PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913391

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913391

Conveyor System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

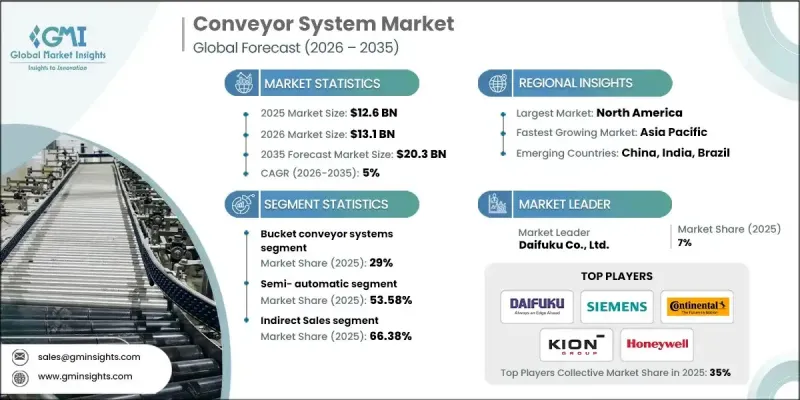

The Global Conveyor System Market was valued at USD 12.6 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 20.3 billion by 2035.

Market growth is supported by increasing focus on operational productivity, cost optimization, and long-term sustainability across industrial supply chains. Industry consolidation through mergers and acquisitions is accelerating technological advancement and strengthening competitive positioning, which is contributing to broader system adoption. Conveyor systems are increasingly preferred as organizations transition away from labor-intensive material movement toward automated and energy-conscious solutions. Modern system designs prioritize reduced power consumption and lower operational emissions, aligning with global sustainability objectives. Growing commitment to environmentally responsible manufacturing and logistics practices continues to influence investment decisions. The rising need for consistent throughput, reliability, and scalability across industrial operations further supports demand. As companies modernize facilities to meet evolving distribution and fulfillment requirements, conveyor systems are becoming a core component of efficient material flow strategies. These trends collectively position the market for steady expansion over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.6 Billion |

| Forecast Value | $20.3 Billion |

| CAGR | 5% |

Demand for advanced warehousing and logistics infrastructure is increasing steadily across North America. At the same time, rising investment in industrial and digital commerce facilities across Europe and the Asia-Pacific region is supporting strong commercial adoption. Businesses are increasingly favoring automated, high-efficiency systems to meet throughput requirements, moving away from slower and labor-dependent processes.

The bucket conveyor systems segment held 29% share in 2025. This segment continues to perform strongly due to its ability to transport high volumes efficiently within limited spatial layouts. Consistent operational performance and load-handling capability support continued adoption across bulk material applications.

The indirect sales segment held 66.38% share in 2025 and is expected to maintain strong growth through 2035. System integrators and specialized distributors play a key role by delivering customized installations, technical expertise, and ongoing service support. Buyers increasingly rely on these channels for maintenance responsiveness and localized assistance.

U.S. Conveyor System Market held a CAGR of 5.4% through 2034, driven by sustained investment in automated facilities and expanding distribution networks. Emphasis on workplace safety, operational consistency, and efficiency improvement continues to support demand nationwide.

Key companies active in the Global Conveyor System Market include Daifuku Co., Ltd., Interroll Holding AG, Honeywell Intelligrated, KION Group, Beumer Group, Swisslog Holding AG (KUKA AG), Hytrol Conveyor Company, Inc., Siemens Logistics, Continental AG, Intralox, L.L.C., Fives Group, Rexnord Corporation, Viastore Systems GmbH, FlexLink AB (Coesia Group), Shuttleworth, LLC, and WAMGROUP S.p.A. Companies operating in the Global Conveyor System Market are reinforcing their market position through product innovation, automation integration, and strategic expansion. Manufacturers are investing in modular and scalable system designs to meet diverse customer requirements. Partnerships with logistics providers and system integrators are helping expand market reach and improve solution customization. Firms are also enhancing digital capabilities, including smart monitoring and predictive maintenance features, to increase system reliability and lifecycle value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 End- Use Vertical

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid E-commerce & Fulfillment Growth

- 3.2.1.2 Industry 4.0 & Smart Manufacturing

- 3.2.1.3 Sustainability & Energy Efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial CAPEX & Long ROI

- 3.2.2.2 Complexity of Retrofitting Legacy Sites

- 3.2.3 Opportunities

- 3.2.3.1 IoT & Predictive Maintenance Integration

- 3.2.3.2 Modular & Flexible Conveyor Design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Bucket Conveyor Systems

- 5.3 Belt Conveyor System

- 5.4 Gravity Roller Conveyor

- 5.5 Screw (Auger) Conveyors

- 5.6 Chain Conveyors

- 5.7 Others (Overhead, Floor, Pallet, etc)

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By End Use Vertical, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Airport

- 7.3 Retail

- 7.4 Automotive

- 7.5 Food & Beverages

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beumer Group

- 10.2 Continental AG

- 10.3 Daifuku Co., Ltd.

- 10.4 FlexLink AB (Coesia Group)

- 10.5 Fives Group

- 10.6 KION Group

- 10.7 Honeywell Intelligrated

- 10.8 Interroll Holding AG

- 10.9 Hytrol Conveyor Company, Inc.

- 10.10 Siemens Logistics

- 10.11 Intralox, L.L.C. (part of Laitram, L.L.C.)

- 10.12 Rexnord Corporation

- 10.13 Shuttleworth, LLC (ProMach)

- 10.14 Viastore Systems GmbH

- 10.15 Swisslog Holding AG (KUKA AG)

- 10.16 WAMGROUP S.p.A.