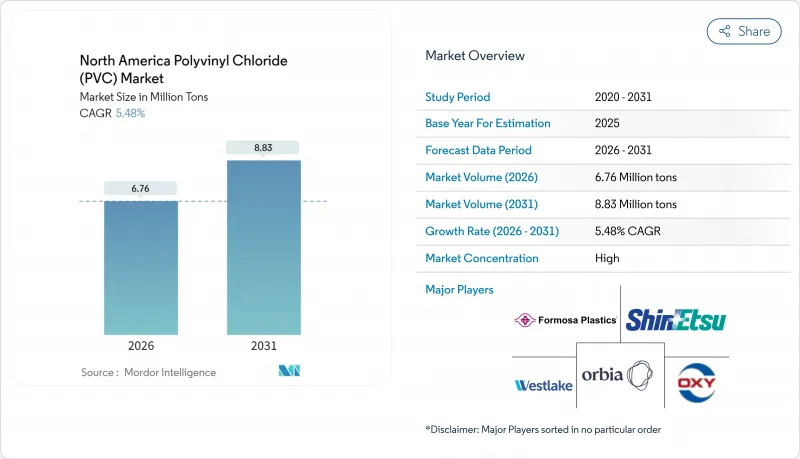

North America Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America Polyvinyl Chloride market is expected to grow from 6.41 million tons in 2025 to 6.76 million tons in 2026 and is forecast to reach 8.83 million tons by 2031 at 5.48% CAGR over 2026-2031.

Continued infrastructure modernization, especially the federally funded replacement of lead service lines, underpins this expansion even as supply-chain volatility persists. Demand visibility is strong because municipalities must comply with the ten-year mandate for full lead pipe replacement, insulating pipe purchases from broader economic swings. The United States accounts for the largest regional PVC consumption, supported by advantaged ethane costs that cushion producers from feedstock price shocks. Healthcare is gaining importance as the fastest-growing end user, propelled by demographic trends and the shift to phthalate-free medical devices. Competitive intensity centers on vertical integration, specialty compounding, and sustainability innovations that protect margins in a globally oversupplied resin market.

North America Polyvinyl Chloride (PVC) Market Trends and Insights

Rising Demand from Building and Construction

PVC consumption in construction tracks the recovery of public works spending, with pipes and fittings representing almost half of all applications. States and provinces are replacing aging distribution networks because federal rules prohibit deferrals. Building codes that cap lead content steer projects toward rigid vinyl systems, while producers leverage integrated ethylene chains to stabilize costs. Long-term infrastructure programs create predictable order books, encouraging capacity upgrades at domestic plants and sustaining resin uptake regardless of private housing cycles.

Surging Use in Medical-Grade Devices and IV Bags

Healthcare demand expands at 6.34% CAGR as hospitals specify non-DEHP compounds for blood bags, tubing, and catheters. Material formulators now offer phthalate-free additives that pass FDA tests without trade-offs in clarity, flexibility, or sterilization resistance. Higher regulatory barriers and validation costs favor established suppliers, enabling premium pricing that offsets commodity margin pressure in the North America Polyvinyl Chloride market. An aging population and the growth of home-based care further extend this demand runway.

Volatile Vinyl Chloride Monomer and Ethylene Prices

Feedstock swings erode margins because raw materials represent up to 70% of production cost. Recent rail incidents underscore logistical risk, while planned shutdowns at major crackers tighten regional availability and amplify spot volatility. Integrated firms cushion some of the impact through advantaged ethane, but merchant buyers face sharper price spikes, complicating inventory planning across the North America Polyvinyl Chloride market.

Other drivers and restraints analyzed in the detailed report include:

- Federal Funding for Replacement Water Infrastructure

- Regulatory Tailwinds for Lead-Free Plumbing

- Intensifying Environmental and Health Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid PVC accounted for 59.65% of total volume in 2025, underscoring its strength in underground water infrastructure, where lifespan and cost stability prevail. That share translates to the largest slice of the North America Polyvinyl Chloride market size, anchored by pipes mandated in federally funded projects. Rigid formulations also serve window profiles and siding, adding steady demand outside public works.

The flexible category advances at a 5.82% CAGR as medical devices, hoses, and wire coatings adopt specialized compounds. Manufacturers differentiate through clarity, low-temperature flexibility, and phthalate-free chemistries. Chlorinated PVC retains a niche in hot-water lines, while low-smoke grades address fire-safety codes in transit and high-occupancy buildings. Product mix continues shifting toward specialty grades that command higher margins and reduce exposure to global commodity cycles.

The North America Polyvinyl Chloride (PVC) Market Report is Segmented by Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC), Application (Pipes and Fittings, Films and Sheets, and More), End-User Industry (Building and Construction, Electrical and Electronics, Healthcare, Automotive, and More), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- AMCO International

- Aurora Material Solutions

- Braskem

- Formosa Plastics Corporation

- GEON

- INEOS

- Kem One

- LG Chem

- Lubrizol

- Occidental Petroleum Corporation

- Orbia Polymer Solutions (Vestolit)

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- SIMONA AMERICA

- Teknor Apex

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from building and construction

- 4.2.2 Surging use in medical-grade devices and IV bags

- 4.2.3 Federal funding for replacement water infrastructure

- 4.2.4 Regulatory tailwinds for lead-free plumbing

- 4.2.5 Bio-based plasticizers unlocking premium niches

- 4.3 Market Restraints

- 4.3.1 Volatile vinyl chloride monomer and ethylene prices

- 4.3.2 Intensifying environmental and health scrutiny

- 4.3.3 Tightening limits on phthalate plasticizers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 By Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses and Tubing

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Packaging

- 5.3.6 Footwear

- 5.3.7 Other End-user Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AMCO International

- 6.4.2 Aurora Material Solutions

- 6.4.3 Braskem

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 GEON

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 LG Chem

- 6.4.9 Lubrizol

- 6.4.10 Occidental Petroleum Corporation

- 6.4.11 Orbia Polymer Solutions (Vestolit)

- 6.4.12 SABIC

- 6.4.13 Shin-Etsu Chemical Co., Ltd.

- 6.4.14 SIMONA AMERICA

- 6.4.15 Teknor Apex

- 6.4.16 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment