PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913386

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913386

Beta Glucan Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

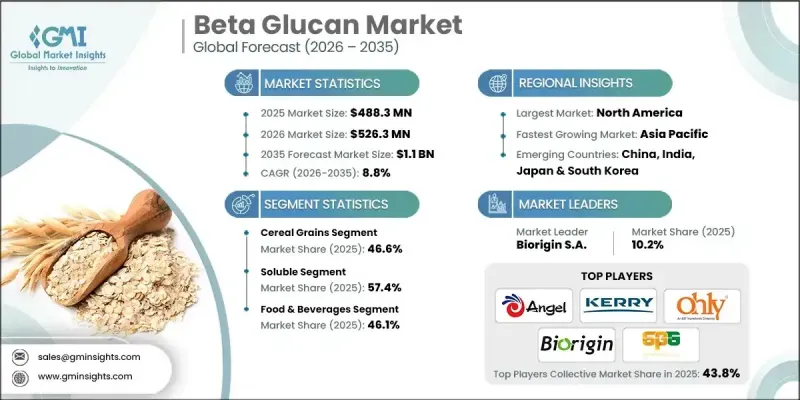

The Global Beta Glucan Market was valued at USD 488.3 million in 2025 and is estimated to grow at a CAGR of 8.8% to reach USD 1.1 billion by 2035.

Market expansion is linked to growing awareness of the physiological benefits associated with beta glucan and its widening use across food, nutrition, and pharmaceutical applications. Beta glucan is positioned as a naturally derived dietary fiber recognized for supporting immune response, managing cholesterol levels, and assisting in balanced carbohydrate metabolism. Its role in promoting heart health and immune defense has strengthened its adoption in wellness-focused product formulations. Consumers are increasingly inclined toward naturally sourced health ingredients, further reinforcing demand. Additional benefits related to blood sugar management and antioxidant activity continue to support its relevance in long-term health management. From a commercial perspective, manufacturers are broadening application areas, with beta glucan increasingly incorporated into food and beverage formulations aimed at health-conscious buyers. This diversification, combined with scientific validation and product innovation, is sustaining strong global market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $488.3 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 8.8% |

The cereal grain-based beta glucan segment accounted for 46.6% share in 2025 and is forecast to grow at a CAGR of 8.9% through 2035. This segment benefits from long-term consumer acceptance of plant-derived functional ingredients and steady improvements in extraction efficiency. Advances in processing technologies are enhancing product purity and consistency, while clean-label preferences are encouraging the use of responsibly sourced raw materials. Supportive regulatory frameworks across developed markets continue to strengthen adoption and commercial scalability.

The soluble form of beta glucan held a 57.4% share in 2025 and is expected to grow at a CAGR of 8.9% from 2026 to 2035. This category is widely used due to its high functional performance, improved absorption, and suitability for nutritional formulations targeting cardiovascular wellness, immune support, and glucose regulation. Enhanced bioavailability contributes to its effectiveness and sustained demand across multiple application segments.

North America Beta Glucan Market held 38.8% share in 2025, making it the leading regional contributor. Market growth in the region is driven by strong consumer engagement with wellness-focused products and increasing incorporation of functional ingredients across food, supplement, and pharmaceutical categories. Emphasis on immune health, heart health, and weight management continues to support product development, while demand for clean-label and plant-based formulations remains high.

Key companies operating in the Global Beta Glucan Market include DSM, Kerry, Tate & Lyle PLC, Givaudan, Angel Yeast, Lallemand, Kemin Industries, Lantmannen Biorefineries, Leiber GmbH, Biorigin S.A., Ohly, Super Beta Glucan, and VW-Ingredients. Companies in the Global Beta Glucan Market are strengthening their competitive position through innovation-driven product development and strategic capacity expansion. Leading players are investing in advanced processing technologies to improve yield, consistency, and functional performance. Strategic collaborations with food, nutrition, and pharmaceutical manufacturers are helping companies expand application reach and secure long-term supply agreements. Firms are also focusing on clean-label positioning, sustainability commitments, and transparent sourcing to align with evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extract

- 2.2.3 Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Extract, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cereal grains

- 5.3 Yeast

- 5.4 Mushroom

- 5.5 Seaweed

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Soluble

- 6.3 Insoluble

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Bakery products

- 7.2.2 Breakfast cereals & bars

- 7.2.3 Functional beverages

- 7.2.4 Dairy & dairy alternatives

- 7.2.5 Soups, sauces & prepared foods

- 7.2.6 Snack foods

- 7.3 Pharmaceuticals

- 7.3.1 Clinical nutrition

- 7.3.2 Wound care & tissue repair

- 7.3.3 Drug delivery systems

- 7.4 Cosmetics

- 7.4.1 Skin care products

- 7.4.2 Hair & scalp care

- 7.4.3 Body care

- 7.5 Animal feed

- 7.5.1 Poultry feed (broiler, layer, turkey & game birds)

- 7.5.2 Swine feed (piglet, grower, finisher, sow)

- 7.5.3 Aquaculture feed (fish, shrimp)

- 7.5.4 Ruminant feed (dairy & beef cattle)

- 7.5.5 Pet nutrition (companion animals)

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Angel Yeast

- 9.2 Biorigin S.A.

- 9.3 DSM

- 9.4 Givaudan

- 9.5 Kemin Industries

- 9.6 Kerry

- 9.7 Lallemand

- 9.8 Lantmannen Biorefineries

- 9.9 Leiber GmbH

- 9.10 Ohly

- 9.11 Super Beta Glucan

- 9.12 Tate & Lyle PLC

- 9.13 VW-Ingredients